Key events

Introduction: UK economy limping along and ‘vulnerable to shocks’

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

It’s the start of the last working week before Christmas, and investors’ minds in the City are turning to 2024 (unless they’ve clocked off already).

After a turbulent 2023, what will next year bring to the markets, and Britain’s economy, they ponder.

Well, according to KPMG, Britain’s growth in 2024 will be modest, at best.

The accountancy giant’s latest global economic outlook, released this morning, cautions that the UK economy is “limping with a sprained ankle”, at at time when global growth is being held back by high interest rates and policy uncertainty.

KPMG estimates UK GDP will rise by 0.5% in 2024, the same as in 2023, picking up to 1% in 2025.

That’s a small upgrade on their old forecasts, of 0.4% growth in 2023 and 0.3% in 2024. And it’s more optimistic than the Bank of England, which projects zero growth next year.

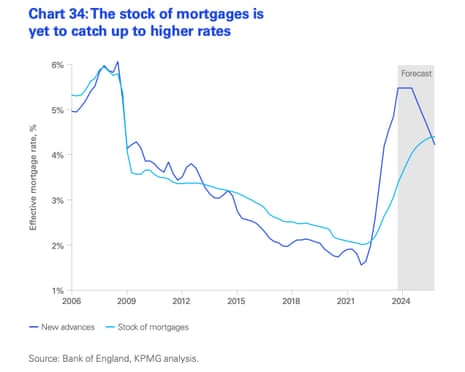

But it’s still a weak prospect, partly due to high borrowing costs. Even though UK interest rates have been stuck at 5.25% since August, much of the impact is yet to be felt as many households have yet to roll onto new, pricier, mortgage deals.

KPMG explain:

Mortgage rates on new loans have risen by 370 basis points since the end of 2021, reflecting higher policy rates. However, the effective rate on the stock of mortgages has only increased by around 120 basis points, as a large share of mortgages with repayments fixed up to five years has been insulated from the immediate impact of higher rates.

UK unemployment is tipped to rise, from 4.1% this year to 4.7% in 2024, and 4.9% in 2025.

Yael Selfin, chief economist at KPMG UK, says:

“While the UK economy is resilient, it needs to get its mojo back. We expect monetary and fiscal policies to act as a headwind to growth over the next two years, and a sudden revival in productivity is not likely to come to the rescue.

This means that even the expected continuation of positive growth should not be celebrated prematurely, as the outlook is dominated by downside risks.”

Looking globally, KPMG predicts global GDP growth of 2.2% in 2024 – down from 2.6% in 2023, with a return to 2.6% growth anticipated in 2025.

Here are the key points from the report:

-

Activity has outperformed expectations, but the UK economy remains weak and vulnerable to shocks.

-

Risks to the UK outlook are skewed to the downside, and stem from a more persistent inflation, delayed impact of monetary policy, and structural weakness of labour supply.

-

Deceleration in growth in some of the world’s largest economies, coupled with little impetus elsewhere, could see global GDP growth easing slightly in 2024.

-

Weaker momentum should help push down inflation, with average world inflation expected to halve by 2025.

Also coming up

We’ll hear from Bank of England deputy governor Ben Broadbent this morning, when he gives a speech at London Business School. Last week, the BoE warned that fighting inflation was tougher in the UK than in the eurozone and US.

On the economics front, the latest German IFO business survey will test the temperature of Europe’s largest economy, as it struggles towards 2024.

Michael Hewson, chief market analyst at CMC Markets UK, says:

Given the weak nature of last week’s PMI numbers it would be surprising to see a significant improvement on the November numbers when the current assessment improved slightly to 89.4.

The agenda

-

9am GMT: IFO Institute’s index of Germany’s business climate

-

10.30am GMT: Bank of England deputy governor Ben Broadbent speech at London Business School

-

3pm GMT: NAHB index of US housing market