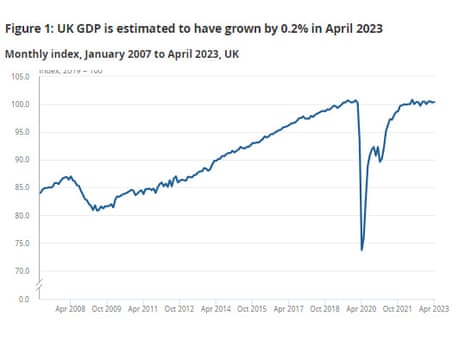

UK GDP grew 0.2% in April

Newsflash! The UK economy has returned to growth.

UK GDP increased by 0.2% in April, new figures from the Office for National Statistics show, matching City forecasts.

That follows the 0.3% contraction recorded in March.

Over the three months to April, the economy only expanded by 0.1%

The ONS says the services sector was the main contributor to the growth in monthly GDP in April, expanding by 0.3%.

Output in consumer-facing services grew by 1.0% in April 2023, following a fall of 0.8% in March 2023.

But the production sector shrank by 0.% in April, while construction output shrank by 0.6%.

Key events

This chart shows how the services sector lifted the UK economy in April (by growing by 0.3%), while production output (-0.3%) and construction output (-0.6%) shrank during the month:

UK GDP: political reaction

Reaction to this morning’s growth figures is rushing in.

Chancellor Jeremy Hunt said:

“We are growing the economy, with the IMF (International Monetary Fund) saying that from 2025 we will grow faster than Germany, France and Italy.

“But high growth needs low inflation, so we must stick relentlessly to our plan to halve the rate this year to protect family budgets.”

Labour’s shadow chancellor Rachel Reeves said:

“Despite our country’s huge potential and promise, today is another day in the dismal low-growth record book of this Conservative Government.

“The facts remain that families are feeling worse off, facing a soaring Tory mortgage penalty and we’re lagging behind on the global stage.”

Bars and pubs helped economy grow

UK bars and pubs had a relatively strong April, the Office for National Statistics reports, helping the economy grow by 0.2% during the month.

There was also a rebound in car sales, after a drop in March which hit GDP.

Activity in the education sector also increased, following strike action in March which hit output.

But, health sector activity was hit by strikes as the pay row between unions and the government continued.

Darren Morgan, director of economic statistics production & analysis at the ONS, says:

“GDP bounced back after a weak March.

“Bars and pubs had a comparatively strong April, while car sales rebounded and education partially recovered from the effect of the previous month’s strikes.

“These were partially offset by falls in health, which was affected by the junior doctors strikes, along with falls in computer manufacturing and the often-erratic pharmaceuticals industry.

“House builders and estate agents also had a poor month.”

UK economy 0.3% larger than pre-pandemic

Monthly UK GDP is now estimated to be 0.3% above its pre-coronavirus levels, set in February 2020, the ONS reports.

UK GDP grew 0.2% in April

Newsflash! The UK economy has returned to growth.

UK GDP increased by 0.2% in April, new figures from the Office for National Statistics show, matching City forecasts.

That follows the 0.3% contraction recorded in March.

Over the three months to April, the economy only expanded by 0.1%

The ONS says the services sector was the main contributor to the growth in monthly GDP in April, expanding by 0.3%.

Output in consumer-facing services grew by 1.0% in April 2023, following a fall of 0.8% in March 2023.

But the production sector shrank by 0.% in April, while construction output shrank by 0.6%.

Yesterday’s turbulence in the financial markets gets plenty of coverage in today’s newspapers.

The i newspaper warns that mortgage misery is set to be as bad as the 1980s — with interest rates seen heading for 5.75% by next spring.

The Financial Times highlights Bank of England governor Andrew Bailey’s warning that inflation is “taking a lot longer” than hoped to come down.

The Daily Telegraph reports that Downing Street has “ordered banks to protect struggling homeowners from soaring mortgage costs”, as markets bet interest rates could hit almost 6pc by the end of the year.

The Prime Minister’s spokesman said yesterday:

The Chancellor has made clear his expectation that lenders should live up to their responsibilities and support any mortgage borrowers who are finding it tough right now.”

“There do remain a large range of mortgage deals available to the public, but we know this current situation may be concerning for some homeowners and mortgage holders.”

Deutsche Bank predict the UK economy expanded by 0.2% in April, rebounding from its March contraction.

Their senior economist, Sanjay Raja, explains:

After a surprise contraction in March, we see GDP expanding modestly in April. What do our models tell us? Our April nowcast sits at 0.2% m-o-m. What’s driving the rise in activity? More services output, as some of the drag from industrial action unwinds.

Consumer facing services, we think, will lead the rebound into spring. We also see construction output expanding a little (0.3% m-o-m).

The one drag to GDP will likely come from industrial production, which we expect will see broad based weakness from energy, water, oil, and manufacturing production.

We’ll find out in 15 minutes if they’re right….

Looking ahead, Deutsche Bank continue to see UK GDP this year expanding by 0.3%.

Introduction: UK GDP and Fed decision in focus

Good morning, and welcome to our rolling coverage of business, the financial markets and the world econony.

At 7am we discover how the UK economy fared in April, when the latest growth figures are released.

Economists predict the UK returned to growth in April, with GDP tipped to have risen by 0.2% despite high inflation, rising interest rates and disruption caused by strikes.

The economy shrank by 0.3% in March, meaning the economy only grew by 0.1% in the first quarter of this year [although this data may be revised]. That left the UK at the bottom of the G7 growth league since the pandemic, behind Germany, France and the US.

But the UK has defied fears of a recession, so far anyway, with the economy showing more resilience than expected, assisted by easing energy costs after last year’s spikes.

Michael Hewson of CMC Markets sets the scene…

As we look to today’s UK April GDP numbers, we’ve just come off a March contraction of -0.3% which acted as a drag on Q1’s 0.1% expansion. The reason for the poor performance in March was due to various public sector strike action from healthcare and transport, which weighed heavily on the services sector which saw a contraction of -0.5%.

The performance would have been worse but for a significant rebound in construction and manufacturing activity which saw strong rebounds of 0.7%.

This isn’t expected to be repeated in today’s April numbers, however there was still widespread strike action which is likely to have impacted on public services output.

The strong performance from manufacturing is also unlikely to be repeated with some modest declines, however services should rebound to the tune of 0.3%, although the poor March number is likely to drag the rolling 3M/3M reading down from 0.1% to -0.1%.

Also coming up today

Today’s GDP report comes amid turmoil in the UK mortgage markets, as lenders scramble to reprice deals as UK borrowing costs soar.

Yesteday, the interest rate on a two-year UK government bond jumped over the levels hit during Liz Truss’s disastrous premiership, following faster-than-expected wage growth this year.

Yesterday, the governor of the Bank of England, Andrew Bailey, warned that inflation was “taking a lot longer” than hoped to come down.

He told the House of Lords economic affairs committee:

“We still think the rate of inflation is going to come down, but it’s taking a lot longer than we expected.”

Tonight America’s central bank sets interest rates, with many forecasters predicting the Federal Reserve will pause its cycle of higher borrowing costs.

Yesterday, US inflation dropped to 4% in May, bringing some relief to households (and some envious looks from the Bank of England’s headquarters…).

That pushed stock markets higher yesterday, as Danni Hewson, head of financial analysis at AJ Bell, explains.

“With US inflation coming in at the lowest print in more than two years markets have taken the bull by the horns and run.

Both the S&P and Nasdaq have surged to fresh 2023 highs as investors buy into speculation that the Fed will indeed pause its rate hiking cycle this month, even if what happens in the months beyond remains uncertain.

The agenda

-

7am BST: UK GDP report for April

-

9am BST: IEA monthly oil market report

-

1.30pm BST: US PPI index of producer price inflation

-

7pm BST: US Federal Reserve decision on interest rates

-

7.30pm BST: US Federal Reserve press conference