ABF raises profit outlook after lifting prices

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Hiking prices has proved profitable for Primark-owner Associated British Foods.

ABF has told shareholders this morning it now expects adjusted operating profit for the current financial year to be “moderately ahead of last year,” having previously expected to be “broadly in line”.

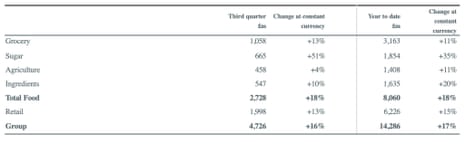

Sales across the group have grown 17% so far this year, and were up 16% in the third quarter (the 12 weeks to 27 May).

Primark, the discount clothes chain, has seen good demand for summer ranges, ABF says. Total sales were up 13% in the last quarter, while like-for-like sales grew 7%, “supported by higher average selling prices.”

Those higher prices will be a blow to struggling households. But despite them, sales at Primark’s flagship city centre stores have “continued to be good”, ABF adds.

The group’s food arm, which produces ingredients such as flour and sugar and various grocery brands including Twinings and Ovaltine, has also recorded good trading, with sales up 18% this year.

ABF adds that price rises, following the jump in commodity costs, lifted revenues, saying:

In particular, we have seen strong constant currency sales growth in Grocery and Ingredients largely driven by the necessary pricing actions taken earlier in the year to offset input cost increases.

ABF’s ‘necessary pricing actions’ have helped to push up prices in the shops, with UK food inflation hitting 19% this year.

This has added to the squeeze on consumers, with new figures last weekend showing that millions of renters are being hit by landlords passing on higher mortgage costs to their tenants.

Also coming up today

Jeremy Hunt is set to meet industry regulators on Wednesday, to ask what they are doing about any companies exploiting rampant inflation by raising prices.

The Chancellor is set to meet the Competition and Markets Authority (CMA), and the watchdogs for energy, water and communications on Wednesday, and will press them on whether there is a profiteering problem in their sectors and what they are doing about it, Treasury sources say.

In the financial markets, the Russian rouble fell to a near 15-month low against the dollar this morning, as traders react to last weekend’s aborted mutiny by the Wagner mercenary group. The rouble dropped to 87.2300 to the dollar, its weakest point since late March 2022.

The Russian rouble opened at a near 15-month low against the dollar in early morning trade on Monday, responding for the first time to an aborted mutiny by heavily armed mercenaries over the weekend. pic.twitter.com/h1BBfW4RJZ

— Srbija Evropa (@srbija_eu) June 26, 2023

And UK borrowers will be watching nervously for signs that interest rates may be heading higher, after last Thursday’s Bank of England rate rise.

Yesterday, Rishi Sunak urged homeowners and borrowers to “hold their nerve” over rising interest rates, as the fight to lower inflation continues, prompting criticism that the PM is out of touch on the the cost of living crisis.

‘Out-of-touch’ Rishi Sunak tells struggling families UK must ‘hold our nerve’ https://t.co/9ZhF3jrpoW. The elite of are selling the workers down the river. Yet saying they have no choice, putting up interest rates has not worked, they have being doing it for months. Stop now.

— oraina curry (@OrainaC) June 25, 2023

The agenda

-

9am BST: IFO survey of German business conditions

-

11am BST: CBI distributive trade survey of UK retail

-

3.30pm BST: Dallas Fed manufacturing index

-

6.30pm BST: European Central Bank forum on central banking

Key events

The value of Ukrainian government bonds has jumped this morning, after the aborted mutiny in Russia by Wagner Group mercenaries over the weekend.

The 2041 bond saw the biggest gains, rising as much as 2.9 cents to trade at 42 cents in the dollar – its strongest level since Russia’s invasion of Ukraine in February 2022, Tradeweb data analysed by Reuters showed.

Markets are trying to work out what Saturday’s dramatic developments mean for the Russia-Ukraine war.

Jim Reid, strategist at Deutsche Bank, says:

It could increase the risk of escalation by Mr Putin to reinstate an air of authority, or it could leave him vulnerable which could be seen as positive or negative for Europe, Ukraine and wider markets.

It’s just impossible to tell at this stage.

Our rolling coverage of the conflict is here:

The news about ABF’s star business, Primark, appears to be good, says retail analyst Nick Bubb.

He adds:

Well, while Kremlinologists try to work out what’s happening in Russia, there isn’t much doubt that Primark is still doing well…

HSBC moving headquarters from Canary Wharf

Banking giant HSBC is to leave its Canary Wharf headquarters after more than two decades, and shift its workforce to a smaller offce in the City.

A memo seen by Reuters shows that HSBC told staff its preferred option was to move to BT’s former head office near St Paul’s, which has been redeveloped.

The bank began a review to assess its “best future location in London” last year, Reuters reported, ahead of its lease expiring at the 45-floor tower at 8 Canada Square in early 2027.

According to The Times, which first reported HSBC’s decision earlier this morning, the bank has been considering several potential new offices since it told staff last Septemner it could leave its Canary Wharf tower.

The Panorama St Paul’s development is around half the size of the Canary Wharf site, but less space is needed following the move to hybrid working after the pandemic.

If the consumer is beginning to have doubts about spending, such reticence is not hurting Primark, says Richard Hunter, head of markets at interactive investor.

The return of the physical shopper helped Primark’s flagship city centre stores to perform strongly this year, Hunter explains, adding:

Of course, any further deterioration in the economic backdrop could weigh further on consumer sentiment, while central banks attempt so far unsuccessfully to put the inflation genie back in the bottle.

Even so, one thing which has become apparent over recent months is the British insistence on taking holidays, as evidenced by improving airline and travel numbers, which is often accompanied by a revamp of the wardrobe.

ABF: Consumers resilient despite ‘doom and gloom’

Primark’s trading in the UK in June was stronger than the 6% like-for-like sales growth achieved in the 12 weeks to May 27, benefiting from warm weather, Eoin Tonge, finance director of parent company ABF, says.

Tonge also told Reuters that consumers have shown resilience despite gloomy commentary.

“Every quarter that’s gone by, it keeps on reminding us that the consumer has been more resilient than the doom and gloom.

“The doom and gloom has been around now for almost 12 months and the consumer continues to outperform the doom and gloom.”

Analyst: Cost conscious consumers kept Primark busy

Here’s Emma-Lou Montgomery, associate director from Fidelity Personal Investing’s share dealing service, on ABF’s profit upgrade this morning.

“Cost conscious consumers – who are after all, Primark’s bread and butter – have kept the tills ringing despite the cost of living crisis raging on in the UK. The no-frills fashion retailer, which has still only established the most basic of online presences, saw sales rise 13% in the third quarter.

“Giving its latest trading update, owner Associated British Foods, said higher average selling prices had boosted sales 7% like-for-like, in the three months under review, meaning like-for-like sales growth for the year is now at 9%. The sales of summer essentials, plus a boom in its beauty range, means that full year adjusted operating profits are now expected to be ‘moderately’ ahead of last year’s.

“Primark’s global expansion into Slovakia and with the signing of its first lease on a store in Texas, means the Primark brand is now in 16 countries – all predominantly reliant on good old-fashioned in-store shoppers.”

Supermarket chain J Sainsbury has announced £15m of price cuts this morning, a sign that the inflationary pressures hitting retailers and consumers is easing.

The price cuts to staple goods include Basmati Rice (1kg cut from £2.10 to £1.75), Spaghetti (500g down from 95p to 75p), and Corn Flakes (500g reduced to 69p from 85p).

It’s also price-matching its by Sainsbury’s whole chicken breast fillets to Aldi – the discount rival which has grown market share this year as customers sought lower prices.

Sainsbury’s says the changes won’t affect much farmers are paid.

The cost of living squeeze has also pushed up the service charges on flats.

The average annual service charge for a flat in England and Wales has jumped by 8% – or just over £100 – over the past year, new data from estate agent Hamptons shows.

The average charge is £1,431, equating to £119 per month, up from an average of £1,325 a year ago.

David Fell, lead analyst at Hamptons, says the increased cost of building materials and insurance are responsible.

He added

“While recent falls in the cost of some building materials and energy costs should start feeding through into lower charges for residents, it won’t happen overnight.”

Another factor is the impact of stricter fire safety measures prompted by the Grenfell Tower disaster.

ABF raises profit outlook after lifting prices

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Hiking prices has proved profitable for Primark-owner Associated British Foods.

ABF has told shareholders this morning it now expects adjusted operating profit for the current financial year to be “moderately ahead of last year,” having previously expected to be “broadly in line”.

Sales across the group have grown 17% so far this year, and were up 16% in the third quarter (the 12 weeks to 27 May).

Primark, the discount clothes chain, has seen good demand for summer ranges, ABF says. Total sales were up 13% in the last quarter, while like-for-like sales grew 7%, “supported by higher average selling prices.”

Those higher prices will be a blow to struggling households. But despite them, sales at Primark’s flagship city centre stores have “continued to be good”, ABF adds.

The group’s food arm, which produces ingredients such as flour and sugar and various grocery brands including Twinings and Ovaltine, has also recorded good trading, with sales up 18% this year.

ABF adds that price rises, following the jump in commodity costs, lifted revenues, saying:

In particular, we have seen strong constant currency sales growth in Grocery and Ingredients largely driven by the necessary pricing actions taken earlier in the year to offset input cost increases.

ABF’s ‘necessary pricing actions’ have helped to push up prices in the shops, with UK food inflation hitting 19% this year.

This has added to the squeeze on consumers, with new figures last weekend showing that millions of renters are being hit by landlords passing on higher mortgage costs to their tenants.

Also coming up today

Jeremy Hunt is set to meet industry regulators on Wednesday, to ask what they are doing about any companies exploiting rampant inflation by raising prices.

The Chancellor is set to meet the Competition and Markets Authority (CMA), and the watchdogs for energy, water and communications on Wednesday, and will press them on whether there is a profiteering problem in their sectors and what they are doing about it, Treasury sources say.

In the financial markets, the Russian rouble fell to a near 15-month low against the dollar this morning, as traders react to last weekend’s aborted mutiny by the Wagner mercenary group. The rouble dropped to 87.2300 to the dollar, its weakest point since late March 2022.

The Russian rouble opened at a near 15-month low against the dollar in early morning trade on Monday, responding for the first time to an aborted mutiny by heavily armed mercenaries over the weekend. pic.twitter.com/h1BBfW4RJZ

— Srbija Evropa (@srbija_eu) June 26, 2023

And UK borrowers will be watching nervously for signs that interest rates may be heading higher, after last Thursday’s Bank of England rate rise.

Yesterday, Rishi Sunak urged homeowners and borrowers to “hold their nerve” over rising interest rates, as the fight to lower inflation continues, prompting criticism that the PM is out of touch on the the cost of living crisis.

‘Out-of-touch’ Rishi Sunak tells struggling families UK must ‘hold our nerve’ https://t.co/9ZhF3jrpoW. The elite of are selling the workers down the river. Yet saying they have no choice, putting up interest rates has not worked, they have being doing it for months. Stop now.

— oraina curry (@OrainaC) June 25, 2023

The agenda

-

9am BST: IFO survey of German business conditions

-

11am BST: CBI distributive trade survey of UK retail

-

3.30pm BST: Dallas Fed manufacturing index

-

6.30pm BST: European Central Bank forum on central banking