UN agency calls for debt pause option as poverty rates rise

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Global finance ministers are being urged to give poor countries debt repayment breaks, to cushion the developing world from the impact of high interest rates.

In a new report, the United Nations is calling for a “Debt-Poverty Pause”, so developing countries can redirect debt repayments toward critical social expenditures.

Such a pause would mitigate poverty, they argue, until the multilateral system can address debt restructuring “at speed and scale”.

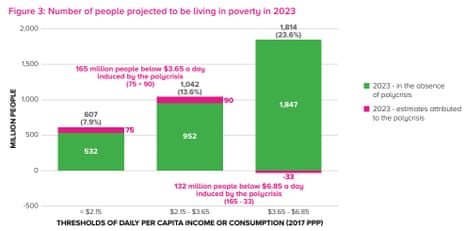

The United Nations Development Programme (UNDP) reports that poverty rates in poor countries have surged over the last three years, with another 165 million people now living on less than $3.65-a-day.

These additional poor all live in low and lower-middle-income economies, UNDP says, with the poorest 20% in low-income countries still suffering incomes below their pre-pandemic levels in 2023.

Rising debt servicing costs are making it increasingly harder for countries to support their populations through investments in health, education and social protection, warns Achim Steiner, UNDP Administrator.

Steiner explains:

“Countries that could invest in safety nets over the last three years have prevented a significant number of people from falling into poverty. In highly indebted countries, there is a correlation between high levels of debt, insufficient social spending, and an alarming increase in poverty rates.

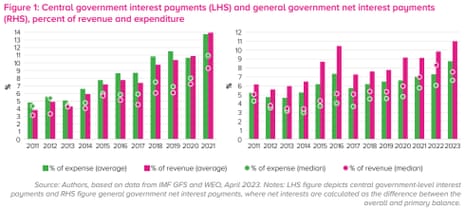

Today, 46 countries pay more than 10 percent of their general government revenue on net interest payments.

Steiner warns there is “a human cost” in not acting to restructure developing countries’ sovereign debt, adding:

“We need new mechanisms to anticipate and absorb shocks and make the financial architecture work for the most vulnerable.”

The increase in interest rates over the last year or so has hit developing nations hard, the UNDP explains.

Those escalating borrowing costs, and the stronger dollar, make repaying loans and raising money significantly more expensive for dozens of developing nations.

The average low-income country devotes between twice and three times as much, as a share of their revenue, on servicing interest payments compared with the average high-income country, UNDP say.

Highly indebted developing countries have run out of fiscal space for continued debt-financing, which forces them to cut spending on social protection, says UNDP chief economist George Gray Molina, adding:

In the absence of credible debt relief, these countries are not able to deliver this ‘temporal and targeted’ support.”

Late last month, the World Bank proposed that poor countries should be able to pause their debt repayments if hit by climate disaster.

Yesterday, Britain’s fiscal watchdog warned that the UK’s public finances are in a “very risky” period after a series of shocks, including the Covid pandemic, the war in Ukraine and the cost of living crisis.

The independent Office for Budget Responsibility said national debt could surge to more than 300% of gross domestic product by the 2070s.

The agenda

-

9.30am BST: ONS report on the impact of increased cost of living on adults across Great Britain

-

10am BST: Eurozone trade balance for May

-

3pm BST: University of Michigan survey of US consumer sentiment

Key events

Turning from the poverty crisis to luxury goods…. Burberry has reported a bounce in sales in China following its pandemic reopening.

Sales in mainland China jumped 46% in the first quarter of the financial year (the 13 weeks to 1 July).

That helped Burberry to grow its comparable store sales by 18%, with strong sales of ‘heritage rainwear’ (ie raincoats) and leather goods (such as handbags).

It told shareholders:

The Group benefitted from strong underlying growth in EMEIA [Europe, the Middle East, India and and Africa.], South Asia Pacific and Japan as well as the recovery in Mainland China from COVID-19 related lockdowns last year.

But, sales in the America fell by 8%, as consumers cut back.

Burbery says:

Globally, the Americas customer decreased mid-single digit with the decline in locals partially offset by outbound tourist spend.

Finance ministers from G20 nations are meeting in India next week, where they should discuss measures to tackle poverty, along with reforming the world’s top multilateral institutions and the international debt architecture.

Achim Steiner, UNDP administrator, called the surge in poverty alarming, Reuters reports.

He told journalists.

“What this means is a government that can no longer pay its teachers; a government that can no longer employ doctors and nurses in hospitals, that cannot provide the medicines for rural health centers.”

The United Nations Development Programme (UNDP) has calculated it would cost around $14bn to lift back out of poverty the extra 165m people since 2020 who are living on less than $3.65 a day.

The solution “is not out of reach for the multilateral system”, they say.

UNDP chief economist George Gray Molina argues that a “Debt-Poverty Pause” would be triggered automatically when a country suffers an economic shock, so it can redirect debt repayment towards financing social expenditures.

Molina says:

“This systemic addition to the international financial architecture should be triggered automatically, to stabilize free-falls when exogenous shocks shrink developing countries’ fiscal space, bloat their debt servicing and throw households into poverty.

This is the beginning of a new adaptive social protection architecture to prepare for a future prone to shocks.”

UN agency calls for debt pause option as poverty rates rise

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Global finance ministers are being urged to give poor countries debt repayment breaks, to cushion the developing world from the impact of high interest rates.

In a new report, the United Nations is calling for a “Debt-Poverty Pause”, so developing countries can redirect debt repayments toward critical social expenditures.

Such a pause would mitigate poverty, they argue, until the multilateral system can address debt restructuring “at speed and scale”.

The United Nations Development Programme (UNDP) reports that poverty rates in poor countries have surged over the last three years, with another 165 million people now living on less than $3.65-a-day.

These additional poor all live in low and lower-middle-income economies, UNDP says, with the poorest 20% in low-income countries still suffering incomes below their pre-pandemic levels in 2023.

Rising debt servicing costs are making it increasingly harder for countries to support their populations through investments in health, education and social protection, warns Achim Steiner, UNDP Administrator.

Steiner explains:

“Countries that could invest in safety nets over the last three years have prevented a significant number of people from falling into poverty. In highly indebted countries, there is a correlation between high levels of debt, insufficient social spending, and an alarming increase in poverty rates.

Today, 46 countries pay more than 10 percent of their general government revenue on net interest payments.

Steiner warns there is “a human cost” in not acting to restructure developing countries’ sovereign debt, adding:

“We need new mechanisms to anticipate and absorb shocks and make the financial architecture work for the most vulnerable.”

The increase in interest rates over the last year or so has hit developing nations hard, the UNDP explains.

Those escalating borrowing costs, and the stronger dollar, make repaying loans and raising money significantly more expensive for dozens of developing nations.

The average low-income country devotes between twice and three times as much, as a share of their revenue, on servicing interest payments compared with the average high-income country, UNDP say.

Highly indebted developing countries have run out of fiscal space for continued debt-financing, which forces them to cut spending on social protection, says UNDP chief economist George Gray Molina, adding:

In the absence of credible debt relief, these countries are not able to deliver this ‘temporal and targeted’ support.”

Late last month, the World Bank proposed that poor countries should be able to pause their debt repayments if hit by climate disaster.

Yesterday, Britain’s fiscal watchdog warned that the UK’s public finances are in a “very risky” period after a series of shocks, including the Covid pandemic, the war in Ukraine and the cost of living crisis.

The independent Office for Budget Responsibility said national debt could surge to more than 300% of gross domestic product by the 2070s.

The agenda

-

9.30am BST: ONS report on the impact of increased cost of living on adults across Great Britain

-

10am BST: Eurozone trade balance for May

-

3pm BST: University of Michigan survey of US consumer sentiment