Sainsbury’s: Food inflation is starting to fall

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

After months of soaring prices, food inflation is starting to fall.

That’s the word from supermarket chain J Sainsbury this morning, which will bring some relief to households, the Bank of England and Rishi Sunak alike.

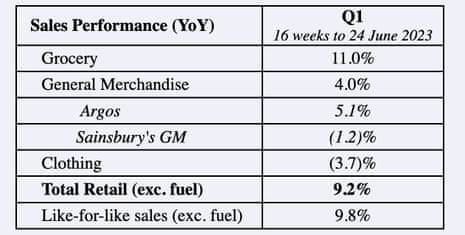

In its latest financial results, just released, Sainsbury’s reports that its like-for-like sales (excluding fuel) jumped by 9.8% in the 16 weeks to 24 June.

Sales at its grocery arm were “strong”, up 11%, Sainsbury’s reports.

Price rises by supermarket chains have driven UK food inflation sharply high this year:

And although global food commodities have been dropping in recent months, having surged after the Ukraine invasion, supermarkets and food producers have been criticised for being too slow to pass them on.

But Simon Roberts, the chief executive of J Sainsbury, says the worst of the food price squeeze is over.

Roberts explains:

“We are putting all of our energy and focus into battling inflation so that customers get the very best prices when they shop with us, particularly now as household budgets are under more pressure than ever.

Food inflation is starting to fall and we are fully committed to passing on savings to our customers. Since March, we have invested over £60m in lowering prices, leading on price cuts across more than 120 essentials like bread, butter, milk, pasta, chicken and toilet roll.

Roberts adds that the prices on Sainsbury’s top 100 selling products are now lower than they were in March, “against a market where prices have gone up”.

He adds:

Customers have also saved over £90m since we launched Nectar Prices in April. In addition, we’re offering great value through Stamford Street, our entry-price range and through our biggest ever Aldi Price Match campaign. All of this is underpinned by the continued delivery of our cost-saving programmes.

Sainsbury’s also reports that its general merchandise sales have risen by 4%, but clothing sales were down 3.7%.

Reaction to follow….

Also coming up today

Nature abhors a vacuum. And with the scandal-hit CBI fighting for its survival, the British Chambers of Commerce seems keen to fill the gap.

This morning, several chambers and their member businesses will be attending a breakfast briefing in Downing Street with the chancellor, Jeremy Hunt.

They will discuss how best to drive investment and local economic growth across England, the role of government, and the role of freeports and investment zones, says the BCC, which has just launched an economic forecasting unit in an apparent move to supplant the CBI.

Earlier today, Australia’s central bank held interest rates on hold, after inflation cooled slightly last month.

The agenda

-

7am BST: German trade balance for May.

-

10.15am BST: Treasury committee holds hearing into UK regional imbalances.

-

3pm BST: House of Lords industry and regulators committee hearing on the UK water industry.

Key events

City investors appear unimpressed with Sainsbury’s results. Its shares have dropped 1.5% at the start of trading in London, one of the biggest fallers on the FTSE 100 index.

Retail analyst Nick Bubb has digested Sainsbury’s results, and reports:

Well, one of the most eye-catching claims in Sainsbury’s better than expected Q1 update is that the business is now seeing grocery volume growth, despite double-digit food price inflation, but one of the most impressive performances is the 5% growth of Argos in a tough electricals market…

Sainsbury’s blames the 3.7% drop in clothing sales in the last quarter on the “cooler weather.

Sales were stronger in recent weeks, though, as the weather improved – encouraging people to buy summer outfits (as Next also reported last month).

Sainsbury’s has delivered “another resilient update” this morning, says Zoe Gillespie, investment manager at RBC Brewin Dolphin.

In an environment that many feared would lead to customers trading down, the supermarket continues to grow sales and its guidance for the year is largely unchanged.

Sainsbury’s is investing in pricing and doing what it can to support customers through the cost of living crisis, which is a prudent move even if it does mean short-term margin pressure.

The company’s share price is up more than one-fifth this year, despite the well-known challenges it faces. With a relatively strong balance sheet, excess cash flow and growing market share, Sainsbury’s looks well placed among its peers.”

Falling inflation is not the same as falling prices, of course.

But Orwa Mohamad, analyst at Third Bridge, is hopeful that food prices will start to fall later this year (reminder, Sainsbury’s says its 100 top-selling products are now cheaper than in March).

Mohamad explains:

Our experts expect prices to come down as we come out of the summer into September. Supermarkets are facing accusations of profiteering from customers and are already exerting more pressure on suppliers

Sainsbury’s reported like-for-like sales growth in line with industry trends. According to our experts, this growth is still being driven by high inflation and a high comparison to last year.

Falling food inflation should ease the pressure on consumers, says Charlie Huggins, manager of the quality shares portfolio at Wealth Club:

“This is a solid trading update from Sainsbury’s with a return to volume growth and an improved market share performance, with bank holidays and warmer weather towards the end of the period providing a welcome boost.

Sainsbury’s has worked hard to lower prices in the face of intense competition. The launch of Nectar prices, where Nectar card holders save money on everyday items seems to have been well received and has helped the group to hold its own against Tesco and the German discounters.

The group comments that food inflation is starting to fall and this should help ease pressure on consumers, whose finances have been squeezed from all angles by rising prices, no more so than for the weekly shop.

That said, it is far too early for Sainsbury’s to declare victory, Huggins adds:

The competitive environment continues to heat up with Aldi, Lidl and Amazon all looking to expand in UK grocery. Cost pressures remain intense, for both Sainsbury’s and its customers, meaning profits will likely go nowhere this year. But for now, the group is holding its own.”

Sainsbury’s adds that its profit outlook is unchanged.

It still expects to make underlying pre-tax profits of between £640m and £700m in the current financial year.

Last year it made underlying profits of £690m – down from £730m at the same time last year.

Sainsbury’s says its sales growth was “driven primarily” by volume growth (as opposed to price rises), with strong food demand over bank holidays and during the warmer weather towards the end of the quarter.

It says:

Our Summer Edition range is particularly popular, with best-sellers such as the Taste the Difference Signature Burger, Taste the Difference Greek Inspired Whipped Feta Salad and our award-winning Slow Cooked British Pork Ribs

Sainsbury’s: Food inflation is starting to fall

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

After months of soaring prices, food inflation is starting to fall.

That’s the word from supermarket chain J Sainsbury this morning, which will bring some relief to households, the Bank of England and Rishi Sunak alike.

In its latest financial results, just released, Sainsbury’s reports that its like-for-like sales (excluding fuel) jumped by 9.8% in the 16 weeks to 24 June.

Sales at its grocery arm were “strong”, up 11%, Sainsbury’s reports.

Price rises by supermarket chains have driven UK food inflation sharply high this year:

And although global food commodities have been dropping in recent months, having surged after the Ukraine invasion, supermarkets and food producers have been criticised for being too slow to pass them on.

But Simon Roberts, the chief executive of J Sainsbury, says the worst of the food price squeeze is over.

Roberts explains:

“We are putting all of our energy and focus into battling inflation so that customers get the very best prices when they shop with us, particularly now as household budgets are under more pressure than ever.

Food inflation is starting to fall and we are fully committed to passing on savings to our customers. Since March, we have invested over £60m in lowering prices, leading on price cuts across more than 120 essentials like bread, butter, milk, pasta, chicken and toilet roll.

Roberts adds that the prices on Sainsbury’s top 100 selling products are now lower than they were in March, “against a market where prices have gone up”.

He adds:

Customers have also saved over £90m since we launched Nectar Prices in April. In addition, we’re offering great value through Stamford Street, our entry-price range and through our biggest ever Aldi Price Match campaign. All of this is underpinned by the continued delivery of our cost-saving programmes.

Sainsbury’s also reports that its general merchandise sales have risen by 4%, but clothing sales were down 3.7%.

Reaction to follow….

Also coming up today

Nature abhors a vacuum. And with the scandal-hit CBI fighting for its survival, the British Chambers of Commerce seems keen to fill the gap.

This morning, several chambers and their member businesses will be attending a breakfast briefing in Downing Street with the chancellor, Jeremy Hunt.

They will discuss how best to drive investment and local economic growth across England, the role of government, and the role of freeports and investment zones, says the BCC, which has just launched an economic forecasting unit in an apparent move to supplant the CBI.

Earlier today, Australia’s central bank held interest rates on hold, after inflation cooled slightly last month.

The agenda

-

7am BST: German trade balance for May.

-

10.15am BST: Treasury committee holds hearing into UK regional imbalances.

-

3pm BST: House of Lords industry and regulators committee hearing on the UK water industry.