UK jobless rate rises to 3.8%

The UK unemployment rate has risen, new figures from the Office for National Statistics show.

The UK unemployment rate for December 2022 to February 2023 increased by 0.1 percentage points on the quarter to 3.8%.

The increase in unemployment, the ONS says, was driven by people unemployed for up to six months.

But, the UK employment rate also rose in the quarter, by 0.2 percentage points to 75.8%, lifted by more part-time employees and self-employed workers.

Both employment and unemployment rose, because more people re-entered the labour market in the last quarter in the search for work.

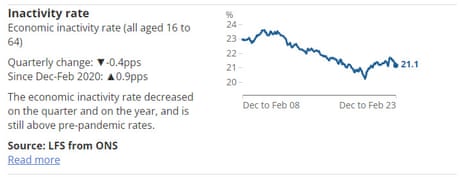

This pulled down the UK’s economic inactivity rate by 0.4 percentage points, to 21.1% from 21.5%.

The ONS says:

The decrease in economic inactivity during the latest three-month period was largely driven by people aged 16 to 24 years. Looking at economic inactivity by reason, the quarterly decrease was largely driven by people inactive because they are students.

And in March, the number of staff on payrolls rose by 31,000, to 30.0 million.

Key events

High inflation, and worker shortages, are holding the UK economy back, warns Matthew Percival, the CBI’s Director for People and Skills:

“This data shows a worrying continuation of the main trends of recent months.

A tight labour market means it is still difficult for firms to hire the people they need and high inflation means that the value of wages are falling. Both of these dynamics are acting as a drag on growth.”

Here’s ITV’s Joel Hills on the UK’s falling wages:

Wage growth (6.6%) across the economy is still not keeping pace with price rises (10.4%) and is higher than Bank of England will feel comfortable with BUT the trend seems to be sloping downwards and the gap between the private and the public has narrowed significantly. pic.twitter.com/KdiNtqJt1n

— Joel Hills (@ITVJoel) April 18, 2023

Faster UK wage growth is unwelcome news for the Bank of England

Today’s jobs market report rather highlights the dilemma facing the Bank of England.

On the one hand, rising unemployment is a reason to hold off raising interest rates again, when policymakers meet in May.

But, the 6.6% rise in basic earnings will worry the BoE, which is already concerned about a wage-price spiral breaking out (although wages aren’t even keeping up with inflation).

This faster UK wage growth is unwelcome news for the Bank of England, says James Smith, developed markets economist at ING.

The surprise pick-up in UK wage growth casts doubt over recent indications that pay pressures have started to ease.

We should caution that one month doesn’t make a trend, though a similar surprise blowout in services inflation due on Wednesday would inevitably move the dial in favour of a 25bp rate from the Bank of England next month.

2 steps forward, 2 steps back…Among employees in Dec 22 to Feb 23 – Growth in avg total pay (inc bonuses)=5.9% & in regular pay (exc bonuses)=6.6%. In the private sector = 6.9%. In the public sector = 5.3%. In real terms growth in total pay fell by 3.0% & 2.3% for reg pay @ONS pic.twitter.com/Zzo91xd3Nh

— Emma Fildes (@emmafildes) April 18, 2023

UK ‘being left behind’ by other major economies

The big picture is that 123,000 fewer people are in employment in the UK than before the Covid-19 pandemic.

Unemployment is lower too, but 422,000 more people are economically inactive (see chart below).

Progress in repairing the UK’s labour market since the pandemic is “painfully slow”, warns Tony Wilson, director at the Institute for Employment Studies:

While in every other major economy, employment is at least as high and often much higher than it was before the pandemic, in the UK there are still over a hundred thousand fewer people in work and over three hundred thousand more people out of work.

Three years on from the start of the pandemic, it’s clearer than ever that we are being left behind by other major economies.

“The main reasons for this appear to be a mix of weak growth, more people out of work with long-term ill health, and fewer older people in work, Wilson explains.

He adds:

We need to do far better on all three of these issues, particularly with more than three million people who want to work and still over a million unfilled jobs. Figures for long-term ill health are particularly worrying, rising again in the latest data to a new peak of over 2.5 million.

This is being driven in particular by people staying out of work longer, rather than more people leaving work now. So we need to focus in particular on how we help those who want to work to get back in – with specialist employment support, faster access to health services and more inclusive recruitment and workplace support.”

The Institute of Directors has welcomed the news that more people are either working or looking for work, which pulled down the UK’s economic inactivity rate.

Kitty Ussher, chief economist at the IoD, says:

“The labour market remains tight, with a historically high vacancy rate, low unemployment and a low redundancy rate meaning businesses are still finding it hard to recruit. Conversely, for those looking for work, there are plenty of opportunities.

“Today’s data also shows a welcome improvement in the inactivity rate, which is down 0.4% on the quarter. This is largely due to younger people being more confident about entering the labour market than they were during the pandemic.”

The “longest wages slump in modern history shows no sign of letting up”, warns TUC general secretary Paul Nowak, after real wages fell again (see earlier post).

Nowak says this pay squeeze is fuelling the current industrial action:

“Hard-pressed families can’t take much more. It is no surprise that workers are having to take strike action to defend their living standards.

“Ministers should be focused on resolving all of the current pay disputes.

“And they must act now to put money in people’s pockets – starting with giving our public sector workers a real pay rise, boosting the minimum wage to £15 as soon as possible, and ending their attack on the right to strike for better pay and conditions in the Strikes Bill.”

Minister for Employment, Guy Opperman MP, says the government is taking steps to help people into work:

“Helping more people into work will deliver on our priority to halve inflation and grow the economy, while tackling labour shortages.

Today’s figures are encouraging, and I remain focused on supporting those on the lowest incomes to progress in work and build a steady and sustainable future.

“To do this we are increasing claimant time with work coaches, and boosting our training and childcare offers to break down barriers for people out of work. But we also recognise the most vulnerable need support as prices climb, which is why we have increased the National Living Wage, extended the Energy Price Guarantee and uprated benefits by 10.1%.”

Hunt: lowering inflation will boost real wages

Chancellor the Exchequer, Jeremy Hunt, points out that the UK jobless rate is still low in historic terms.

Hunt add that lowering inflation this year will help workers, after today’s data showed a another fall in real pay.

“While unemployment remains close to historic lows, rising prices continue to eat into pay cheques which is why halving inflation this year is one of our top economic priorities.

“To help families in the meantime, we are making work pay with a record increase in the National Living Wage, while providing cost of living support worth an average of £3,300 per household this year and last, funded through windfall taxes on energy profits.”

Another way of raising real wages would be to agree inflation-matching pay rises for public sector workers, of course, as strikes continue to grip parts of the public sector.

348,000 working days lost to February strikes

There were 348,000 working days lost because of labour disputes in February 2023, up from 210,000 in January 2023.

Over three-fifths of the strikes in February were in the education sector, the ONS says.

Strikes by teachers, and civil servants, were one reason why the UK economy failed to grow during the month.

The ONS’s director of economic statistics, Darren Morgan, says:

“Pay continues to grow more slowly than prices, so earnings are still falling in real terms, although the gap between public and private sector earnings growth continues to narrow.”

Commenting on today’s labour market figures, ONS Director of Economic Statistics Darren Morgan said: (1/3) ⬇️ pic.twitter.com/7y5o4oqfSX

— Office for National Statistics (ONS) (@ONS) April 18, 2023

Public sector pay rises continued to lag behind the private sector in the last quarter.

Average regular pay growth for the private sector was 6.9% in December 2022 to February 2023, while in the public sector it was only 5.3%.

But, the difference between private and public sector growth rates has narrowed in recent months, the ONS says.

Across the economy, the finance and business services sector saw the largest regular growth rate at 8.3%, followed by the construction sector at 6.2%.

UK real wages fall as inflation bites pay

UK workers continued to suffer from falling real wages at the start of this year, as the cost of living squeeze continued to bite.

The ONS reports that regular pay (excluding bonuses) rose by 6.6% per year in December-February, while total pay (including bonuses) was up 5.9%.

That pay growth is stronger than economists had expected (basic earnings were forecast to rise by 6.2%).

But, wage growth is still lagging behind inflation. In real terms, total pay fell by 3% while regular pay was down 2.3%.

The ONS says:

A larger fall on the year for real total pay was last seen in February to April 2009 when it fell by 4.5%, but it still remains among the largest falls in growth since comparable records began in 2001.

UK vacancies fall again

UK firms have cut the number of vacancies on offer over the last quarter, the ONS says.

In January to March 2023, the estimated number of vacancies fell by 47,000, to 1,105,000.

That’s the ninth consecutive fall in a row, going back to May to July 2022.

Although vacancies are still high in historic terms, it suggests firms are more cautious about hiring as economic growth has stumbled.

UK jobless rate rises to 3.8%

The UK unemployment rate has risen, new figures from the Office for National Statistics show.

The UK unemployment rate for December 2022 to February 2023 increased by 0.1 percentage points on the quarter to 3.8%.

The increase in unemployment, the ONS says, was driven by people unemployed for up to six months.

But, the UK employment rate also rose in the quarter, by 0.2 percentage points to 75.8%, lifted by more part-time employees and self-employed workers.

Both employment and unemployment rose, because more people re-entered the labour market in the last quarter in the search for work.

This pulled down the UK’s economic inactivity rate by 0.4 percentage points, to 21.1% from 21.5%.

The ONS says:

The decrease in economic inactivity during the latest three-month period was largely driven by people aged 16 to 24 years. Looking at economic inactivity by reason, the quarterly decrease was largely driven by people inactive because they are students.

And in March, the number of staff on payrolls rose by 31,000, to 30.0 million.

China’s GDP growth cheers analysts

China’s forecast-beating growth in the last quarter shows that businesses and consumers have been energing from the crippling pandemic disruption of last year.

Zhiwei Zhang, chief economist at Pinpoint Asset Management, says:

“Economic recovery is well on track. The bright spot is consumption, which is strengthening as household confidence improves.

“The strong export growth in March also likely helped to boost GDP growth in Q1.”

Elsa Lignos, RBC’s global head of FX strategy, confirms that China’s Q1 GDP growth surprised to the upside at 4.5% y/y.

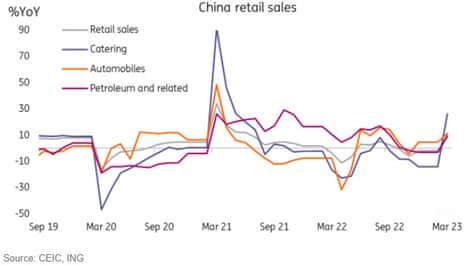

The March key growth indicators showed consumption leading China’s post-Covid economic rebound again.

March industrial output and fixed asset investment were both slightly weaker than expected, but the sharp rise in retail sales more than made up for their shortfall.

GDP growth is easily on track to hit Beijing’s “around 5%” growth target for the year (and Q2 will have much easier comps), still, the government’s moderate growth target and wariness of debt-fuelled stimulus, along with weak external demand, suggest that China’s growth pick-up will likely plateau by around mid-year.

Introduction: China beats forecasts with 4.5% year-on-year growth

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

China’s economy has beaten forecasts this morning, as the relaxation of Covid-19 restrictions at the end of last year boosted growth.

China’s GDP grew by 4.5% in the January-to-March period, compared with a year ago. It’s the strongest growth recorded by China in a year, in a boost for the global economy.

China’s National Bureau of Statistics says the economy “made a good start in the first quarter” of 2023, despite facing a “grave and complex international environment”.

Growth was driven by consumption, with China’s retail sales 10.6% stronger than a year ago, following the ending of pandemic restrictions at the start of the year.

Industrial production grew by 3.9% per year, while fixed asset investment was 5.1% higher than a year ago.

On a quarter-by-quarter basis, GDP grew 2.2% in January-March, up from 0.6% in the final quarter of last year.

The GDP report is better than expected, says Iris Pang, ING’s chief economist for Greater China. She predicts it will encourage Beijing’s government to hold back extra stimulus plans.

Pang says:

Such rapid retail sales growth has not been seen since June 2021, when it grew 12.1%YoY. The growth in retail sales was mainly boosted by catering.

China’s currency, the yuan, should benefit from the report, Pang predicts.

When comparing the fundamentals of the US and China, China’s economy is strengthening and will get stronger over the rest of the year. In contrast, the US economy will likely continue to slow.

Also coming up today

UK energy regulators will be banned from forcibly installing prepayment energy meters in the homes of customers aged over-85 in Britain, as part of a new code of conduct.

Energy firm representatives will also wear body cameras as part of a new code of conduct, my colleague Alex Lawson explains:

Suppliers have agreed to fresh guidelines for putting in the devices when households have run up energy debt after an outcry over agents using court-approved entry warrants to break in to install them.

As a result, energy firms will now have to make at least 10 attempts to contact a customer and conduct a “site welfare visit” before a prepayment meter is installed.

In response to the prepayment meter scandal, energy firms have now agreed to:

– Not forcibly install prepayment meters in homes over over-85s

– make at least 10 attempts to contact a customer before installing

– make their representatives wear bodycams https://t.co/wiUYpdhSID— Alex Lawson (@MrAlexLawson) April 17, 2023

The latest UK unemployment report, due this morning, will show the state of the labour market.

And the Treasury Committee will gather expert views on the Bank of England’s quantitative tightening strategy – the sale of the government bonds it bought to stimulate the UK economy.

MPs will look at the costs to the taxpayer, and the impact of quantitative easing on inflation…..

The agenda

-

7am BST: UK labour market report

-

10am BST: ZEW Economic Sentiment Index (APR)

-

10.15am BST: UK Treasury committee holds hearing into Bank of England’s quantitative tightening programme

-

1.30pm BST: US building permits and housing starts