Introduction: UK house price gauge falls to lowest since 2009 as interest rates rise

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Britain’s housing sector continues to weaken, as rising interest rates hit demand for property, the country’s surveyors are warning today.

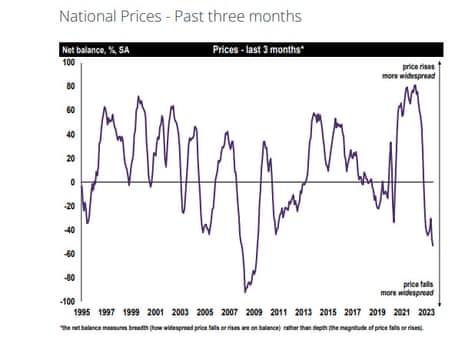

The Royal Institution of Chartered Surveyors (Rics) has reported the most widespread falls in British house prices since 2009 in the last month.

Tighter lending environment continues to weigh heavily upon homebuyer activity, Rics says.

But there may be relief around the corner, with several major lenders cutting their mortgage rates this week.

The latest survey of Rics members, for July, found that:

-

House inquiries and sales continue to decline

-

House prices fall for a further month

-

Near-term market expectations remain negative

-

Rental demand continues to rise along with expected rental prices

Rics’s house price balance, which measures the difference between the percentage of surveyors reporting price rises and falls, dropped to -53 in July from a downwardly revised -48 for June.

That’s a larger fall than expected, and the lowest reading since April 2009,

Summer proves dismal in both the weather & in property as both buyers & sellers take time out. RICS surveyors also noticed agreed sales nose dived in July leaving them to suspect sales will remain subdued as affordability issues dampen the mood to move in 2023 @RICSnews pic.twitter.com/lr749ynhFv

— Emma Fildes (@emmafildes) August 10, 2023

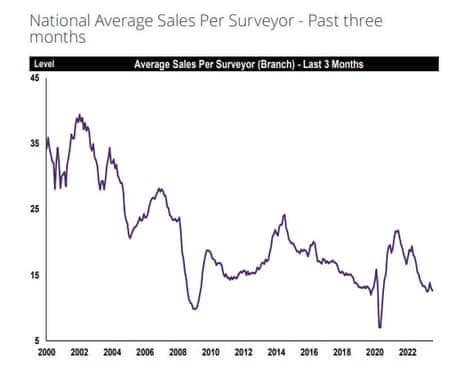

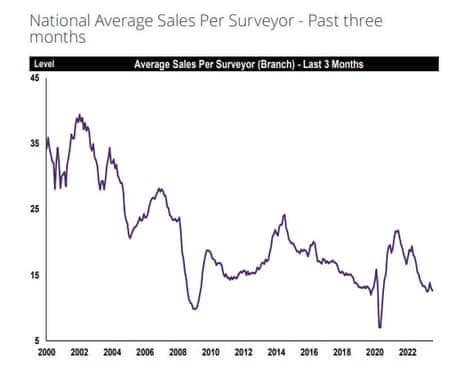

A net balance of -44% of surveyors reported a decline in agreed sales during July.

That’s down from -36% in June and is the weakest reading for the sales measure since the early stages of the pandemic.

That backs up the message from lenders Nationwide and Halifax in recent months, who have both reported falling prices since their peak last August.

Rics chief economist, Simon Rubinsohn, warns that demand is weakening:

“The recent uptick in mortgage activity looks likely to be reversed over the coming months if the feedback to the latest Rics Residential Survey is anything to go by.

The continued weak reading for the new buyer enquiries metric is indicative of the challenges facing prospective purchasers against a backdrop of economic uncertainty, rising interest rates and a tougher credit environment.

But the tide may be turning, with Halifax, HSBC, TSB and Nationwide all announced cuts to their mortgage rates, in what the Daily Mail is dubbing a “mortgage price war”.

Halifax, the nation’s largest lender, will slash the cost of its loans by up to 0.71 percentage points tomorrow, prompting brokers to predict mortgage rates would now be lowered elsewhere.

Jamie Lennox of Dimora Mortgages said:

‘Halifax is making the single largest rate reduction I have seen from a high street lender,’ said

‘I expect others to reduce their rates this week, which could start a price war.’

Lewis Shaw, founder of Mansfield-based Shaw Financial Services, says Halifax’s move is a positive development:

It’s a welcome relief to see rate reductions, and this could be the start of a price war as transaction volumes drop and mortgage lenders need to get the sharp elbows out to hit their targets.”

But, rates are still much higher than before the recent surge. The average two-year fixed mortgage was 6.83% yesterday, according to Moneyfacts, up from 5.35% in April.

Also coming up today

The financial markets are eager to scrutinise the latest US inflation report, due at 1.30pm UK time.

Economists predict that US CPI rose to 3.3% in the year to July, up from a two-year low of 3% in June. That could create concerns that the drop in American inflation has bottomed out.

Asia-Pacific markets have dropped, amid anxiety after the White House unveiled a ban on US investment in Chinese technology.

The executive order signed by Joe Biden authorises the US treasury secretary to prohibit or restrict certain US investments in Chinese entities in three sectors: semiconductors and microelectronics, quantum information technologies, and certain artificial intelligence systems.

The agenda

-

9am BST: Italian inflation report for July

-

9.30am BST: Weekly UK economic and business activity report from the ONS

-

11am BST: Ireland’s inflation report for July

-

1.30pm BST: US inflation report for July

-

1.30pm BST: US weekly jobless data

Key events

The UK government says it is weighing how to respond to US president Joe Biden’s decision to prohibit some tech investments in China.

A spokesperson for Prime Minister Rishi Sunak’s government said the executive order gave important clarity on the U.S. approach:

“The UK will consider these new measures closely as we continue to assess potential national security risks attached to some investments.”

Rhys Schofield, brand director at Peak Mortgages and Protection, also predicts mortgage lenders will continue to cut rates in the months ahead:

Following the mortgage rate cuts by Halifax, HSBC, TSB and Nationwide, Schofield says:

To brokers up and down the land, it certainly looks like a corner has been turned.

Clearly, it had been assumed that rates may go higher than now seems likely but with the forecasts looking a bit better I’d be expecting more rate reductions from lenders over the coming weeks.

Rob Gill, managing director at Altura Mortgage Finance, says the drop in UK inflation in June is now feeding through to mortgage rates.

That’s because fixed-term mortgages are priced against the yield, or interest rate, on UK government bonds, which are sensitive to interest rate and inflation changes.

Gill says:

The forecast following last month’s below-expected inflation figure was that mortgage rate cuts would follow 2-3 weeks after and we’re now seeing that prediction come true.

All eyes will now be on next week’s inflation figure, due on August 16th. If this confirms a further fall in inflation, a mortgage price war in September cannot be ruled out as lenders seek to make up for a quiet July and August.

Kalyeena Makortoff

The owner of Ladbrokes and Coral bookmakers has said it is close to “drawing a line” under a scandal at its former Turkish business, as it set aside £585m to pay a fine over alleged bribery.

Entain has put aside the cash in anticipation of a settlement with UK authorities, who entered into a deferred prosecution agreement with the international betting and gaming group earlier this year.

Entain said on Thursday that negotiations with the UK’s Crown Prosecution Service had now “progressed to a point where the company believes it is likely to be able to agree a resolution” to an investigation by HM Revenue and Customs (HMRC).

Housebuilder Persimmon has reported a sharp drop in housing completions this year.

Persimmon completed 4,249 homes in the first half of 2023, down from 6,652 in January-June 2022.

Pre-tax profits dropped to £151.0m, down from £439.7m a year ago, even though average prices rose to £256,445 from £245,597. Profit margins shrunk, as costs rose.

But Britain’s failure to build enough homes will support the market, Persimmon’s CEO, Dean Finch, argues:

“With the historic under-supply of homes the longer term outlook for housing remains positive.”

Update: Shares in Persimmon are up 1.3% in early trading.

Chris Beauchamp, chief market analyst at IG Group, says:

While the figures this morning are dire, Persimmon’s share price has actually held steady so far today, with a lot of the bad news priced in it seems.

Now the UK outlook is less gloomy, some hope prevails that the year ahead might be a better one, helping to keep the pessimism in check.

A classic RNS from Persimmon this morning. Nearly 400 words of scene-setting before they get to the awkwardness of the slump in profits & margins…

— Chris Beauchamp (@ChrisB_IG) August 10, 2023

Full story: Four of Britain’s biggest lenders cut rates on fixed mortgage deals

Rupert Jones

Four of Britain’s biggest lenders have cut rates on their fixed mortgage deals, easing some of the pressure on hard-pressed homeowners, my colleague Rupert Jones reports.

Halifax, part of Lloyds Banking Group – the UK’s biggest mortgage lender – is reducing rates by up to 0.71 percentage points from Friday. That means a five-year fixed rate currently priced at 6.10% will be offered at a rate of 5.39%.

It also emerged that average rates on new two- and five-year fixed mortgages have fallen slightly.

Mortgage rates have risen rapidly as the Bank of England has pushed up interest rates in an attempt to tame inflation. Last week the Bank raised interest rates for the 14th consecutive time, bringing the base rate to 5.25%.

Relentlessly increasing housing costs have piled further pressure on Britons already struggling to cope with higher food and energy costs, but the cuts to rates – in some cases for the second time in a fortnight – will provide optimism that those costs may ease.

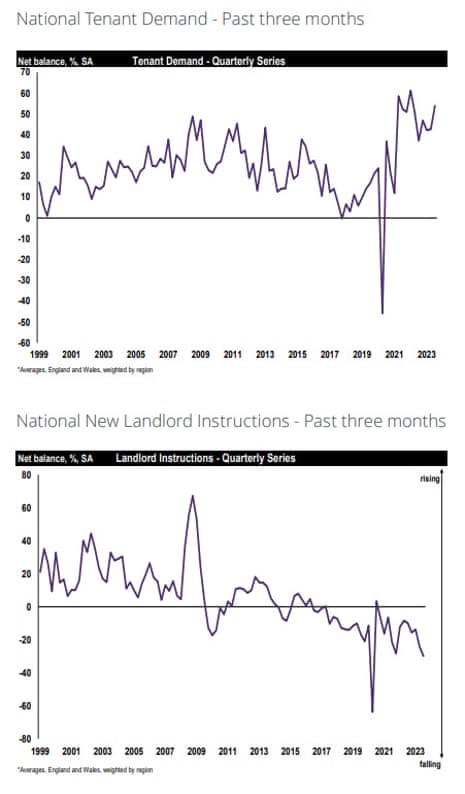

Rents are climbing

Britain’s surveyors have also reported the broadest increases in rents since Rics’ series began in 1999.

Demand from tenants to rent a home rose at the fastest pace since early 2022, as rising interest rates made it harder for people to buy a new home.

Those rising borrowing costs are also pushing some landlords out of the market – the number of properties being offered by landlords fell by the most since the early in the pandemic.

Rents are likely to continue rising sharply despite the cost-of-living crisis, surveyors are warning.

RICS chief economist, Simon Rubinsohn, explains:

Demand shows no signs of letting up, supply remains constrained and that means rents are likely to continue rising sharply despite the cost-of-living crisis.”

Introduction: UK house price gauge falls to lowest since 2009 as interest rates rise

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Britain’s housing sector continues to weaken, as rising interest rates hit demand for property, the country’s surveyors are warning today.

The Royal Institution of Chartered Surveyors (Rics) has reported the most widespread falls in British house prices since 2009 in the last month.

Tighter lending environment continues to weigh heavily upon homebuyer activity, Rics says.

But there may be relief around the corner, with several major lenders cutting their mortgage rates this week.

The latest survey of Rics members, for July, found that:

-

House inquiries and sales continue to decline

-

House prices fall for a further month

-

Near-term market expectations remain negative

-

Rental demand continues to rise along with expected rental prices

Rics’s house price balance, which measures the difference between the percentage of surveyors reporting price rises and falls, dropped to -53 in July from a downwardly revised -48 for June.

That’s a larger fall than expected, and the lowest reading since April 2009,

Summer proves dismal in both the weather & in property as both buyers & sellers take time out. RICS surveyors also noticed agreed sales nose dived in July leaving them to suspect sales will remain subdued as affordability issues dampen the mood to move in 2023 @RICSnews pic.twitter.com/lr749ynhFv

— Emma Fildes (@emmafildes) August 10, 2023

A net balance of -44% of surveyors reported a decline in agreed sales during July.

That’s down from -36% in June and is the weakest reading for the sales measure since the early stages of the pandemic.

That backs up the message from lenders Nationwide and Halifax in recent months, who have both reported falling prices since their peak last August.

Rics chief economist, Simon Rubinsohn, warns that demand is weakening:

“The recent uptick in mortgage activity looks likely to be reversed over the coming months if the feedback to the latest Rics Residential Survey is anything to go by.

The continued weak reading for the new buyer enquiries metric is indicative of the challenges facing prospective purchasers against a backdrop of economic uncertainty, rising interest rates and a tougher credit environment.

But the tide may be turning, with Halifax, HSBC, TSB and Nationwide all announced cuts to their mortgage rates, in what the Daily Mail is dubbing a “mortgage price war”.

Halifax, the nation’s largest lender, will slash the cost of its loans by up to 0.71 percentage points tomorrow, prompting brokers to predict mortgage rates would now be lowered elsewhere.

Jamie Lennox of Dimora Mortgages said:

‘Halifax is making the single largest rate reduction I have seen from a high street lender,’ said

‘I expect others to reduce their rates this week, which could start a price war.’

Lewis Shaw, founder of Mansfield-based Shaw Financial Services, says Halifax’s move is a positive development:

It’s a welcome relief to see rate reductions, and this could be the start of a price war as transaction volumes drop and mortgage lenders need to get the sharp elbows out to hit their targets.”

But, rates are still much higher than before the recent surge. The average two-year fixed mortgage was 6.83% yesterday, according to Moneyfacts, up from 5.35% in April.

Also coming up today

The financial markets are eager to scrutinise the latest US inflation report, due at 1.30pm UK time.

Economists predict that US CPI rose to 3.3% in the year to July, up from a two-year low of 3% in June. That could create concerns that the drop in American inflation has bottomed out.

Asia-Pacific markets have dropped, amid anxiety after the White House unveiled a ban on US investment in Chinese technology.

The executive order signed by Joe Biden authorises the US treasury secretary to prohibit or restrict certain US investments in Chinese entities in three sectors: semiconductors and microelectronics, quantum information technologies, and certain artificial intelligence systems.

The agenda

-

9am BST: Italian inflation report for July

-

9.30am BST: Weekly UK economic and business activity report from the ONS

-

11am BST: Ireland’s inflation report for July

-

1.30pm BST: US inflation report for July

-

1.30pm BST: US weekly jobless data