China’s trade slumps, threatening hopes of recovery

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

A tumble in China’s trade last month has reignited concerns that the world’s second-largest economy is stumbling.

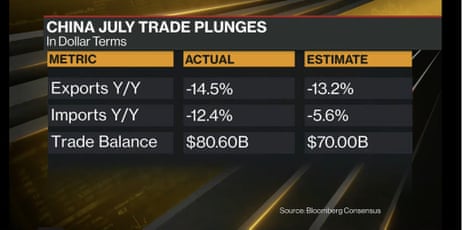

China’s imports and exports fell much faster than expected in July, new trade data today shows, indicating weak economic activity and subdued domestic demand

Imports dropped 12.4% in July year-on-year, customs data showed on Tuesday, much worse than the 5% fall which economists expected.

Exports also fell faster than expected, contracting by 14.5%, after June’s 12.4% fall.

Inbound shipments saw their biggest decline since January, when COVID infections shut shops and factories, Reuters reports.

This slowdown in trade will put more pressure on Beijing to provide fresh stimulus to prop up demand, as the initial economic bounce following the relaxation of pandemic restrictions in late 2022 fades.

It could also be a sign that global economy demand is slowing, meaning less demand for Chinese exports.

Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd, said the deepened slump in imports “is a reflection of weak domestic demand,” adding:

“The overall consumption and investment growth probably both stayed quite weak in China.”

Julian Evans-Pritchard, head of China Economics at Capital Economics, explained:

“Most measures of export orders point to a much greater decline in foreign demand than has so far been reflected in the customs data.

“And the near-term outlook for consumer spending in developed economies remains challenging, with many still at risk of recessions later this year, albeit mild ones.”

It could also indicate that inflationary pressures will continue to ease in the coming months.

BIG plunge in trade

China said Tuesday that exports fell by 14.5% in July from a year ago, while imports dropped by 12.4% in U.S. dollar terms https://t.co/yq8ayERKG2— Joumanna Nasr Bercetche 🇱🇧 (@CNBCJou) August 8, 2023

Also coming up today

Britain’s retail sector stumbled in July too, new figures show, forcing retailers to slash their prices to drum up business after dismal summer weather and ever-higher interest rates combined to depress consumer spending in July.

The monthly health check of high street and online spending patterns from the British Retail Consortium and the consultancy KPMG reported a steep annual drop in the volume of sales and an increasing number of retailers offering promotional offers to woo consumers reluctant to part with their cash.

The agenda

-

7.45am BST: French trade data for June

-

11am BST: US NFIB Small Business Optimism Index

-

1.30pm BST: Canada’s balance of trade for June

Key events

Economist Alicia García-Herrero says today’s Chinese trade data is a shock to the markets:

#China‘s July #trade data has shocked markets: plummeting exports (much worse than in June), even more than imports (YoY) both with double-digit negative growth. Recent #RMB appreciation from stimulus announcements wiped out with this worrisome data (1/2)

— Alicia GarciaHerrero 艾西亞 (@Aligarciaherrer) August 8, 2023

Exports fell much more to the US (and the EU to a lesser extent). Hard to tell if derisking or waning demand. The fact that exports to Russia also fell 8% may point to the latter (2/2)

— Alicia GarciaHerrero 艾西亞 (@Aligarciaherrer) August 8, 2023

Reuters: China’s July imports from Russia fall for first time since Feb 2021

Today’s customs data also shows that China’s imports from Russia dropped in July, Reuters reports.

This is the first monthly decline since February 2021 when imports of oil and other goods began steadily rising after the outbreak of conflict in Ukraine, Chinese customs data showed.

China’s imports from Russia shrank 8% to $9.2bn last month from a year earlier, in contrast to 15.7% growth in June, according to Reuters calculations based on data from the General Administration of Customs. China has been buying discounted Russian oil, coal, and certain metals.

Exports to Russia expanded 52% in July to $10.28bn, much slower than the 90.9% growth registered in June.

While China’s exports to Russia held up relatively well compared with subdued demand elsewhere, they were a small portion of overall exports, at only 3% in January-July.

The value of bilateral trade between the two dropped to $19.49bn in July from June’s $20.83bn, which was the highest since the Ukraine war began.

China’s trade slumps, threatening hopes of recovery

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

A tumble in China’s trade last month has reignited concerns that the world’s second-largest economy is stumbling.

China’s imports and exports fell much faster than expected in July, new trade data today shows, indicating weak economic activity and subdued domestic demand

Imports dropped 12.4% in July year-on-year, customs data showed on Tuesday, much worse than the 5% fall which economists expected.

Exports also fell faster than expected, contracting by 14.5%, after June’s 12.4% fall.

Inbound shipments saw their biggest decline since January, when COVID infections shut shops and factories, Reuters reports.

This slowdown in trade will put more pressure on Beijing to provide fresh stimulus to prop up demand, as the initial economic bounce following the relaxation of pandemic restrictions in late 2022 fades.

It could also be a sign that global economy demand is slowing, meaning less demand for Chinese exports.

Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd, said the deepened slump in imports “is a reflection of weak domestic demand,” adding:

“The overall consumption and investment growth probably both stayed quite weak in China.”

Julian Evans-Pritchard, head of China Economics at Capital Economics, explained:

“Most measures of export orders point to a much greater decline in foreign demand than has so far been reflected in the customs data.

“And the near-term outlook for consumer spending in developed economies remains challenging, with many still at risk of recessions later this year, albeit mild ones.”

It could also indicate that inflationary pressures will continue to ease in the coming months.

BIG plunge in trade

China said Tuesday that exports fell by 14.5% in July from a year ago, while imports dropped by 12.4% in U.S. dollar terms https://t.co/yq8ayERKG2— Joumanna Nasr Bercetche 🇱🇧 (@CNBCJou) August 8, 2023

Also coming up today

Britain’s retail sector stumbled in July too, new figures show, forcing retailers to slash their prices to drum up business after dismal summer weather and ever-higher interest rates combined to depress consumer spending in July.

The monthly health check of high street and online spending patterns from the British Retail Consortium and the consultancy KPMG reported a steep annual drop in the volume of sales and an increasing number of retailers offering promotional offers to woo consumers reluctant to part with their cash.

The agenda

-

7.45am BST: French trade data for June

-

11am BST: US NFIB Small Business Optimism Index

-

1.30pm BST: Canada’s balance of trade for June