Introduction: UK’s surging shop price inflation eased in June

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Food inflation has been one of the worst elements in the cost of living crisis, but there are signs that the squeeze is easing, with prices in shops rising at a slower rate.

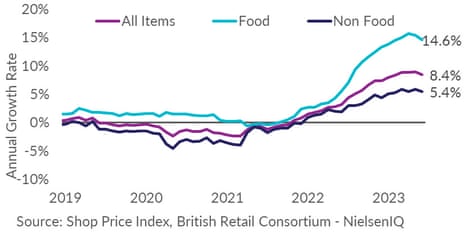

Shop Price annual inflation decelerated to 8.4% in June, down from 9.0% in May, according to the latest data from the British Retail Consortium and NielsenIQ.

Within that, food inflation decelerated to 14.6% in June, down from 15.4% in May. That’s still a desperately fast rate of price increases, but it could signal that inflationary pressures are easing.

Average basic pay rose by 7.2% per year in the three months to April, so food prices are accelerating twice as quickly.

But still, households up and down the country will welcome the easing of shop price inflation in June, says Helen Dickinson, OBE, chief executive of the British Retail Consortium.

“If the current situation continues, food inflation should drop to single digits later this year.

Fresh food prices were 15.7% higher than a year ago down from the 17.2% inflation rate recorded in May. That was driven by retailers cutting the price of many staples including milk, cheese and eggs.

The slowdown follows a drop in global food commodity prices, which spiked after the full-scale invasion of Ukraine more than a year ago.

Mike Watkins, head of retailer and business insight at NielsenIQ, explains:

“Whilst prices are still higher than a year ago, the slowdown in food inflation is welcome news for shoppers, helped by supermarkets lowering prices of some staple goods.

And if global supply chain costs continue to fall, we may now be past the peak of price increases. However, with most households needing to save money, purchasing behaviour for the rest of this year is still likely to shift towards essential needs with discretionary consumption being deprioritised or delayed.”

Falling inflation does not mean that prices are falling – simply that they are rising at a slower rate, compared to a year ago.

This morning’s data arrives ahead of a crunch meeting at parliament, where MPs will question key figures from the supermarket industry on rising food and fuel prices, and ask whether shoppers will see price falls soon.

They’ll hear from David Potts, the chief executive officer of Morrisons, and senior staff from J Sainsbury, Asda and Tesco.

The UK’s Groceries Code Adjudicator, Mark White, will also testify, and outline its plans to ensure retailers treat their direct suppliers lawfully and fairly.

In our one-off session tomorrow we’ll be questioning supermarket key figures on rising food and fuel prices and whether we’ll soon see price falls. We’ll also be questioning the Groceries Code Adjudicator.

👉Watch it here tomorrow at 10:10am: https://t.co/jmATJeqXxe

— Business and Trade Committee (@CommonsBTC) June 26, 2023

Yesterday, Sainsbury’s announced plans for another £15m of price cuts on essential staples, including own-brand pasta, rice, cornflakes and jam.

We’ll hear more from inflation today, as the European Centra Bank holds an annual seminar in Sintra, Portugal.

The agenda

-

9am BST: European Central Bank president Christine Lagarde speaks at ECB’s central banking forum

-

9.30am BST: Bank of England policymaker Silvana Tenreyro gives a speech on “Monetary policy in the face of supply shocks: the role of inflation expectations”

-

10.10am BST: Business and Trade Committee hearing on rising food and fuel prices

-

1.30pm BST: US durable good orders for May

-

3pm BST: US consumer confidence report for May

Key events

Victoria Scholar, head of investment at interactive investor, points out that UK supermarkets have recently been cutting prices, helping to lower food inflation.

She explains:

“The British Retail Consortium’s shop price inflation hit 8.4% in June falling from 9% in May which was the highest since records began in 2005. Food price inflation fell for the second consecutive month but remains at 14.6%, sharply above the headline rate of inflation.

Last week’s inflation figures from the ONS signal that bringing down inflation is proving to be a lot more difficult than expected. Prime Minister Rishi Sunak’s goal to halve inflation by year-end looks less and less likely as the months go by, despite aggressive monetary tightening from the Bank of England which has caused shockwaves across the mortgage market.

Supermarkets have been cutting their prices lately in an attempt to lure in increasingly cost-conscious customers. Sainsbury’s for example this week invested £15 million to cut prices on own brand items like pasta and jams. The highly price competitive German discounters, Aldi and Lidl have forced UK supermarkets to participate in the fierce price competition, with any abstention putting the likes of Morrisons, Asda and others at risk of losing market share.

Supermarket executives will face questions from MPs at the business and trade committee today responding to questions about soaring food price inflation which has been exacerbating the cost-of-living crisis.

Food businesses have been accused of ‘greedflation’, profiteering from inflation by failing to pass on falls in energy and other prices to consumers through lower prices. This is something that companies like Sainsburys and Unilever have strongly denied.

Rising food prices have detrimental effect on mental health

Soaring food prices are damaging the mental health of shoppers, particularly younger families, consumer group Which? warns.

A new survey from consumer group Which? shows that rising prices of everyday groceries has worsened the mental health of a quarter (25%) of people.

It also found that:

-

Some 23% say that rising food prices has hindered their ability to eat a healthy diet, while 22% said they had lost sleep over food costs, and one in five said their physical health had deteriorated.

-

Three in 10 women (30%) said their mental health had worsened as a result of soaring food prices.

-

A third of people aged 35 to 54 – those most likely to be parents of young families – said food costs had had a negative impact on their mental health.

-

They were more likely to be negatively affected than those aged 18 to 35 (27%) and over 55 (18%).

Which? head of food policy Sue Davies says the government must ensure retailers offer essential budget items in all their shops, to help those strugging.

“Women and young parents are among the worst affected and some people struggling to feed their children are asking themselves how much more of this they can take.

“Now is the time to act. The government must urgently get supermarkets to commit to stocking essential budget ranges in all their stores, particularly in areas where people are most in need, as well as make pricing much clearer so shoppers can compare prices and find the best value products.”

IMF: Rising corporate profits driving Europe’s inflation

Rising corporate profits account for almost half the increase in Europe’s inflation over the past two years.

That’s the verdict from the International Monetary Fund this morning, which reports that companies increased prices by more than spiking costs of imported energy.

In a new blog post, the IMF says profits account for 45% of price rises since the start of 2022. The surge in import costs after Russia’s invasion of Ukraine also drove eurozone inflation over 10% last year, they point out.

This means that Europe’s businesses have so far been shielded more than workers from the adverse cost shock, the IMF write:

Profits (adjusted for inflation) were about 1 percent above their pre-pandemic level in the first quarter of this year. Meanwhile, compensation of employees (also adjusted) was about 2 percent below trend.

So, if Europe is to hit its inflation targets, and workers receive pay rises to make up for inflation, companies must accept a smaller profit share.

The IMF explains:

Should wages increase more significantly—by, say, the 5.5 percent rate needed to guide real wages back to their pre-pandemic level by end-2024—the profit share would have to drop to the lowest level since the mid-1990s (barring any unexpected increase in productivity) for inflation to return to target.

This research adds to the debate over ‘greedflation’ – where companies whack up their prices faster than is justified by rising costs….

However, recent data from the UK showed that the profitability of British private non-financial companies remained stable in the final quarter of last year – suggesting that higher corporate profit margins were not pushing up UK inflation.

Last night Gita Gopinath, the first deputy managing director of the IMF, warned that inflation is taking too long to get back to target.

She told the ECB’s annual conference in Sintra, Portugal:

“While headline inflation has eased significantly, inflation in services has stayed high, and the date by when it is expected to return to target could slip further.”

Wales to clamp down on junk food meal deals to tackle obesity

Steven Morris

Clampdowns on unhealthy meal deals and supermarket temporary price reductions for foods high in fat, sugar or salt are to be introduced in Wales.

The move is part of a push to tackle the obesity crisis, my colleague Steven Morris reports.

With almost two-thirds of adults in Wales overweight or obese, the Labour-led government announced it would go further than England in framing laws designed to tackle the promotion of ultra-processed foods.

The government said it intended to match the UK government’s plans to curb volume promotions such as buy one get one free in England. It also revealed proposals to tackle meal deals and temporary price reductions, arguing it needed to do more because of the scale of the crisis.

Clothing and electrical goods at UK shops also saw falling prices this month, the British Retail Consortium reports, “helping customers to pick up a bargain ahead of the summer holidays”.

Inflation has proven particularly sticky in the UK with the consumer prices index rising the same amount in May as the previous month, points out Bloomberg.

They add:

A larger-than-expected Bank of England rate rise last week jolted markets and drove up the cost of mortgages.

Supermarkets are under scrutiny as food price inflation has remained at elevated levels. However, bosses have pushed back against the idea that grocers are profiteering.

Full story: Shop price inflation easing, say top UK retailers before key meeting with MPs

Richard Partington

MPs will hold a ‘crunch meeting’ with the UK supermarket industry today, my colleague Richard Partington writes.

Senior executives from Tesco, Sainsbury’s, Asda and Morrisons will be questioned over soaring prices on Tuesday by MPs on the cross-party business and trade committee, with a focus on their profit margins, competition in the supply chain and when shoppers can expect to see a significant fall in prices.

Ministers have explored the option of supermarkets adopting a voluntary price cap for the price of basic food items, but have insisted they would not impose limits on the industry.

Last week, chancellor Jeremy Hunt brushed aside calls for caps on basic food products, saying he didn’t believe it was “the right long-term solution”.

Introduction: UK’s surging shop price inflation eased in June

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Food inflation has been one of the worst elements in the cost of living crisis, but there are signs that the squeeze is easing, with prices in shops rising at a slower rate.

Shop Price annual inflation decelerated to 8.4% in June, down from 9.0% in May, according to the latest data from the British Retail Consortium and NielsenIQ.

Within that, food inflation decelerated to 14.6% in June, down from 15.4% in May. That’s still a desperately fast rate of price increases, but it could signal that inflationary pressures are easing.

Average basic pay rose by 7.2% per year in the three months to April, so food prices are accelerating twice as quickly.

But still, households up and down the country will welcome the easing of shop price inflation in June, says Helen Dickinson, OBE, chief executive of the British Retail Consortium.

“If the current situation continues, food inflation should drop to single digits later this year.

Fresh food prices were 15.7% higher than a year ago down from the 17.2% inflation rate recorded in May. That was driven by retailers cutting the price of many staples including milk, cheese and eggs.

The slowdown follows a drop in global food commodity prices, which spiked after the full-scale invasion of Ukraine more than a year ago.

Mike Watkins, head of retailer and business insight at NielsenIQ, explains:

“Whilst prices are still higher than a year ago, the slowdown in food inflation is welcome news for shoppers, helped by supermarkets lowering prices of some staple goods.

And if global supply chain costs continue to fall, we may now be past the peak of price increases. However, with most households needing to save money, purchasing behaviour for the rest of this year is still likely to shift towards essential needs with discretionary consumption being deprioritised or delayed.”

Falling inflation does not mean that prices are falling – simply that they are rising at a slower rate, compared to a year ago.

This morning’s data arrives ahead of a crunch meeting at parliament, where MPs will question key figures from the supermarket industry on rising food and fuel prices, and ask whether shoppers will see price falls soon.

They’ll hear from David Potts, the chief executive officer of Morrisons, and senior staff from J Sainsbury, Asda and Tesco.

The UK’s Groceries Code Adjudicator, Mark White, will also testify, and outline its plans to ensure retailers treat their direct suppliers lawfully and fairly.

In our one-off session tomorrow we’ll be questioning supermarket key figures on rising food and fuel prices and whether we’ll soon see price falls. We’ll also be questioning the Groceries Code Adjudicator.

👉Watch it here tomorrow at 10:10am: https://t.co/jmATJeqXxe

— Business and Trade Committee (@CommonsBTC) June 26, 2023

Yesterday, Sainsbury’s announced plans for another £15m of price cuts on essential staples, including own-brand pasta, rice, cornflakes and jam.

We’ll hear more from inflation today, as the European Centra Bank holds an annual seminar in Sintra, Portugal.

The agenda

-

9am BST: European Central Bank president Christine Lagarde speaks at ECB’s central banking forum

-

9.30am BST: Bank of England policymaker Silvana Tenreyro gives a speech on “Monetary policy in the face of supply shocks: the role of inflation expectations”

-

10.10am BST: Business and Trade Committee hearing on rising food and fuel prices

-

1.30pm BST: US durable good orders for May

-

3pm BST: US consumer confidence report for May