UK inflation drops to 4.6%

Newsflash: UK inflation has fallen to a two-year low, as the cost of living squeeze eases.

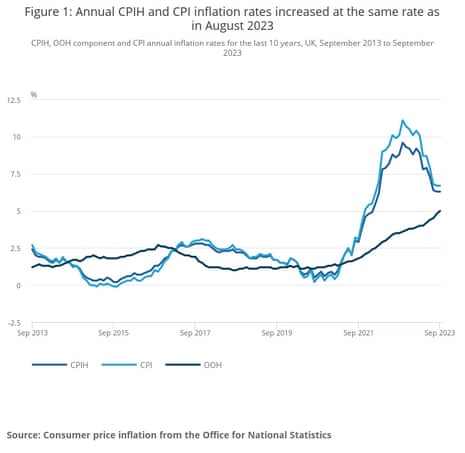

The UK’s CPI index has dropped to 4.6% in October, down from 6.7% in September.

That’s the lowest rate of price increases in two years, and means inflation has more than halved since late last year.

It’s an even bigger fall than the City expected.

In the year to October 2023:

▪️ Consumer Prices Index including owner occupiers’ housing costs rose by 4.7%, down from 6.3% in September

▪️ Consumer Prices Index (CPI) rose by 4.6%, down from 6.7% in September

➡️ https://t.co/8axCF0xTBa pic.twitter.com/60khlBx0c4

— Office for National Statistics (ONS) (@ONS) November 15, 2023

As expected, the decline follows the drop in energy bills last month after Ofgem lowered the cap on household bills.

But, although inflation has dropped, prices are still rising compared with a year ago.

This means that real wages are continuing to rise – we learned yesterday that total pay rose by 7.9% per year, on average, in July-September.

Grant Fitzner, chief economist at the Office for National Statistics, says::

“Inflation fell substantially on the month as last year’s steep rise in energy costs has been followed by a small reduction in the energy price cap this year.

“Food prices were little changed on the month, after rising this time last year, while hotel prices fell, both helping to push inflation to its lowest rate for two years.”

Key events

ICAEW: falling energy and higher interest rates get credit for lower inflation

Falling energy bills, and the economic drag caused by higher interest rates, should get the credit for the drop in inflation.

That’s the view of Suren Thiru, economics director at ICAEW (The Institute of Chartered Accountants in England and Wales).

Thiru says:

“This dramatic drop suggests that the UK has turned the corner in its battle against soaring inflation, particularly given the fall in core inflation, which indicates that underlying price pressures are also easing.

“While the Prime Minister has achieved his target to halve inflation this year, this owes more to the downward pressure on prices from falling energy costs and rising interest rates than any government action.

“Although subsequent declines will be more modest, the drag on demand from a softening jobs market and high interest rates may mean that inflation falls back to the Bank of England’s 2% target more quickly than they currently expect.

“This fall in inflation seals the deal on a December interest rate hold and may drive a three-way voting split among rate setters with a member voting for a rate cut as concerns over a flatlining economy grow.”

Reeves: Conservative ministers shouldn’t pop champagne corks

Shadow chancellor Rachel Reeves has warned the Government not to start “popping champagne corks” about the fall in the rate of inflation.

Reeves points out that people still struggling with the cost of living.

She explains:

“The fall in inflation will come as some relief for families struggling with the cost of living.

“But now is not the time for Conservative ministers to be popping champagne corks and patting themselves on the back.

“After 13 years of economic failure under the Conservatives, working people are worse off with higher mortgage bills, prices still rising in the shops and inflation twice as high as the Bank of England’s target.

“Rishi Sunak is too out of touch and his party is too divided to help people who are worried about the cost of living.

“A Labour government’s priority would be making working people better off by boosting wages, cutting people’s bills and getting the economy growing again.”

Sunak: We have delivered on inflation pledge

October’s sharp drop in the CPI rate to 4.6% means Rishi Sunak can claim victory in his pledge to halve inflation by the end of this year.

And he has wasted no time in doing that.

In a statement just released, Sunak says:

“In January I made halving inflation this year my top priority. I did that because it is, without a doubt, the best way to ease the cost of living and give families financial security.

“Today, we have delivered on that pledge.”

In January we said we’d halve inflation.

Today we’ve done that – inflation is now 4.6%.

Why does that matter?

Because it means people keeping more of what they earn, letting them provide for their families, do the things they love & invest in their futures. pic.twitter.com/FXJOjrZgvc

— HM Treasury (@hmtreasury) November 15, 2023

Mathematically, Sunak is correct – CPI was 10.7% when he made his pledge.

However, as flagged earlier, the drop in inflation is mainly driven by cheaper energy costs compared with a year ago (when European countries were scrambling to fill their gas storage ahead of the winter).

Food inflation slowed

The pace of price rises for food and non-alcoholic beverages also fell sharply in October, but was still – just – in double-digits.

The annual inflation rate for food and non-alcoholic beverages dropped to 10.1% in October 2023, down from 12.2% in September.

That’s an improvement on the recent high of 19.2% hit in March 2023 (the highest annual rate seen for over 45 years).

But it’s still a very painful rate of price increases, which will hurt lower-income households badly.

Gas and electricity prices slumped in October

The largest downward contribution to UK inflation came from “housing and household services”, where the annual rate for CPI was the lowest since records began in January 1950, the ONS says.

That’s due to the drop in energy bills last month, after Britain’s energy price cap was lowered.

The ONS says:

Gas costs fell by 31.0% in the year to October 2023, compared with a rise of 1.7% in September. This is the lowest annual rate since records began in January 1989.

Electricity costs fell by 15.6% in the year to October 2023, compared with a rise of 6.7% in September. This is the lowest annual rate since records began in January 1989.

On a monthly basis, CPI did not change in October, the Office for National Statistics says.

That means prices (measured by a basket of goods and services) were flat last month, compared with a rise of 2.0% in October 2022 when energy prices were surging.

UK inflation drops to 4.6%

Newsflash: UK inflation has fallen to a two-year low, as the cost of living squeeze eases.

The UK’s CPI index has dropped to 4.6% in October, down from 6.7% in September.

That’s the lowest rate of price increases in two years, and means inflation has more than halved since late last year.

It’s an even bigger fall than the City expected.

In the year to October 2023:

▪️ Consumer Prices Index including owner occupiers’ housing costs rose by 4.7%, down from 6.3% in September

▪️ Consumer Prices Index (CPI) rose by 4.6%, down from 6.7% in September

➡️ https://t.co/8axCF0xTBa pic.twitter.com/60khlBx0c4

— Office for National Statistics (ONS) (@ONS) November 15, 2023

As expected, the decline follows the drop in energy bills last month after Ofgem lowered the cap on household bills.

But, although inflation has dropped, prices are still rising compared with a year ago.

This means that real wages are continuing to rise – we learned yesterday that total pay rose by 7.9% per year, on average, in July-September.

Grant Fitzner, chief economist at the Office for National Statistics, says::

“Inflation fell substantially on the month as last year’s steep rise in energy costs has been followed by a small reduction in the energy price cap this year.

“Food prices were little changed on the month, after rising this time last year, while hotel prices fell, both helping to push inflation to its lowest rate for two years.”

Darius McDermott, managing director at Chelsea Financial Services, says today’s UK inflation report could move the markets – especially if CPI is higher than expected.

McDermott explains:

The consensus is a fall of two percentage points to 4.8%. Generally, if the data is in line with consensus, you wouldn’t expect a major move in bond and equity prices. We have also seen a big fall in bond yields ahead of the data which means a fair bit of good news has been priced in. This could mean the market is particularly vulnerable to a negative surprise in the data.

The fall in headline inflation we will see tomorrow is largely from an automatic mechanical adjustment as the inflation figures for October 2022, when the month-on-month inflation was exceptionally high, falls out of the data. The market will likely be more concerned with core inflation, which is expected to fall from 6.1% to 5.8%.

If the numbers were to come in significantly under, we would anticipate a sharper move upwards in all risk assets – particularly UK smaller companies, which we believe are already significantly undervalued – that could fuel a broader rally until the end of the year.

Breaching that 5% barrier is a significant psychological threshold and also the government’s target. The bottom line is that it has become an important number for markets: miss significantly and it could be ugly; beat it and expect a rally.

Preview: Inflation fall would ease interest rate pressure

Phillip Inman

The annual pace of UK price rises is expected to have slowed sharply when the latest official figure for October is released on Wednesday, easing fears that the Bank of England could increase interest rates next month, my colleague Phillip Inman writes.

City economists polled by Reuters have signalled that inflation as measured by the consumer prices index (CPI) will fall almost two percentage points to 4.8% from September’s 6.7% reading.

The decline does not mean prices are falling, just that they are rising less rapidly, and would remain well above the central bank’s 2% target, but would be a significant signal to Bank rate-setters that prices are on course to come down over the next year without the need for further increases in the cost of borrowing.

Here’s our preview of this morning’s inflation data:

Introduction: UK inflation expected to hit two-year low today

Good morning.

Britain may be able to celebrate an easing in the cost of living squeeze today, with inflation expected to have dropped sharply last month.

The latest inflation reading, due at 7am, is expected to hit a two-year low in October.

Economists predict that the CPI inflation rate will fall to around 4.8% in the year to October, down from the 6.7% in both September and August.

Such a sharp fall in the speed of price rises would allow Rishi Sunak to claim victory in his promise to halve inflation this year (CPI was 10.7% when he made the pledge).

But much of the credit should really go to energy regulator Ofgem, who cut the maximum price which suppliers can charge for power from the start of October.

That means average household energy bills fell last month.

Economists at Investec Economics have said that an inflation slowdown in October “should not come as a huge surprise” because last year saw gas and electricity prices soar.

Food price pressures may also have eased; data provider Kantar reported last week that grocery inflation has dropped to single digits for the first time in a year and a half.

Sanjay Raja, chief UK economist for Deutsche Bank, has predicted that the UK inflation picture “will likely change dramatically in October” with headline inflation expected to drop a lot further today.

Raja told clients this week that “more disinflation pressure is building”, with Deutsche Bank predicting UK inflation will have fallen “closer to 3%” by next April.

A sharp drop in inflation would be cheered in the Bank of England, where policymakers are trying to steer the pace of price rises down to its 2% target.

Financial markets already predict the BoE will leave interest rates on hold, at 5.25%, until next spring, with many economists forecasting a cut to 5% in May 2024.

But inflation is still lower in other advanced economies.

Yesterday, US inflation fell more than expected, to just 3.2% in the year to October, down from 3.7% in September, sparking a strong rally on Wall Street.

Economic data posted today – UK Inflation (CPI, PPI & RPI), EU Balance of Trade, EU Industrial Production, US MBA Mortgage Application, US PPI, US Retail Sales, US Business Inventories, US Crude Oil Inventories

— David Buik (@truemagic68) November 15, 2023

The agenda

-

7am GMT: UK inflation report for October

-

7am GMT: UK PPI index of factory gate prices

-

9.30am GMT: UK house price index for September

-

9.30am GMT: UK rental prices index for October

-

10am GMT: Eurozone trade balance for September

-

1.30pm GMT: US PPI index of factory gate prices