UK food and drink manufacturers cut prices for the first time in more than three years

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK food and drink manufacturers have cut their prices for first time in over three years, offering hopes that the inflationary squeeze on households may be easing.

Producers across the food and drink sector reduced their ‘factory gate’ prices for the first time since February 2020, as they passed on falls in their own costs to their customers.

The Lloyds Bank UK Sector Tracker, releaased this morning, showed that the prices paid by manufacturers’ direct customers, such as wholesalers and retailers, fell from the previous month.

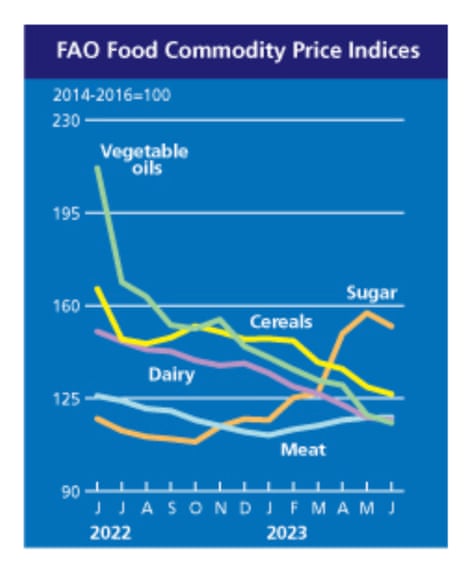

This was driven by a drop in input costs for the second month runnng, as global food commodity prices fell between May and June.

The data will drive hopes that Britons could soon see prices fall at the till.

Six of the 14 sectors monitored by Lloyds reported falls in input costs in June, including manufacturers of food and drink, chemicals manufacturers, and automobile and auto parts producers.

Nikesh Sawjani, senior UK economist at Lloyds Bank Corporate & Institutional Banking, explains:

“June’s data shows that more and more sectors are seeing moderations in cost pressures, which could – if sustained – carry through to falls in prices charged to customers.

“However, any benefit this has in terms of future inflation trends could be cancelled out by what is clearly still strong demand in some areas of the economy, which could lead to inflation being ‘stickier’ than hoped.

“This will be a factor that will pose serious consideration for the Bank of England as it continues to deliberate over how much further interest rates need to go in the UK.”

Relief on prices cannot come soon enough for households. Yesterday, consumer group Which? reported that supermarket prices have surged by a quarter since the cost of living squeeze began, up 25.8% between June 2021 and June 2023.

Tomorrow, June’s inflation rate is expected to drop to 8.2% from 8.7%.

Also coming up today

At 8am, data firm Kantar releases its monthly report on the grocery sector, showing how prices changes and which supermarkets grew market share.

The UK government is launching a new body to support the nuclear power industry, Great British Nuclear (GBN), with an offer of £157m of grants.

And prime minister Rishi Sunak is convening 14 senior bosses on a new business advisory council today, covering banking, pharmaceuticals, retail, construction, energy, tech, insurance, telecoms and defence.

Senior leaders from AstraZeneca, NatWest Group, BAE Systems, SSE, Google Deepmind, Sainsbury’s, Vodafone, GSK, Aviva, Shell, Sage, Taylor Wimpey, Diageo and Barclays are all attending.

Sunak says he wants to learn how to break down the barriers facing businesses, and help them to thrive.

The PM adds:

My new Business Council is one of the many ways we are making the UK the best place to do business and invest, so we can future-proof and grow our economy.

The agenda

-

8am BST: Kantar’s grocery price inflation report

-

11am BST: Great British Nuclear launch at the Science Museum

-

1.30pm BST: Canadian inflation report for June

-

1.30pm BST: US retail sales report for June

-

2.15pm BST: US industrial production report for June

Key events

Iceland Foods has become the latest supermarket group in Britain to announce food price cuts.

It’s a further sign that a surge in food inflation over the last year could be abating.

Reduced items include a pack of 15 Youngs fish fingers, cut to £2.0 from £3.50, McCain home chips (2.25 kg), cut from £5 to £4.25, and Iceland chicken breast fillets (600g), cut from £4 to £3.60.

Ocado posts EBITDA profit as price inflation continues’

British online supermarket and technology group Ocado has reported a widening loss this morning, despite raising prices.

Ocado made a pre-tax loss of £289m in the six months to 28 May, larger than the £211m in the same period a year ago, including the costs of closing its Hatfield warehouse.

But on an underlying basis, Ocado made an EBITDA profit of £16.6m, better than the loss of £13.6m recorded in the first half of 2022.

Ocado also reports that “price inflation has continued”, with the average item price up 8.4% to £2.72.

But customers at its retail arm, a joint venture with Marks & Spencer, are spending less – the average basket size declined by 6.3% to 45 individual items, down from 48 a year ago,

Ocado also reports an increase in active customers, offset by lower frequency of orders., leading to a 4% rise in total orders per week.

Ocado Retail made an EBITDA loss of £2.5m in the first half of the year, down from a £31.3m profit a year ago.

#OCDO OCADO Revs £1.4bn vs £1.33bn est. EBITDA of £16.6m vs an expected loss of £25.1m. However there is a £289m charge due to depreciation & amortisation & exceptionals. Retail sales look a small beat and expect a return to profitability in Q2, with avg orders per week in line.

— The Dude (@Redpanda73) July 18, 2023

Tim Steiner, CEO of Ocado Group, says the company has made good progress over the last six months, adding:

Technology Solutions has continued to deliver our industry-leading Ocado Smart Platform around the world and the opening of the first CFC for AEON, Japan’s biggest food retailer, in Chiba City, just outside Tokyo, is a landmark for the grocery sector.

It demonstrates that our proprietary AI and robotics can be applied to businesses across the globe.

UK food and drink manufacturers cut prices for the first time in more than three years

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK food and drink manufacturers have cut their prices for first time in over three years, offering hopes that the inflationary squeeze on households may be easing.

Producers across the food and drink sector reduced their ‘factory gate’ prices for the first time since February 2020, as they passed on falls in their own costs to their customers.

The Lloyds Bank UK Sector Tracker, releaased this morning, showed that the prices paid by manufacturers’ direct customers, such as wholesalers and retailers, fell from the previous month.

This was driven by a drop in input costs for the second month runnng, as global food commodity prices fell between May and June.

The data will drive hopes that Britons could soon see prices fall at the till.

Six of the 14 sectors monitored by Lloyds reported falls in input costs in June, including manufacturers of food and drink, chemicals manufacturers, and automobile and auto parts producers.

Nikesh Sawjani, senior UK economist at Lloyds Bank Corporate & Institutional Banking, explains:

“June’s data shows that more and more sectors are seeing moderations in cost pressures, which could – if sustained – carry through to falls in prices charged to customers.

“However, any benefit this has in terms of future inflation trends could be cancelled out by what is clearly still strong demand in some areas of the economy, which could lead to inflation being ‘stickier’ than hoped.

“This will be a factor that will pose serious consideration for the Bank of England as it continues to deliberate over how much further interest rates need to go in the UK.”

Relief on prices cannot come soon enough for households. Yesterday, consumer group Which? reported that supermarket prices have surged by a quarter since the cost of living squeeze began, up 25.8% between June 2021 and June 2023.

Tomorrow, June’s inflation rate is expected to drop to 8.2% from 8.7%.

Also coming up today

At 8am, data firm Kantar releases its monthly report on the grocery sector, showing how prices changes and which supermarkets grew market share.

The UK government is launching a new body to support the nuclear power industry, Great British Nuclear (GBN), with an offer of £157m of grants.

And prime minister Rishi Sunak is convening 14 senior bosses on a new business advisory council today, covering banking, pharmaceuticals, retail, construction, energy, tech, insurance, telecoms and defence.

Senior leaders from AstraZeneca, NatWest Group, BAE Systems, SSE, Google Deepmind, Sainsbury’s, Vodafone, GSK, Aviva, Shell, Sage, Taylor Wimpey, Diageo and Barclays are all attending.

Sunak says he wants to learn how to break down the barriers facing businesses, and help them to thrive.

The PM adds:

My new Business Council is one of the many ways we are making the UK the best place to do business and invest, so we can future-proof and grow our economy.

The agenda

-

8am BST: Kantar’s grocery price inflation report

-

11am BST: Great British Nuclear launch at the Science Museum

-

1.30pm BST: Canadian inflation report for June

-

1.30pm BST: US retail sales report for June

-

2.15pm BST: US industrial production report for June