Introduction: Bank of England interest rate decision

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

The Bank of England is widely expected to leave UK interest rates on hold today, at its latest monetary policy committee (MPC) meeting. But should it actually be cutting rates, to help the weak economy?

Experts in the City are pretty confident the BoE will leave base rate at 5.25% at noon today, its highest level in 15 years, extending the pause which began in September.

But the vote may not be unanimous, with several of the nine MPC policymakers expected to vote to increase rates further. Those hawkish members of the committee are concerned that even higher borrowing costs are needed to cool inflationary pressures.

The majority, though, seem likely to stick to the view that the BoE should maintain borrowing costs at the current elevated level for long enough to push inflation down.

Matthew Ryan, head of market strategy at global financial services firm Ebury, predicts a 6-3 split in favour of leaving rates on hold.

“Since the last meeting in September, indicators of economic activity have remained less than impressive, wage growth has eased and hawk Jon Cunliffe has left the committee, with his replacement, Sarah Breeden, appearing likely to side with the doves.

“This would suggest no closer than a 6-3 vote in favour of no change. The BoE will probably strike a cautious tone on the growth outlook, and downward revisions to the GDP forecasts for 2023 and 2024 are on the cards.

Other major central banks have already held borrowing costs in recent days – the ECB did so last week, and the Federal Reserve left policy unchanged last night.

The BoE’s problem is that inflation is running higher in the UK than other advanced economies, clocked at 6.7% in September. It should have fallen in October, but could still be higher than the eurozone, where it was just 2.9% in October.

But even so, some economists think the Bank should be cutting borrowing costs.

Right-wing think tank the Institute of Economic Affairs runs a Shadow Monetary Policy Committee, and it voted 7-2 to cut Bank Rate.

This SMPC fears the Bank of England is at risk of over-correcting and slowing economic activities.

Trevor Williams, Chair of the Shadow Monetary Policy Committee and former chief economist at Lloyds Bank, said:

“There is mounting evidence that the UK’s monetary policy is too tight and could lead to price deflation in a few years and potential recession in the interim. The Bank of England should act now by lowering interest rates.

“The Bank’s overly tight monetary stance is pushing mortgage lending down, companies are struggling to repay debt, insolvencies are rising, and households are withdrawing money to meet higher repayments.

“By underestimating the importance of the money supply, the Bank risks repeating the mistake that caused high inflation. It is essential for the Bank to ‘look through’ the current level of inflation and focus on where it could be in two years.”

We’ll find out the Bank’s view, along with its latest economic forecasts, at noon.

The agenda

-

9am GMT: Eurozone manufacturing PMI for October

-

9am BST: Norges Bank interest rate decision

-

Noon GMT: Bank of England sets interest rates

-

12.30m GMT: Bank of England press conference

-

12.30pm GMT: US weekly jobless claims

Key events

In the UK property market, the lowest available 85% LTV (loan to value) mortgage rate has dropped below 5% for the first time since June, online portal Rightmove reports.

The lowest available rate for an 85% LTV five-year fixed mortgage is now 4.99%, they report.

Rightmove also shows that some average mortgage rates are noticeable cheaper than a year ago, when the chaos after the mini-budget drove up borrrowing costs:

-

The average 5-year fixed mortgage rate is now 5.36%, down from 5.97% a year ago

-

The average 2-year fixed mortgage rate is now 5.81%, down from 6.22% a year ago

-

The average 85% LTV 5-year fixed mortgage rate is now 5.44%, down from 6.00% a year ago

-

The average 60% LTV 5-year fixed mortgage rate is now 4.94%, down from 5.71% a year ago

-

The average monthly mortgage payment on a typical first-time buyer type property when taking out an average five-year fixed, 85% LTV mortgage, is now £1,164 per month, down from £1,228 per month a year ago

The Bank of England should “follow the money” when setting interest rates, argues Costas Milas, professor of finance at the University of Liverpool.

He tells us:

The Bank of England is expected to leave the Bank’s base rate unchanged at 5.25%.

One has to “follow the money” to realise that inflation is on its way down and therefore no further monetary tightening is necessary.

From the Chart below, Divisia money growth, which is a powerful measure of the economy’s liquid conditions as I have shown in my recent paper for The European Journal of Finance, reached a high of 19% in the first quarter of 2021, prior to UK inflation peaking at 10.7% in late 2022.

This means that money growth affects inflation with long and variable lags. Everything else equal, my own estimates suggest that the big drop in money growth in the third quarter of 2023 will reduce inflation by as much as 0.5 percentage points in 2023 Q4.

My ongoing worry is that the Bank of England’s policymakers have largely ignored money movements when setting interest rates. Something the ongoing review of the Bank’s forecasting, led by Ben Bernanke, should look at!

The Bank of England will be aware that most of the impact of its previous interest rate rises have not, yet, been fully felt by the real economy.

Mike Riddell, a senior portfolio manager at Allianz Global Investors, said the long lags between changes in rates and their impact meant most of the BoE’s increases in borrowing costs between late 2021 and August this year was yet to be felt.

“The BoE will most likely therefore be keen to keep all options open, but seems set to wait and observe how much pain the previous hikes have caused before changing rates again in either direction,” Riddell said.

Eurozone factory decline continues

The slump in the eurozone’s manufacturing sector continued in October, new data shows, reinforcing concerns over the region’s economy.

The latest poll of purchasing managers at eurozone factories shows another “considerable” fall in factory production last month.

Firms reported “steep and accelerated” falls in new orders, purchasing activity and backlogs, and the fastest reduction in factory employment levels since August 2020.

This pulled the HCOB Eurozone Manufacturing PMI, compiled by S&P Global, down to a three-month low of 43.1 in October, down from 43.4 in September. Anything below 50 shows a fall.

That shows a further marked deterioration in the health of the euro area’s goods-producing sector, just days after we learned the eurozone shrank in July-September, putting it halfway into recession.

Dr Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, says:

“The Eurozone manufacturing sector’s trend over the last two years or so looks like a bumpy sleigh ride down into the valley. Given that the headline PMI did barely move over the last few months, including October, we may be about to reach the bottom of the valley.

Thus, the big question is when we will begin to make an ascent. The stagnating new orders index, which remains deep in negative territory, and the similar behaviour of the Quantity of Purchase Index does not suggest an immediate turnaround.

Having said this, history tells us that in many cases the levelling out of these indices is the precondition for a start of the recovery. We expect this to happen in the first half of next year.

Norges Bank leaves interest rates on hold

Norway’s central bank has just announced that it has left interest rates on hold.

Norges Bank’s Monetary Policy and Financial Stability Committee decided unanimously to keep its policy rate unchanged at 4.25%.

Announcing the move, the committee says that pressures in the Norwegian economy are easing, although the labour market is still tight.

And while underlying inflation is high, Norwegian policymaker are concerned that they should not over-tighten monetary policy.

They say:

Persistently high inflation imposes substantial costs on society. The longer inflation remains high, the more costly subsequent disinflation may prove to be. On the other hand, the Committee does not want to raise the policy rate more than is necessary to bring inflation back to target within a reasonable horizon.

Monetary policy is now having a tightening effect on the economy, and the full effects of the past rate hikes are yet to be seen. In the Committee’s assessment, the policy rate is likely close to the level needed to tackle inflation, which provides the Committee with a little more time to assess whether there is a need to raise the policy rate further.

There will likely be a need to maintain a tight monetary policy stance for some time ahead. Whether additional rate hikes will be needed depends on economic developments.

📷 Norges Bank Interest Rate Decision Actual: 4.25% Expected: 4.25% Previous: 4.25%

— CentFx (@cent_fx) November 2, 2023

These charts, from asset manager ICG, show the dilemma facing the Bank of England as it sets interest rates today.

Nick Brooks, head of economic and investment research at ICG, says”:

-

The BoE is likely to keep its benchmark rate steady at 5.25% and emphasise that future policy remains data dependent.

-

The dilemma the BoE faces is that although economic growth is slowing, the UK’s inflation rate is running at the highest among major developed economies and is proving very hard to bring down.

-

Until there is a significant loosening of labour markets, the BoE will likely need to keep rates at current levels, with the risk that it is forced to tighten further in the coming months.

Canada Life Asset Management’s Liquidity Fund Manager, Steve Matthews, predicts UK interest rates will remain on hold today…. and for much of the next year.

Matthews says:

“The Bank of England (BoE) is wary of potential bumps in the road.

The key here is not only getting inflation down to 2%, but doing so in a stable and lasting way. With MPC member Mann saying she was still worried about persistent rises in the cost of living, and with CPI holding steady in the last print, there are no guarantees that the hiking is over.

“However, UK Manufacturing PMI and employment data indicate a generally weakening economy and, as such, we expect the BoE to judge this as a precursor to inflation falling as previous hikes take hold.

Naturally, as we perceive rates to peak, the market looks to when the first cuts may take place. We feel it’s too early to say that the work to control inflation is done and see rates remaining at 5.25% for much of 2024.”

FT: Lloyds rebuffs Barclay family’s latest £1bn attempt to regain Telegraph

The Barclay family’s latest attempt to reclaim the Telegraph has reportedly been rebuffed.

The Financial Times reports that Lloyds Banking Group, which is handling the auction of the newsaper group, has rejected the £1bn approach from the Barclays.

The move is an attempt to reassure other bidders, who were concerned that the Barclays £1bn “back door” offer could have a “chilling effect” on the official auction.

The bank, which placed the Telegraph into receivership in June, rejected a £1bn offer initially made by the family and backed by Middle Eastern investors as recently as three weeks ago, according to two people familiar with the situation.

Lloyds told the Barclays to either repay the £1.1bn with a transparently funded offer, or bid in an ongoing auction, those people said. The bank has contacted bidders to reassure them of progress in the auction, which aims to be completed by early next year, they added.

Analysts do not expect the sale price for the Telegraph to exceed £600mn based on market comparisons.

Lst week Axel Springer, the German-based media group, cast doubt over whether it will submit a bid for the Telegraph group.

Danish manufacturer Novo Nordisk has reported a surge in sales of obesity and diabetes drugs, thanks to the success of the weightloss drug Wegovy.

Novo Nordisk grew its operating profits by 37% in the first nine months of this year, with sales up by a third.

Lars Fruergaard Jørgensen, president and CEO, says:

“We are very satisfied with the sales growth in the first nine months of 2023, which is reflecting that more people than ever are benefiting from our innovative diabetes and obesity treatments.”

Novo Nordisk became Europe’s most valuable company in September.

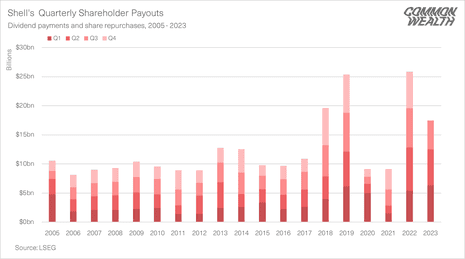

Chris Hayes, senior analyst at Common Wealth, isn’t impressed that Shell is pumping billions of dollars more to shareholders.

Hayes says:

The last two years have locked us into two mutually reinforcing distributive and ecological crises, with oil majors hoovering up cash from the rest of the economy and using to consolidate their position and hasten climate breakdown.

All net zero pathways demand fossil fuel majors wind down their existing dirty assets and scale up renewables. Yet as we see, as long as the stewards of these assets remain answerable to shareholders, the pace of both will remain glacial. Using cash windfalls to buy up existing low-

carbon companies should not be mistaken for additive investment in decarbonisation and should be recognised for what it is — consolidation of market power whose consequences are purely distributive.

Shell moves ahead with $3.5bn shareholder windfall despite profits fall

Jillian Ambrose

Shell will hand its shareholders $3.5bn in share buybacks even as profits for the last quarter tumbled in line with lower oil and gas market prices.

The oil and gas company said its adjusted profits for the quarter fell to $6.2bn from $9.5bn in the same months last year, broadly in line with the expectations of industry analysts.

Despite the weaker earnings Shell will continue to hand shareholders multibillion-dollar quarterly windfalls. The company will buy back a further $3.5bn worth of shares by the time of its fourth-quarter 2023 results announcement, after a $3bn buyback over the last quarter.

Shell’s chief executive officer, Wael Sawan, said the company would hand shareholders $6.5bn in share buybacks over the second half of the year, “well in excess of the $5bn announced at Capital Markets Day in June”.

In total, the company’s shareholder payouts for 2023 stand at $23bn, he said.

More here.

The London stock market has opened higher ahead of the Bank of England’s interest rate decision, while the pound is stable.

The blue-chip FTSE 100 index has gained 73 points, or 1%, to 7416 points, a one-week high.

Ocado (+6.8%) are the top riser, followed by BT Group (+5.6%) which posted second quarter earnings slightly ahead of forecasts this morning.

Sainsbury (+4%) are rising after forecasting full-year profits will hit the upper half of previous guidance, following “strong trading momentum” in recent weeks.

Julien Lafargue, chief market strategist at Barclays Private Bank, predicts the BoE will hint that further interest rate rises are possible in future months, if needed:

“The BoE is widely expected to follow the ECB and the Fed in keeping interest rates unchanged. Andrew Bailey himself expects to see a “noticeable drop” in the headline rate of inflation when October figures are released later this month. While, at the same time, the most recent job data suggests that the UK labour market is cooling off, albeit gradually.”

“Although the BoE is likely to revise its short-term growth and inflation forecasts lower, just like its peers, the MPC will want to prevent financial conditions from easing prematurely.

As such, we expect a hawkish narrative to remain in place, with the door still open for future hikes should they be required.”

The main focus from the Bank of England’s interest rate decision will on how the vote breaks down, and on the BoE’s new forecasts, predicts Jim Reid, strategist at Deutsche Bank.

RReid explains:

Our economist expects a 6-3 vote count to keep rates on hold, with the 3 voting in favour of another 25bp hike.

With regards to the forward guidance, he expects no changes, and sees the MPC reiterating its view that policy will remain sufficiently restrictive for sufficiently long to get CPI sustainable back to 2%.

Saxo: BoE ‘on verge of losing credibility’

Althea Spinozzi, senior fixed income strategist at investment platform Saxo, has warned that the Bank of England is on the ‘verge of losing credibility’.

Spinozzi says the Bank was too slow to react to rising inflation.

And she warns that the decline in popularity for Prime Minister Rishi Sunak is ‘adding to inflation upside risk’ (as it could prompt tax cuts in an attempt to win votes)

Spinozzi says the BoE cannot afford to lean dovish, explaining:

UK inflation remains the highest among developed economies. At the same time, the labour market is tight, and the country depends on energy and goods imports.

With upcoming elections [due by January 2024], fiscal policies remain uncertain as Rishi Sunak is losing popularity, adding to inflation upside risk.

“Within this environment, the BoE is on the verge of losing its credibility. It tightened the economy too little, too slowly. There is no option for governor Andrew Bailey other than sticking to the higher-for-longer rhetoric, hoping to maintain a hawkish bias while it’s becoming more apparent that policymakers are afraid of breaking something. As high inflation becomes entrenched in the economy, sterling will come under pressure.

The money markets are indicating that there’s little suspense over the UK interest rate decision.

Currently, ‘no-change’ is an 89% chance, with just 11% likelihood that the Bank of England lifts base rate to 5.5%.

Those probabilities are based on the price of overnight index swaps.

They’re not infallible, though – they suggested the Bank would start raising interest rates in November 2021 (when it surprisingly held at the record low of 0.1%), and to hold in December 2021 (when it unexpectedly started raising Bank rate).

The Bank of England is expected to keep the interest rate steady in response to the ongoing challenge of rising inflation.

— Roensch Capital News (@RoenschNews) November 2, 2023

Looking further ahead, the market expects two rate cuts over the next 12 months, bringing bank rate down to 4.75% by November 2024.

Labour says 630,000 will be hit by surge in mortgage costs before 2024 elections

Richard Partington

Labour has warned that more than half a million homeowners face a surge in mortgage costs before the local elections in England in May, as ministers battle to contain the damage from what is expected to be a long period of high interest rates.

With the Bank of England widely expected to hold its key base rate at 5.25% today, the party released analysis that showed 630,000 more homeowners would be hit by higher borrowing costs before local elections next year.

Based on figures from the Office for National Statistics, Labour’s analysis suggested that more than 3,400 households would re-mortgage every day in the six months between 2 November and 1 May 2024 in a financial timebomb ahead of the next local and general elections.

Speaking on a visit to a housebuilding site in Stevenage, Rachel Reeves, the shadow chancellor, said homeowners were being left worse off after 13 years of Tory economic failure.

“It was the Conservatives’ disastrous mini-budget last year that crashed the economy, sent mortgage rates soaring and made the dream of homeownership a nightmare for hard-pressed families.”

More here.

Introduction: Bank of England interest rate decision

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

The Bank of England is widely expected to leave UK interest rates on hold today, at its latest monetary policy committee (MPC) meeting. But should it actually be cutting rates, to help the weak economy?

Experts in the City are pretty confident the BoE will leave base rate at 5.25% at noon today, its highest level in 15 years, extending the pause which began in September.

But the vote may not be unanimous, with several of the nine MPC policymakers expected to vote to increase rates further. Those hawkish members of the committee are concerned that even higher borrowing costs are needed to cool inflationary pressures.

The majority, though, seem likely to stick to the view that the BoE should maintain borrowing costs at the current elevated level for long enough to push inflation down.

Matthew Ryan, head of market strategy at global financial services firm Ebury, predicts a 6-3 split in favour of leaving rates on hold.

“Since the last meeting in September, indicators of economic activity have remained less than impressive, wage growth has eased and hawk Jon Cunliffe has left the committee, with his replacement, Sarah Breeden, appearing likely to side with the doves.

“This would suggest no closer than a 6-3 vote in favour of no change. The BoE will probably strike a cautious tone on the growth outlook, and downward revisions to the GDP forecasts for 2023 and 2024 are on the cards.

Other major central banks have already held borrowing costs in recent days – the ECB did so last week, and the Federal Reserve left policy unchanged last night.

The BoE’s problem is that inflation is running higher in the UK than other advanced economies, clocked at 6.7% in September. It should have fallen in October, but could still be higher than the eurozone, where it was just 2.9% in October.

But even so, some economists think the Bank should be cutting borrowing costs.

Right-wing think tank the Institute of Economic Affairs runs a Shadow Monetary Policy Committee, and it voted 7-2 to cut Bank Rate.

This SMPC fears the Bank of England is at risk of over-correcting and slowing economic activities.

Trevor Williams, Chair of the Shadow Monetary Policy Committee and former chief economist at Lloyds Bank, said:

“There is mounting evidence that the UK’s monetary policy is too tight and could lead to price deflation in a few years and potential recession in the interim. The Bank of England should act now by lowering interest rates.

“The Bank’s overly tight monetary stance is pushing mortgage lending down, companies are struggling to repay debt, insolvencies are rising, and households are withdrawing money to meet higher repayments.

“By underestimating the importance of the money supply, the Bank risks repeating the mistake that caused high inflation. It is essential for the Bank to ‘look through’ the current level of inflation and focus on where it could be in two years.”

We’ll find out the Bank’s view, along with its latest economic forecasts, at noon.

The agenda

-

9am GMT: Eurozone manufacturing PMI for October

-

9am BST: Norges Bank interest rate decision

-

Noon GMT: Bank of England sets interest rates

-

12.30m GMT: Bank of England press conference

-

12.30pm GMT: US weekly jobless claims