Introduction: UK borrowing falls

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Britain’s monthly government borrowing fell last month, potentially giving chancellor Jeremy Hunt more room for tax cuts in the March budget.

Figures just released by the Office for National Statistics show that the UK’s public sector net borrowing (excluding public sector banks) fell to £7.8bn in December.

That’s the lowest deficit for any December since 2019, just before the Covid-19 pandemic, and half as much as the UK borrowed to balance the books in December 2022.

It’s also a lot lower than forecast; economists polled by Reuters had expected public sector net borrowing, excluding state-owned banks, to hit £14bn.

Falling inflation helped to push down borrowing, by lowering the interest bill on index-linked government debt.

Central government debt interest payable was £4bn in December, £14.1bn less than in December 2022, the ONS says, due to the fall in the Retail Price Index measure of inflation.

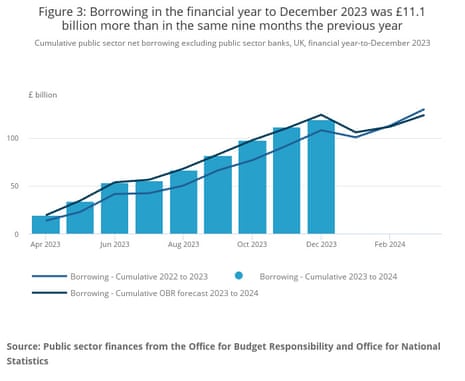

So far this financial year (since April), the UK has borrowed £119.1bn, which is £5bn lower borrowing than the £124.1bn forecast by the Office for Budget Responsibility.

That indicates there is wiggle-room for some fiscal loosening, while keeping within the government’s fiscal rules.

This is the fourth-highest borrowing bill at this stage of the financial year since monthly records began in 1993, behind the Covid-19 years of 2020, 2021, and 2009 following the global financial crisis.

Last week in Davos, Hunt dangled the prospect of big tax cuts in his March budget, telling reporters that he wanted to move in the direction of a low-tax economy.

Speaking at the World Economic Forum, the chancellor said:

“In terms of the direction of travel we look around the world and we note that the economies growing faster than us in North America and Asia tend to have lower taxes, and I believe fundamentally that low-tax economies are more dynamic, more competitive and generate more money for public services like the NHS.

That’s the direction of travel we would like to go in but it is too early to say what we are going to do.”

Also coming up today

Workers from Tata’s steelworks in Port Talbot are heading to Parliament today, ahead of a House of Commons debate on the future of the plant.

The debate was called by the Labour Party, following the announcement last week that Tata is planning to close its blast furnaces at Port Talbot and is intending to cut 2,800 jobs. Labour will use an opposition day debate to force a vote on the issue….

Investors in the City will be digesting the latest policy decision from the Bank of Japan overnight – it left interest rates at -0.1%, and stuck to its yield curve control policy that keeps the upper limit for 10-year Japanese government bond yield at 1%.

BOJ board members also lowered their forecast for core consumer inflation.

The agenda

-

7am GMT: UK public finances for December

-

10.15am GMT: Treasury Committee inquiry into SME access to finance

-

3pm GMT: Eurozone consumer confidence index

Key events

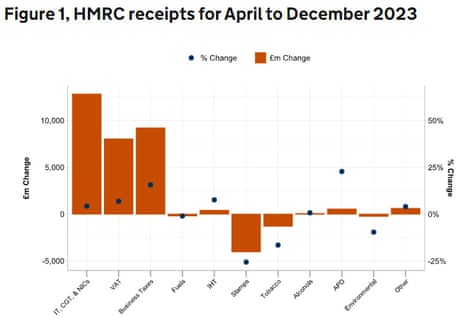

New data from HM Revenue and Customs this morning shows how the tax burden has risen this year.

Total HMRC receipts for April 2023 to December 2023 have risen to £580.8bn, which is £26bn higher than a year ago.

Income Tax, Capital Gains Tax and National Insurance Contributions (NICs) rose by £12.8bn, while VAT brought in £8bn more and business taxes raked in an extra £9.2bn.

Inheritance Tax receipts for April 2023 to December 2023 were £5.7bn, £0.4bn higher than the same period last year.

Nicholas Hyett, Investment Manager at Wealth Club says:

“The government’s income from death duties is going up. That makes changes to IHT policy a careful balancing act.

Cutting rates might win votes, since many see IHT as an unjust grab for money that’s already been taxed once. But the revenue earned is playing an important part in the government’s spending programme, and a shortfall would need to be made up somewhere else.

Contrary to popular belief, inheritance tax doesn’t just affect the super-rich. Frozen tax brackets mean many who would not consider themselves wealthy will find themselves falling into the IHT bracket in future. Their standard of living hasn’t changed, indeed inflation means it might have gone backwards, but the government now considers them to be wealthy enough to face inheritance tax.

But receipts from stamp taxes fell by £4bn, while tobacco reeipts were £1.3bn lower.

Sarah Butler

Elsewhere in the economy, Lidl is increasing minimum pay for its shop staff from £11.40 to £12.00 an hour from 1 March, in the cut-price grocer’s third pay rise in a year.

The increase brings Lidl in line with rival Aldi which will increase minimum pay to £12 an hour next month.

Both will be in line with the independently verified living wage as competition for workers continues to be high in a tight labour market.

The drop in government support for energy bills also pushed down borrowing in December, says Michal Stelmach, senior economist at KPMG UK.

Stelmach explains:

“Public sector net borrowing came in at £7.8 billion in December 2023, down significantly from £16.2 billion a year earlier. This was mainly due to a large drop in debt interest payments which reflected a fall in monthly RPI inflation in October, while the energy price schemes, which contributed to spending last winter, are no longer in place.

Indeed, government spending on subsidies and other current grants, which included the cost of the Energy Price Guarantee and other support schemes, was down by £5.9 billion on a year ago.

Stelmach cautions, though that the UK’s fiscal outlook is “riddled with uncertainty”. That means that some of Jeremy Hunt’s wiggle room could “easily be squashed” if some of the downside risks materialise.

Stelmach explains:

The government’s implicit commitment to freeze fuel duty rates lowers revenue by £6 billion a year relative to current plans, while the assumption that real spending on unprotected departments would have to fall by over 2% a year is largely unrealistic in the absence of significant productivity improvements.

That’s before considering the longer-term pressures from an ageing population, energy transition, and slowing workforce growth.”

Capital Economics: more wiggle room for a big pre-election splash

Jeremy Hunt has “more wiggle room for a big pre-election splash”, following this morning’s drop in government borrowing, say City consultancy Capital Economics.

Ruth Gregory, their Deputy Chief UK Economist, estimates that Hunt could have £20bn of headroom for tax cuts in March.

She says:

After nine months of the 2023/24 fiscal year, borrowing is on track to undershoot the OBR’s full-year borrowing forecast of £123.9bn by £5.0bn.

What’s more, with market interest rate expectations and long-dated gilt yields having fallen since November, we suspect the OBR will revise down its borrowing forecast significantly from 2025/26. That may provide the Chancellor with “headroom” against his fiscal mandate of about £20bn in the Budget.

That will probably allow him to unveil a freeze in fuel duty in April 2024 (costing about £6.0bn a year) but perhaps also to announce more crowd-pleasing measures, such as a 1p cut to income tax (costing £6.9bn a year), while still maintaining fiscally prudent appearances.

Divya Sridhar, economist at PwC, is hopeful that the bill for the UK’s inflation-linked bonds will continue to fall – easing the pressure on the public finances:

“The relatively lower debt interest payments in December 2023 were a key driver of the lower monthly borrowing figure compared to recent months.

Last month recorded the lowest December interest payment figure since 2020, and was less than a fourth of the interest payments paid in December 2022.

Despite the small uptick in CPI inflation last month from 3.9% to 4.0%, we expect inflation pressures to continue easing over the coming months, further lowering government spending on interest payments.”

Trott: economy is beginning to turn a corner

Chief Secretary to the Treasury, Laura Trott, has commented on this morning’s UK borrowing figures, saying:

“Protecting millions of lives and livelihoods during Putin’s energy shock and a once in a century pandemic has created economic challenges. However, it is right that we pay back these debts so future generations are not left to pick up the tab.

“Because of this Government’s decisive action, the economy is now beginning to turn a corner: Inflation has more than halved. Debt is on track to fall as a share of the economy. And we have been able to afford tax cuts for 27 million working people, and an £11 billion tax cut to drive business investment. “

The broader picture is that the UK national dent was clocked at £2.685 trillion at the end of December 2023, which is around 97.7% of UK GDP.

That’s 1.9 percentage points higher than in December 2022 and the highest level since the early 1960s.

Introduction: UK borrowing falls

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Britain’s monthly government borrowing fell last month, potentially giving chancellor Jeremy Hunt more room for tax cuts in the March budget.

Figures just released by the Office for National Statistics show that the UK’s public sector net borrowing (excluding public sector banks) fell to £7.8bn in December.

That’s the lowest deficit for any December since 2019, just before the Covid-19 pandemic, and half as much as the UK borrowed to balance the books in December 2022.

It’s also a lot lower than forecast; economists polled by Reuters had expected public sector net borrowing, excluding state-owned banks, to hit £14bn.

Falling inflation helped to push down borrowing, by lowering the interest bill on index-linked government debt.

Central government debt interest payable was £4bn in December, £14.1bn less than in December 2022, the ONS says, due to the fall in the Retail Price Index measure of inflation.

So far this financial year (since April), the UK has borrowed £119.1bn, which is £5bn lower borrowing than the £124.1bn forecast by the Office for Budget Responsibility.

That indicates there is wiggle-room for some fiscal loosening, while keeping within the government’s fiscal rules.

This is the fourth-highest borrowing bill at this stage of the financial year since monthly records began in 1993, behind the Covid-19 years of 2020, 2021, and 2009 following the global financial crisis.

Last week in Davos, Hunt dangled the prospect of big tax cuts in his March budget, telling reporters that he wanted to move in the direction of a low-tax economy.

Speaking at the World Economic Forum, the chancellor said:

“In terms of the direction of travel we look around the world and we note that the economies growing faster than us in North America and Asia tend to have lower taxes, and I believe fundamentally that low-tax economies are more dynamic, more competitive and generate more money for public services like the NHS.

That’s the direction of travel we would like to go in but it is too early to say what we are going to do.”

Also coming up today

Workers from Tata’s steelworks in Port Talbot are heading to Parliament today, ahead of a House of Commons debate on the future of the plant.

The debate was called by the Labour Party, following the announcement last week that Tata is planning to close its blast furnaces at Port Talbot and is intending to cut 2,800 jobs. Labour will use an opposition day debate to force a vote on the issue….

Investors in the City will be digesting the latest policy decision from the Bank of Japan overnight – it left interest rates at -0.1%, and stuck to its yield curve control policy that keeps the upper limit for 10-year Japanese government bond yield at 1%.

BOJ board members also lowered their forecast for core consumer inflation.

The agenda

-

7am GMT: UK public finances for December

-

10.15am GMT: Treasury Committee inquiry into SME access to finance

-

3pm GMT: Eurozone consumer confidence index