Hunt’s tax cuts give back less than 25p for every £1 taken by Treasury in increased taxes since 2021, IFS says

Turning back to the Institute for Fiscal Studies’ assessment of the autumn statement, it says that Jeremy Hunt’s tax cuts yesterday return less than £1 to taxpayers for every extra £4 they are paying because of tax rises since 2021.

Another way of putting that would be to say that, for every £1 the Treasury has taken, less than 25p is coming back under yesterday’s measures.

This is from the analysis by the IFS’s Robert Joyce.

The headline measures in this autumn statement were cuts to the rates of national insurance contributions for employees and the self-employed. Taken in isolation, these put money back into the pockets of almost 30 million workers at a cost of around £10 billion per year, with anyone earning at least £12,570, or making profits of at least £6,725, per year benefitting.

The bigger picture is that these changes give back less than £1 of every £4 that is being taken away from households through changes to NICs and income tax announced since March 2021. Those takeaways are far less transparent than the smaller giveaway announced today – implemented as they are through multi-year freezes to income tax and NICs thresholds, which gradually bring more and more people into higher tax brackets, and especially so at a time of high inflation.

Key events

-

Hunt’s tax cuts give back less than 25p for every £1 taken by Treasury in increased taxes since 2021, IFS says

-

Labour says Cameron should reveal more details of his role in China-linked port project in Sri Lanka

-

Tory MPs say party faces ‘do or die’ moment if Sunak can’t slash immigration before next election

-

Hancock, Gove, Raab and Javid due to give evidence to Covid inquiry next week

-

Hunt has paid for tax cuts with unrealistic spending cuts which create huge problems for next chancellor, IFS says

-

Cameron visits scene of one of last month’s Hamas massacres in Israel

-

ONS puts net migration at 672,000, but says provisional figures suggest it might be falling from record high

-

Hunt says he feels ‘incredibly guilty’ after autumn statement – because he did not buy his wife birthday present or even card

-

Estimated net migration to UK in year to June 2023 was 672,000, ONS says

-

Hunt rejects claim it is misleading for Tories to say they are giving people ‘biggest tax cut in British history’

-

Hunt rejects claims his proposals to hold down government spending will make public services worse

-

Households will be £1,900 poorer on average over course of this parliament, says thinktank

-

Hunt says it is ‘silly’ to see his autumn statement tax cuts as pre-election giveaway

In its own report on the autumn statement, the Resolution Foundation thinktank says this will be the first parliament on record in which household incomes in real terms will be lower at the end than at the beginning. (See 9.02am.) Here is the chart illustrating this.

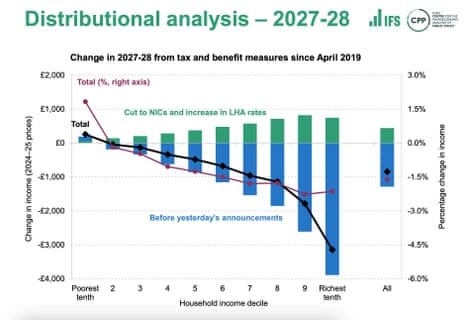

The Institute for Fiscal Studies has also published a distributional impact of the autumn statement. Confirming what other researchers have said, it shows that the measures announced yesterday (the green bars on the graph – cuts to national insurance contributions and the increase in local housing allowance rates) benefit the richest households most. But, if all tax and benefit measures from April 2019 are included, the poorest 10% of households have gained most.

(In fact, the poorest 10% of households are the only group that have gained overall. But the changes have been progressive, in that wealthier households have lost out more – both proportionally and in cash terms – than poorer ones.)

Hunt’s tax cuts give back less than 25p for every £1 taken by Treasury in increased taxes since 2021, IFS says

Turning back to the Institute for Fiscal Studies’ assessment of the autumn statement, it says that Jeremy Hunt’s tax cuts yesterday return less than £1 to taxpayers for every extra £4 they are paying because of tax rises since 2021.

Another way of putting that would be to say that, for every £1 the Treasury has taken, less than 25p is coming back under yesterday’s measures.

This is from the analysis by the IFS’s Robert Joyce.

The headline measures in this autumn statement were cuts to the rates of national insurance contributions for employees and the self-employed. Taken in isolation, these put money back into the pockets of almost 30 million workers at a cost of around £10 billion per year, with anyone earning at least £12,570, or making profits of at least £6,725, per year benefitting.

The bigger picture is that these changes give back less than £1 of every £4 that is being taken away from households through changes to NICs and income tax announced since March 2021. Those takeaways are far less transparent than the smaller giveaway announced today – implemented as they are through multi-year freezes to income tax and NICs thresholds, which gradually bring more and more people into higher tax brackets, and especially so at a time of high inflation.

Labour says Cameron should reveal more details of his role in China-linked port project in Sri Lanka

Labour wants David Cameron to reveal the extent of his links to a Chinese-backed enterprise, PA Media reports. PA says:

Labour has questioned reports of the foreign secretary’s links to a Sri Lankan port development and its ties with the Chinese government.

MPs also continued to question the Tory peer’s role in the Greensill affair, in which he privately lobbied ministers in an attempt to win access for the now-collapsed financial firm to an emergency coronavirus loan scheme.

During Cabinet Office questions in the Commons, Labour’s Pat McFadden asked who the “ultimate client” was for Cameron’s “role in promoting the Port City Colombo project in Sri Lanka”, and if it was a company owned by the Chinese state.

The project is part of China’s global infrastructure strategy, the belt and road initiative, with Chinese companies involved in its construction.

The Cabinet Office minister John Glen replied: “This isn’t a matter for me. This is a matter for the processes that I have set out which have been complied with. And I believe Lord Cameron has made some comments with respect to those matters.”

McFadden had earlier asked “whether all benefits in kind received by the foreign secretary while he acted as a lobbyist for Greensill Capital have been properly declared”, and whether the former prime minister’s tax affairs were examined and considered by the House of Lords appointments commission before his peerage was approved.

Glen replied: “I’m not going to comment on media speculation … Lord Cameron’s appointment followed all the established processes for both peerages and ministerial appointments. The ennoblement was approved by the House of Lords appointments commission in the usual way, and that included a check with HMRC.”

Tory MPs say party faces ‘do or die’ moment if Sunak can’t slash immigration before next election

The New Conservatives, a group of rightwing Tory MPs co-chaired by Miriam Cates and Danny Kruger, have expressed alarm about today’s net migration figure.

In a statement, the group says that this is a “do or die” moment for the Tories and that Rishi Sunak should publish plans to show how the party will get net migration below 229,000, the level it was at the time of the last election, when reducing migration was a Tory manifesto promise. The New Conservatives say this must happen by the next election, which must be held by January 2025 at the latest.

They say:

For the Treasury, there may be reasonable arguments for increasing immigration – because more people translates into more recorded economic activity – but the truth is the public won’t accept it. Our voters can tell the difference between real economic growth that improves the standard of living for ordinary households, and the phantom ‘growth’ that importing ever more people puts on a Treasury spreadsheet.

High rates of immigration depress wages, reduce investment in skills and technology, put unsustainable pressure on housing and public services, and threaten community cohesion.

The word ‘existential’ has been used a lot in recent days but this really is ‘do or die’ for our party. Each of us made a promise to the electorate. We don’t believe that such promises can be ignored.

The government must propose, today, a comprehensive package of measures to meet the manifesto promise by the time of the next election. We will assess any such package and report publicly on whether it will meet the promise made to the electorate.

The New Conservatives include prominent supporters of Suella Braverman, the former home secretary who has herself criticised Sunak for not doing enough to bring down immigration.

Hancock, Gove, Raab and Javid due to give evidence to Covid inquiry next week

The Covid inquiry has announced its timetable for hearings next week. Matt Hancock, the former health secretary, who has been repeatedly accused by witnesses to the inquiry of giving false assurances to colleagues, is due to give evidence for a day and a half, starting on Thursday. And Michael Gove, who as Cabinet Office minister at the time was one of the lead ministers dealing with Covid, is due to give evidence for most of Tuesday.

Sajid Javid, another former health secretary, and Dominic Raab, foreign secretary and first secretary of state during most of the Covid crisis, and stand-in PM when Boris Johnson was ill, are due to appear on Wednesday.

Here is the full schedule.

This timetable suggests Boris Johnson and Rishi Sunak may appear the following week.

Hunt has paid for tax cuts with unrealistic spending cuts which create huge problems for next chancellor, IFS says

The Institute for Fiscal Studies has released its full assessment of the autumn statement. In his summary, Paul Johnson, the IFS director, says Jeremy Hunt’s tax cuts are “paid for by planned real cuts in public service spending” which are not credible. He says this means Hunt has left a huge problem for whoever is chancellor after the next election. He explains:

The net result is that Mr Hunt is, by the narrowest of tiny margins, still on course to meet his (poorly designed) fiscal rule that debt as a fraction of national income should be falling in the last year of the forecast period. In reality debt is set to be just about flat at around 93 per cent of national income over the whole period. And that is on the basis of a series of questionable, if not plain implausible, assumptions. It assumes that many aspects of day to day public service spending will be cut. It assumes a substantial real cut in public investment spending. It assumes that rates of fuel duties will rise year on year with inflation – which they have not done in more than a decade and they surely will not do next April. It assumes that the constant roll over of “temporary” business rates cuts will stop. It assumes, of course, that the economy doesn’t suffer any negative shocks.

Like his predecessors Mr Hunt has taken a modest improvement in the public finance forecasts and spent most of it. He has spent up front and told us he will meet his targets largely by unspecified fiscal restraint at some point in the future. What he will do in March if the OBR downgrades its forecasts we do not know. Any such downgrading would leave him with a big headache. More importantly he or his successor is going to have the mother and father of a headache when it comes to making the tough decisions implied by this statement in a year or two’s time.

And here is Johnson’s conclusion.

The fiscal forecasts have not in any real sense got better. Debt is not declining over time. Taxes are still heading to record levels. Spending is also due to stay high by historic standards, not least because of high debt interest payments. But those payments plus pressures on health and pension spending mean current plans are for some pretty serious cuts across other areas of public spending. How did Mr Hunt afford tax cuts when real economic forecasts got no better? He banked additional revenue from higher inflation, and pencilled in harsher cuts to public spending.

I’m not sure I’d want to be the chancellor inheriting this fiscal situation in a year’s time.

Cameron visits scene of one of last month’s Hamas massacres in Israel

David Cameron, the new foreign secretary, is in Israel, where he visited Kibbutz Be’eri, the scene of one of the Hamas massacres last month. He said:

I wanted to come here to see it for myself; I have heard and seen things I will never forget.

Today is also a day where we hope to see progress on the humanitarian pause.

This is a crucial opportunity to get hostages out and aid in to Gaza, to help Palestinian civilians who are facing a growing humanitarian crisis.

As PA Media reports, Cameron’s visit comes a day after he met counterparts from Arab and Islamic countries – including the Palestinian Authority – at Lancaster House in London to discuss the Middle East crisis. Foreign ministers from Saudi Arabia, Jordan, Egypt, Turkey, Indonesia and Nigeria, as well as the secretary general of the League of Arab States and the ambassador of Qatar, attended the event.

Cameron said the group discussed how to use the planned pause in the Israel-Hamas fighting to consider “how we can build a peaceful future which provides security for Israel but also peace and stability for the Palestinian people”.

ONS puts net migration at 672,000, but says provisional figures suggest it might be falling from record high

Here is the Office for National Statistics’ report on migration figures. (See 9.33am.)

Here is an extract from the ONS’s summary. It puts the latest annual net migration figure at 672,000, but says provisional figures suggest this is starting to fall from a record high. That would be due to immigration falling and emigration rising, it says.

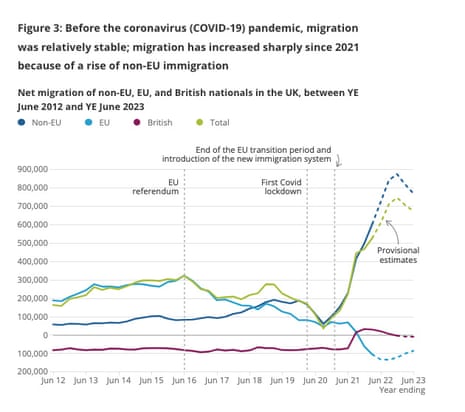

The provisional estimate of total long-term immigration for year ending (YE) June 2023 was 1.2 million, while emigration was 508,000, meaning that net migration was 672,000; most people arriving to the UK in the YE June 2023 were non-EU nationals (968,000), followed by EU (129,000) and British (84,000).

Net migration for YE June 2023 was 672,000, which is slightly higher compared with YE June 2022 (607,000) but down on our updated estimate for YE December 2022 (745,000); while it is too early to say if this is the start of a new downward trend, these more recent estimates indicate a slowing of immigration coupled with increasing emigration.

Methods for measuring international migration are in development, and these timely estimates for year ending June 2023 and December 2022 are provisional, supported by assumptions that are informed by past behaviour; this means the uncertainty associated with these estimates will reduce in our next releases, when we have more data to confirm people’s long-term migration status.

Before the coronavirus (Covid-19) pandemic, migration was relatively stable, but patterns and behaviours have been shifting considerably since then; net migration increased sharply since 2021 because of a rise in non-EU immigration driven by a range of factors including those arriving on humanitarian routes (including Ukrainian and British national (overseas) schemes), as well as an increase in non-EU students and workers.

And here is a table from the report.

Hunt says he feels ‘incredibly guilty’ after autumn statement – because he did not buy his wife birthday present or even card

Jeremy Hunt does not seem to have any qualms about the Conservative party misleadingly saying taxes are going down, when the tax burden is going up. (See 9.31am.) But there is something about which he feels “incredibly guilty”. He told LBC this morning that, despite starting his autumn statement speech with a reference to it being his wife’s birthday, he did not get round to buying her a present – or even a card. He said:

I’m afraid I have not bought anything for my wife. I didn’t even get her a birthday card. I feel incredibly guilty.

What I did was publicly acknowledge her birthday to millions of people, which is something I haven’t done before. So, hopefully I will be able to make up for that at the weekend.

Estimated net migration to UK in year to June 2023 was 672,000, ONS says

PA Media has just snapped this.

Estimated net migration to the UK stood at a provisional 672,000 in the year to June 2023, up from 607,000 in the previous 12 months but below a revised record figure of 745,000 in the year to December 2022, the Office for National Statistics said.

Hunt rejects claim it is misleading for Tories to say they are giving people ‘biggest tax cut in British history’

Yesterday the Conservative party released an advert in history saying Jeremy Hunt had announced “the biggest tax cut in British history”.

In an interview on the Today programme, Nick Robinson put it to Jeremy Hunt that this was “downright misleading” given the fact that the tax burden is at a record high. Hunt rejected this. He replied:

No. We’ve been very clear and upfront that we’ve had to take difficult decisions to increase taxes to pay down our Covid debt. But we are starting now to bring taxes down again. That is very significant.

Hunt rejects claims his proposals to hold down government spending will make public services worse

In his analysis of the autumn statement, Larry Elliott, the Guardian’s economics editor, described it as “a classic ‘live now, pay later’ ploy in which pre-election tax cuts are paid for by implausibly tough public spending plans in future years”.

Larry is referring to the way the autumn statement includes spending plans for the future which have not gone up in line with inflation. Most experts think they are unrealistic because they think in practice a future chancellor will have to spend more to stop public services collapsing.

In an interview with Times Radio, Hunt defended his spending plans. “We do need to be disciplined in public spending in the short run,” he said. But he claimed that this approach was necessary to stimulate growth.

And when it was put to him that his spending plans would lead to public services getting worse, he said he did not accept that. He explained:

No, and the reason is very straightforward. If we want to have money to invest in the NHS, in schools, in our armed forces over the longer term, you have to grow the economy.

That is the only way in the longer run that you can fund the cost of an ageing population and that’s why I took those decisions for the long term.

In the short run, I am showing discipline with public spending. I think that is the right thing to do. We need a more productive state, not a bigger state.

Households will be £1,900 poorer on average over course of this parliament, says thinktank

Jeremy Hunt may claim that his autumn statement wasn’t influenced by election timing (see 8.43am), but that’s not the view of the Resolution Foundation. The thinktank has now published its analysis of the autumn statement and its title is: “A pre-election Statement”. Here is a summary from Torsten Bell, the RF’s chief executive.

Jeremy Hunt yesterday got his pre-election giveaways in early, with an autumn statement offering tax cuts today, at the price of implausible spending cuts tomorrow. Well-targeted specifics, addressing problems such as our tax system’s bias against working-age earnings or benefit system’s failure to keep pace with fast-rising rents, were juxtaposed with far less well-designed big picture fiscal choices. Tax-cutting rhetoric clashed with tax-rising reality, and positive steps to encourage business investment combined with a growth-sapping hit to public investment.

Ultimately this reflects the pressures, not only of an upcoming election, but of governing a sicker, older, slower-growing Britain, amidst an era of far higher interest rates.

That might be difficult for policy makers, but it’s a disaster for households whose wages are stuck in a totally unprecedented 20-year stagnation. This parliament is set to achieve a truly grim new record: the first in which household incomes will be lower at its end than its beginning.

The thinktank says the fall in the value of real household incomes over the course of this parliament will work out at £1,900 on average in real terms. It says:

The biggest inflation shock in four decades, and taxes rising to their highest level in eight decades, means the outlook for living standards remains dire. Real household disposable income per person is expected to fall by 1.5 per cent in 2024 – presenting a bleak economic backdrop to the 2024 election. The last time RHDI fell in an election year was 50 years ago, in 1974. This helps drive a new grim record on living standards: this parliament is on track to be the first in which real household disposable incomes actually fall (by 3.1 per cent from December 2019 to January 2025): households will, on average, be £1,900 poorer at the end of this parliament than at its start.

The RF also says that around 40% of the gains from the tax and benefit measures announced yesterday will go to the richest fifth of the population. Graeme Wearden has more on this on his business live blog.

Hunt says it is ‘silly’ to see his autumn statement tax cuts as pre-election giveaway

Good morning. The tax cuts in Jeremy Hunt’s autumn statement yesterday were larger than expected and, unusually, the national insurance cut will take effect from January, not April, when tax cuts or tax rises are normally implemented. Inevitably, that prompted speculation at Westminster that Hunt was preparing for an early election.

But in an interview this morning Hunt claimed it was “silly” to view his tax cuts as a pre-election giveaway. He told Sky News:

We haven’t chosen the most populist tax cuts. I think it’s silly to think about this in terms of the timing of the next election.

We’re trying to make the right decisions for the long-term growth of the British economy.

Hunt also claimed he had not even discussed election timing with the PM. He told LBC:

I can confirm regarding the date of the election that I’ve had absolutely no discussions with the prime minister.

Those are some of the lines from Hunt’s morning interview round. I will post a full summary shortly.

Here is the agenda for the day.

9.30am: The ONS publishes its latest migration figures.

9.30am: Prof Dame Angela McLean, the government’s chief scientific adviser, gives evidence to the Covid inquiry. At 2pm Kemi Badenoch is due to give evidence as minister for women and equalities.

10.30am: The Institute for Fiscal Studies publishes its assessment of the autumn statement.

Morning: Jeremy Hunt is on a visit in Wrexham.

Morning: Keir Starmer and Rachel Reeves, the shadow chancellor, are on a visit in Essex.

11.30am: Downing Street holds a lobby briefing.

12.30pm: Richard Hughes, chair of the Office for Budget Responsibility, speaks at an Institute for Government event.

Afternoon: Rishi Sunak is on a visit in Yorkshire.

If you want to contact me, do try the “send us a message” feature. You’ll see it just below the byline – on the left of the screen, if you are reading on a laptop or a desktop. This is for people who want to message me directly. I find it very useful when people message to point out errors (even typos – no mistake is too small to correct). Often I find your questions very interesting, too. I can’t promise to reply to them all, but I will try to reply to as many as I can, either in the comments below the line; privately (if you leave an email address and that seems more appropriate); or in the main blog, if I think it is a topic of wide interest.