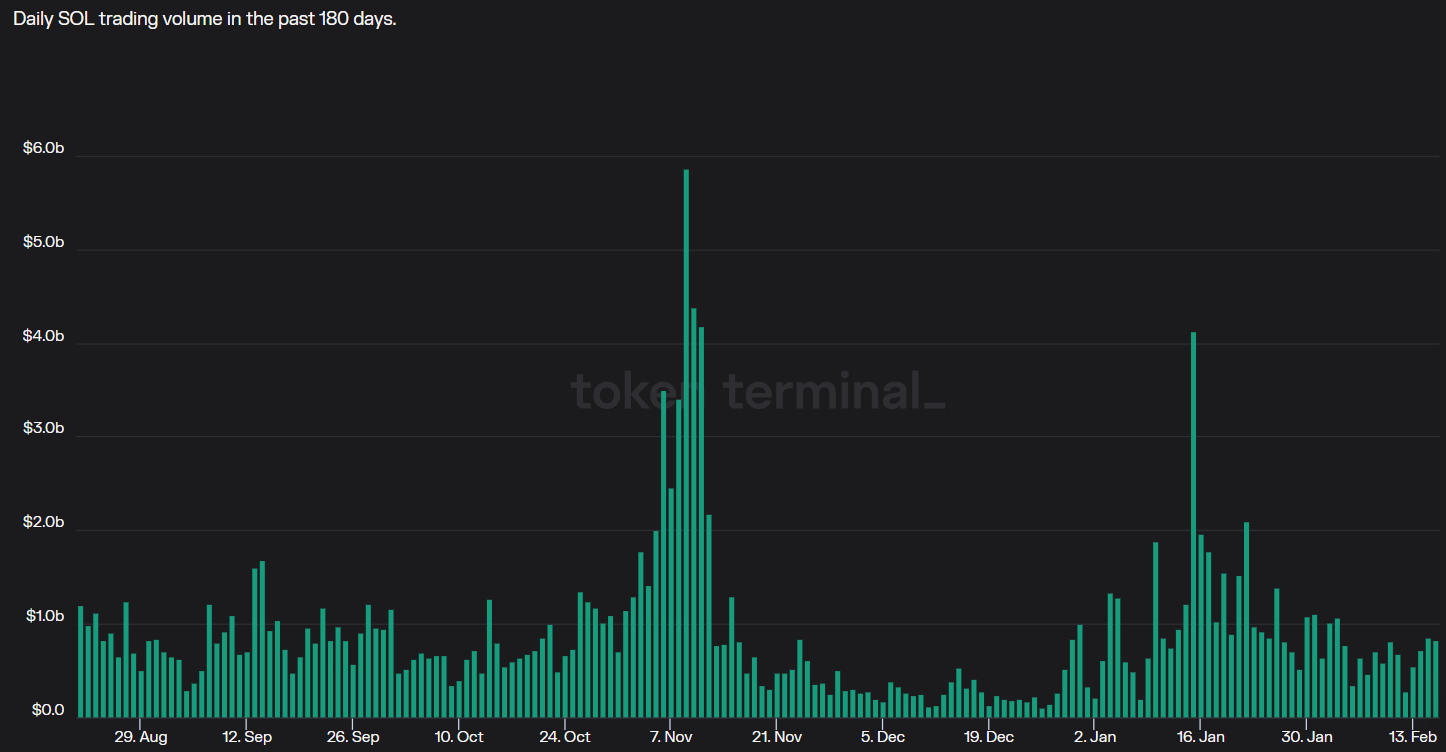

Solana (SOL), the cryptocurrency that powers Solana’s high-performance smart-contract-enabled blockchain, saw an impressive $830 million in trading volumes on Thursday, according to data presented by crypto analytics platform Token Terminal. That was the second-highest daily trading volume in two weeks, with only Wednesday (the 15th of February) clocking in ahead with volumes of $850 million.

The uptick in trading volumes comes with Solana having whipsawed either side of its 21-Day Moving Average (DMA) at $23.0. The cryptocurrency was last trading around $22.80 per token on Friday, up around 2.5% on the day, but down around 5% versus Thursday’s weekly highs above $24. Solana has not this week been able to match the feats achieved by its major rivals Bitcoin and Ethereum.

Bitcoin on Thursday managed to hit new eight-month highs in the $25,000s while Ethereum managed to hit its highest levels since last September in the $1,700s. Both have since backed off from these highs. Solana, meanwhile, has not been able to muster a test of its recent highs in the $26.00s, after failing to break convincingly above its 21DMA and amid selling pressure ahead of its 200DMA, which is now at $25.24.

Price Prediction – Where Next for SOL?

Solana’s 200DMA, which has acted as a key area of resistance in recent weeks, isn’t the only thing blocking the path higher. The $26.00-$2700 area is a key area of long-term support-turned-resistance and, if Solana was able to get above that, it would face significant resistance from a downtrend that has been in play going all the way back to early 2022.

But the broader cryptocurrency market is rallying, despite growing macro headwinds, like chatter from Fed policymakers this week about a possible return to 50 bps rate hikes. That resilience, if continued, could continue to lift Solana. While the cryptocurrency has already recovered a staggering 180% from its late-2022 lows around $8.0 per token, it remains over 90% below 2021’s record highs.

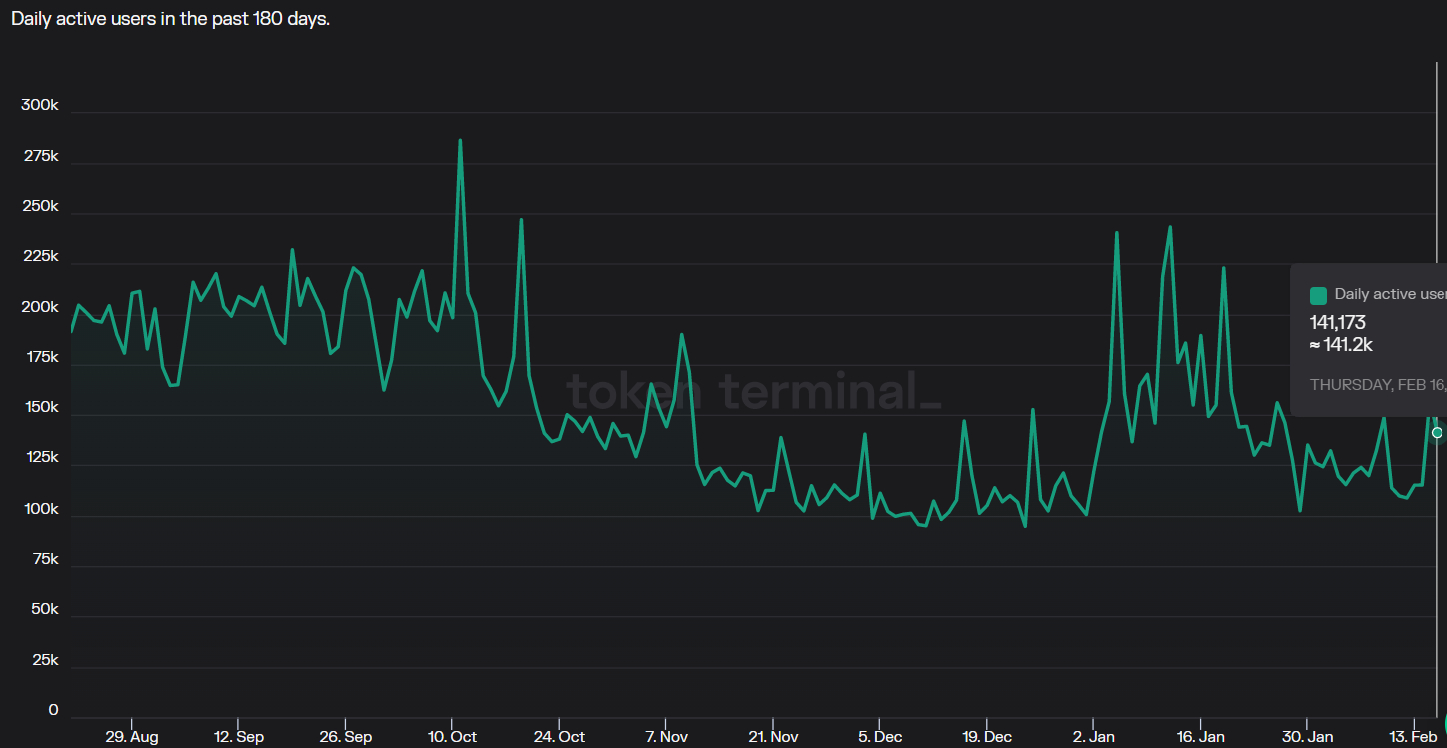

The overhang of last year’s FTX/Alameda collapse, which triggered a massive outflow of capital from Solana’s Decentralized Finance (DeFi) ecosystem – Sam Bankman Fried’s FTX and Alameda hedge fund had been big Solana proponents and users – may still be weighing significantly on Solana’s price. Some claimed that the Solana ecosystem would “die” alongside FTX and Alameda. But die it hasn’t. Daily active users remained at a fairly healthy 140,000 on Thursday, as per Token Terminal.

There might well be room for a further pricing out of post-FTX/Alameda pessimism in SOL, which alongside a broader crypto rally, could lift the cryptocurrency above the aforementioned key resistance levels in the coming weeks. If Solana could muster a meaningful break to the north of the $30 level, that would open the door to a swift run higher towards the next key resistance area around $39, over 70% higher versus current levels.