Introduction: UK house prices stable in May

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Stability has returned to the UK housing market, the latest data from lender Halifax shows, with prices dipping slightly last month.

Halifax’s latest house price index, just released, shows that average prices were little changed month-on-month in May,

The average house prices slipped to £288,688 last month, a 0.1% drop compared to £288,862 in April.

But on an annual basis, house price inflation rose to +1.5% in May, up from +1.1% in April.

Rising wages and a pick-up in economic confidence are supporting house prices, says Amanda Bryden, head of mortgages at Halifax.

Bryden explains:

This has been reflected in a broadly stable picture in terms of property price movements, with the average cost of a property little changed over the last three months.

Bryden adds that a period of relative stability in both house prices and interest rates should lift confidence for both buyers and sellers.

While homebuyers and those remortgaging will continue to respond to changes in borrowing costs, set against a backdrop of a limited supply of available properties, the market is unlikely to see huge fluctuations in the near term.

Last week, rival lender Nationwide reported a rise in prices last month.

It’s important to remember, though, that both Halifax and Nationwide’s data is based on mortgage transactions, so doesn’t capture cash buyers.

Also coming up today

UK entrepreneur Mike Lynch will be celebrating after being cleared of all charges by a US jury in a fraud case related to the sale of his software company Autonomy to Hewlett-Packard (HP) in 2011.

Investors are poised for the latest US jobs report, which is expected to show the unemployment rate stuck at 3.9% in May.

The agenda

-

7am BST: Halifax house price index for May

-

7am BST: German industrial output report for May

-

10am BST: Third estimate of eurozone GDP for Q1 2024

-

11.30am BST: Bank of Russia sets interest rates

-

1.30pm BST: US non-farm payroll report for May

Key events

World food prices up in May for third month running

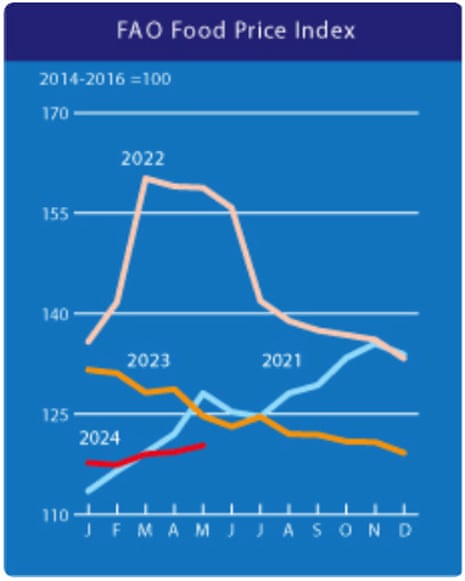

Global food commodity prices have risen again, in a blow to households worldwide.

The United Nations world food price index rose for a third consecutive month in May, as falling prices for sugar and vegetable oil were counted by rising prices for cereal and dairy products.

Prices rose by 0.9% in May compared with April.

But, that still left the FAO Food Price Index (FFPI) 3.4% lower than a year ago, and nearly 25% below the peak of 160.2 points reached in March 2022, after Russia’s invasion of Ukraine drove up prices.

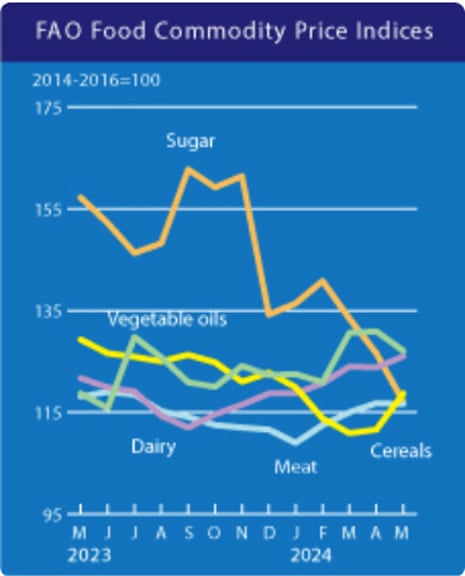

Cereal prices jumped by 6.3% in March, which the UN attribues to “growing concerns about unfavourable crop conditions for the 2024 harvests” and “damage to the Black Sea shipping infrastructure”.

Dairy prices rose 1.8% in the month, due to “increased demand from the retail and food services sectors ahead of the summer holidays”, and expectations that milk production may fall below historical levels in Western Europe.

But sugar prices fell by 7.5%, due to a “good start” of the new harvest season in Brazil, and “conducive weather conditions” boosting the global supply outlook.

And vegetable oil prices dropped by 2.4%, driven by a fall in the cost of palm oil as outputs across major producing countries in Southeast Asia rose.

These higher commodity costs will feed through to shoppers, and may slow the fall in food inflation.

There could be a ‘bounce’ in house prices this autun, predicts Tom Bill, head of UK residential research at Knight Frank, if interest rates start to fall.

Bill says:

“House prices remain under pressure as an interest rate cut moves further over the horizon. Demand will typically rise in spring but there has been a 0.3% price decline over the last three months thanks to stubborn services inflation and rising swap rates.

There should be a more noticeable bounce this autumn when the first rate cut since March 2020 is likely to have happened and the political backdrop will have stabilised. We expect UK prices to rise by 3% this year as the prospect of more mortgages starting with a ‘3’ gets closer.”

We’re not there yet, though! Here are the latest fixed-rate mortgage rates, just released by Moneyfacts:

-

The average 2-year fixed residential mortgage rate today is 5.95%. This is unchanged from the previous working day.

-

The average 5-year fixed residential mortgage rate today is 5.52%. This is up from an average rate of 5.51% on the previous working day.

Boss of Magners maker C&C steps down after overseeing accounting failures

The maker of Bulmers, Magners and Tennent’s cider has announced the shock departure of its CEO after revealing it had overstated its profits in recent years by €5m.

C&C told the City that detailed internal and external reviews had discovered a series of mistakes in its accounts in recent years.

This means it will take a €1m adjustment charge for the 2023 financial year, a €3m adjustment credit in FY2022 and a €7m adjustment charge in FY2021.

This folllows a botched software upgrade which cost C&C millions of pounds.

And CEO Patrick McMahon is paying the price; he’s leave his role, having stepped up from his position as finance chief a year ago.

C&C explains:

The Group’s Chief Executive Officer, Patrick McMahon, was Chief Financial Officer during the periods to which these adjustments relate and acknowledges that the relevant shortcomings occurred at a time when he had overall responsibility for the Group’s finance function.

Accordingly, he has informed the Board that he will step down as CEO and as a director with immediate effect.

C&C also reported a loss of €111m for the last financial year, down from a profit of €52m a year before.

Shares in C&C are down 7% in early trading, the biggest faller on the FTSE 250 index.

Bellway has also raised its forecast for the overall average selling price of its houses to around £305,000, up from previous guidance of £295,000.

This is “mainly due to changes in product mix”, says Bellway – meaning it expects to sell more high-end, pricier, homes.

UK housebuilder Bellway has issued an upbeat trading statement, saying it has seen “stronger trading through the spring selling season”.

Bellway says “improved affordability” is helping to lift customer confidence, leading to an increase in reservations for new houses and “firm” prices.

Bellway’s private reservation rate per outlet has risen to 0.62 per week in the February-May quarter, a 6.9% increase on a year ago.

Jason Honeyman, Bellway’s CEO, says the company is on track to build around 7,500 homes this financial year, adding:

We have been encouraged by ongoing healthy levels of customer interest and combined with the strength of our outlet opening programme, we continue to expect a year-on-year increase in the forward order book at 31 July 2024.

As a result, Bellway remains in a strong position to return to growth in financial year 2025.

EY UK: housing market has passed the bottom

The recent rise in mortgage rates is likely to prevent any meaningful pickup in transactions and prices in the short-term, predicts Peter Arnold, chief economist at EY UK.

But Arnold also suggests we won’t see a new downturn in prices either… saying:

“While 2023 was a challenging year for the housing market, data for the first half of 2024 has suggested that the market has passed the bottom. The substantial fall in mortgage rates since last summer, combined with strong growth in nominal wages, has reduced the scale of the mortgage affordability problem. This has helped to entice some buyers back to the market, leading to a recovery in transactions and putting a floor under prices.

“Over the past couple of months, mortgage rates have edged up again in response to rising swap rates, as financial markets anticipate a slower pace of Bank of England interest rate cuts. This is likely to prevent any meaningful pickup in transactions and prices in the near-term. But so far, the increases have been small and mortgage rates remain well below last summer’s peaks. The EY ITEM Club does not expect to see a renewed downturn in the housing market.

Labour’s mortgage guarantee scheme to offer ‘freedom to buy’ to young people

Building up a deposit to buy a house is a large hurdle for first-time buyers, especially those who can’t turn to wealthy parents for help.

But the Labour Party are pledging to help – last night, they annouced they would permanently sustain and expand the current mortgage guarantee scheme.

The measure sees the government act as guarantor for part of a home loan – to encourage lenders to make low-deposit mortgages available for first-time buyers,

Labour, whose offering is dubbed ‘Freedom to Buy’, says it will help over 80,000 young people to get on the housing ladder over the next five years.

Labour leader Keir Starmer says:

“After 14 years of Conservative government, the dream of home ownership is out of reach for too many hard working people. Despite doing everything right, they can’t move on and up. A generation face becoming renters for life.

“My parents’ home gave them security and was a foundation for our family. As Prime Minister, I will turn the dream of owning a home into a reality.

“Our changed Labour Party will be on the side of the builders not the blockers, to get Britain building again. My Labour Government will help first-time buyers onto the ladder with a new Freedom to Buy scheme for those without a large deposit, and by giving them first dibs on new developments.

Labour are also pledging planning reform to build 1.5 million homes, saying this is the best way in the long term.

They say:

We will reintroduce housing targets, build on disused grey belt land, fast track permissions on brownfield and build the next generation of new towns.

Over the last quarter, average UK house prices were 0.3% lower than in the previous three months, Halifax reports.

This chart shows the monthly changes we’ve seen this year:

After jumping 1.2% in January, they grew 0.3% in February, before dropping 0.9% in March, stagnating in April and then dipping 0.1% in May.

North West has the strongest price growth of nation or region in the UK

House prices rose fastest in the North West of England in May – they were up 3.8% on an annual basis in May, taking the average price to £232,258.

In Northern Ireland, prices rose by 3.2%, while in Scotland they were 1.9% higher than a year ago.

In Wales, house prices grew annually by +0.7% – below the UK average of 1.5%.

Prices fell fastest in Eastern England, where they dropped by 0.8% in the year to May.

In London, prices have risen by 0.2% over the last year, to an average of £536,821 – still the most expensive part of the UK.

Base rate date jitters cause average house prices to take a baby step back on April, dropping -0.1% but up +1.5% annually, making the avg house price £288,688. The North West inc’d +3.8%, Northern Ireland +3.2%, Scotland +1.9% & Wales +0.7% but the East of England fell -0.8% on… pic.twitter.com/aAIWnOR2Bh

— Emma Fildes (@emmafildes) June 7, 2024

Introduction: UK house prices stable in May

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Stability has returned to the UK housing market, the latest data from lender Halifax shows, with prices dipping slightly last month.

Halifax’s latest house price index, just released, shows that average prices were little changed month-on-month in May,

The average house prices slipped to £288,688 last month, a 0.1% drop compared to £288,862 in April.

But on an annual basis, house price inflation rose to +1.5% in May, up from +1.1% in April.

Rising wages and a pick-up in economic confidence are supporting house prices, says Amanda Bryden, head of mortgages at Halifax.

Bryden explains:

This has been reflected in a broadly stable picture in terms of property price movements, with the average cost of a property little changed over the last three months.

Bryden adds that a period of relative stability in both house prices and interest rates should lift confidence for both buyers and sellers.

While homebuyers and those remortgaging will continue to respond to changes in borrowing costs, set against a backdrop of a limited supply of available properties, the market is unlikely to see huge fluctuations in the near term.

Last week, rival lender Nationwide reported a rise in prices last month.

It’s important to remember, though, that both Halifax and Nationwide’s data is based on mortgage transactions, so doesn’t capture cash buyers.

Also coming up today

UK entrepreneur Mike Lynch will be celebrating after being cleared of all charges by a US jury in a fraud case related to the sale of his software company Autonomy to Hewlett-Packard (HP) in 2011.

Investors are poised for the latest US jobs report, which is expected to show the unemployment rate stuck at 3.9% in May.

The agenda

-

7am BST: Halifax house price index for May

-

7am BST: German industrial output report for May

-

10am BST: Third estimate of eurozone GDP for Q1 2024

-

11.30am BST: Bank of Russia sets interest rates

-

1.30pm BST: US non-farm payroll report for May