UK avoids stagnation with 0.2% growth in Q2

Newsflash: The UK economy has posted modest growth in the second quarter of this year, defy fears of stagnation.

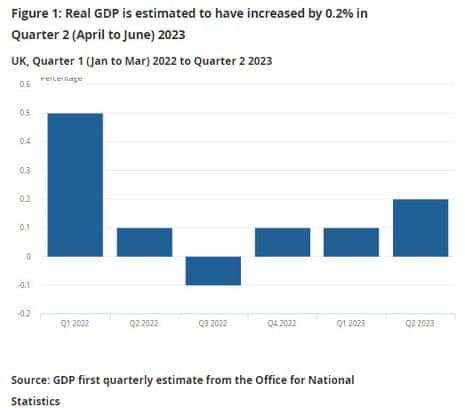

UK GDP expanded by 0.2% in April-June, the Office for National Statistics reports, beating forecasts of no growth in the quarter. This follows growth of 0.1% in January-March.

In June, the economy also fared better than expected — with growth of 0.5%.

That follows the GDP fall of 0.1% in May, and growth of 0.2% in April.

The ONS explains:

In output terms, the services sector grew by 0.1% on the quarter, driven by increases in information and communication, accommodation and food service activities, and human health and social work activities; elsewhere, the production sector grew by 0.7%, with 1.6% growth in manufacturing.

In expenditure terms, there was strong growth in household consumption and government consumption, which was partially offset by a fall in international trade flows in the second quarter.

Key events

UK’s Hunt: Plan to fight inflation taking effect

Chancellor of the Exchequer Jeremy Hunt has welcomed the news that the UK economy grew by 0.2% in April-June, saying:

“The actions we’re taking to fight inflation are starting to take effect, which means we’re laying the strong foundations needed to grow the economy.

“The Bank of England are now forecasting that we will avoid recession, and if we stick to our plan to help people into work and boost business investment, the IMF (International Monetary Fund) have said over the longer-term we will grow faster than Germany, France and Italy.”

Sterling strengthens after GDP report beats forecasts

The pound has strengthened, jumping almost half a cent to $1.272 against the US dollar.

June’s stronger-than-expected growth feels like “the first positive surprise in a long run of economic plot twists”, says Joseph Calnan, corporate FX dealing manager at Moneycorp:

Calnan explains:

However, both GDP and inflation are still off where they need to be, with the Bank of England and government policymakers clearly struggling to deliver on their respective remits.

“The thornier question is what this will mean for interest rates. What the BoE has been looking for in its relentless campaign of back-to-back interest rate hikes is a meaningful slowdown in the economy, and this doesn’t hit that brief.

“Despite the backdrop of spiralling wage growth and a hot labour market; it’s possible the 25 bps rate rise forecast at the next MPC meeting will remain. But, as the past few months have shown us, you can never be sure which way the next set of economic indicators will go.”

This morning’s UK GDP report is stronger than expected:

UK GDP beats forecasts

GDP year on year to June

Actual 0.9%

Forecast 0.5%

Previous -0.4%Year on Year for Q2

Actual 0.4%

Forecast 0.2%

Previous 0.2%Quarter on Quarter for Q2

Actual 0.2%

Forecast 0.0%

Previous 0.1%Month on Month to June

Actual 0.5%

Forecast 0.2%…— Justin Waite (@SharePickers) August 11, 2023

ONS: Economy bounced back from May’s extra bank holiday

ONS director of economic statistics Darren Morgan says there was “particularly buoyant growth” in the UK’s car-making sector in June, and also in the pharma sector:

“The economy bounced back from the effects of May’s extra bank holiday to record strong growth in June. Manufacturing saw a particularly strong month with both cars and the often-erratic pharmaceutical industry seeing particularly buoyant growth.

“Services also had a strong month with publishing and car sales and legal services all doing well, though this was partially offset by falls in health, which was hit by further strike action.

“Construction also grew strongly, as did pubs and restaurants, with both aided by the hot weather.”

Monthly UK GDP is now estimated to be 0.8% above its pre-Covid-19 levels, following the 0.5% growth reported in June this morning.

A range of businesses cited the additional bank holiday in May as a reason for increased output in June compared with May, the ONS says.

A breakdown of today’s GDP report shows that production (which includes manufacturing) grew by 1.8%, and was the main contributor to growth in monthly GDP in June.

The UK’s dominant service sector grew by 0.2% in June, while construction expanded by 1.6%.

The UK economy grew at its fastest pace in over a year in the last quarter, according to today’s GDP report.

It has now grown for the last three quarters in a row, as this chart shows:

Growth has been modest – with the economy expanding by just 0.1% in October-December and January-March, before picking up in April-June. That’s weak by historic standards.

But happily, the recession feared last year has not materialised, yet anyway.

UK avoids stagnation with 0.2% growth in Q2

Newsflash: The UK economy has posted modest growth in the second quarter of this year, defy fears of stagnation.

UK GDP expanded by 0.2% in April-June, the Office for National Statistics reports, beating forecasts of no growth in the quarter. This follows growth of 0.1% in January-March.

In June, the economy also fared better than expected — with growth of 0.5%.

That follows the GDP fall of 0.1% in May, and growth of 0.2% in April.

The ONS explains:

In output terms, the services sector grew by 0.1% on the quarter, driven by increases in information and communication, accommodation and food service activities, and human health and social work activities; elsewhere, the production sector grew by 0.7%, with 1.6% growth in manufacturing.

In expenditure terms, there was strong growth in household consumption and government consumption, which was partially offset by a fall in international trade flows in the second quarter.

Just five minutes to go until we get the UK economy’s report card for the second quarter of the year…

A trio of bank holidays in May hurt activity in the manufacturing and construction sectors as workers enjoyed the extra days off, points out Victoria Scholar, head of investment at interactive investor.

But that should also provide a “back-to-work boost for the economy” in June, she explains, adding:

According to June’s retail sales figures, the record-breaking heatwave supported sales in supermarkets and department stores, partly driven by high inflation which flattered food sales, lifted by higher prices rather than stronger volumes. Lower fuel prices versus last year during the energy crisis are also likely to provide a tailwind to fuel sales and in turn June’s growth figure.

However, the boiling hot temperatures are likely to have dampened productivity, particularly in agriculture and construction. They also caused problems in the transport sector with passengers on trains and planes facing delays and cancellations.

The UK economy probably stalled in the second quarter due to carry-over weakness from strikes and a drag from May’s extra bank holiday, Bloomberg Economics predict.

Bloomberg adds:

GDP is seen registering zero growth quarter on quarter and expanding 0.2% year on year.

For this quarter, BE forecasts a gain of 0.1% but that’s probably the last positive news for a while: High interest rates are expected to tip the economy into recession later in 2023.

Introduction: UK GDP in focus

Good morning.

We’re about to discover how the UK economy fared over the spring and early summer, in the face of rising interest rates and the cost of living crisis.

The Office for National Statistics will release its first estimate of UK GDP for the second quarter of 2023, and just for June, at 7am.

Economists fear the economy stagnated in Q2, with no growth, after the meagre 0.1% expansion recorded in January-March.

In June alone, City analysts are expecting to see growth of 0.2%, a modest recovery after the 0.1% contraction in May.

Activity in May was disrupted by the extra bank holiday for King Charles’s coronation, so June could see a recovery in activity in comparison.

Adam Cole of RBC Capital Markets explains:

Though there was an extra bank holiday in May for the Coronation, the impact of that appears to have been less than the impact of similar additional public holidays in 2022. Also, a recovery in activity from strikes the previous month helped compensate.

That is likely to reverse again in June which will drag on activity and act as a counterweight to a moderate recovery in activity in June from the impact of May’s extra bank holiday.

Michael Hewson of CMC Markets reckons the forecasts for stagnation in Q2 are too pessimistic.

Having eked out 0.1% growth in Q1 of this year, today’s UK Q2 GDP numbers ought to show an improvement on the previous two quarters for the UK economy, yet for some reason most forecasts are for zero growth.

That seems unduly pessimistic to me, although the public sector strike action is likely to have been a drag on economic activity.

Contrary to a lot of expectations economic activity has managed to hold up reasonably well, despite soaring inflation which has weighed on demand, and especially on the more discretionary areas of the UK economy.

The data is released at 7am UK time…

UK companies posting earnings today – Beazley, Soho House – Economic data – UK Balance of Trade, UK GDP, UK Index of Services, UK Industrial Production & Manufacturing Output, US PPI, US University of Michigan Consumer Confidence.

— David Buik (@truemagic68) August 11, 2023

The agenda

-

7am BST: UK GDP report for Q2 2023, and for June

-

7am BST: UK trade report for June

-

9am BST: IEA monthly oil report

-

1.30pm BST: US PPI index of producer prices

-

3pm BST: University of Michigan Index of Consumer Expectation