Whitty says ‘extremely concerning’ threats to expert advisers during Covid could undermine future disaster planning

Back at the Covid inquiry, Prof Sir Chris Whitty, the chief medical officer for England, says Britain has a strong network in place providing scientific advice to government for emergencies.

But he says there are two potential threats to this.

First, he says, universities are becoming more “hawkish”, which means they may be less willing to spare academics for this sort of work.

Second, he says, the amount of abuse, and in some cases threats, levelled at experts during Covid was “extremely concerning”, he says. He says society should be firm in saying how much it appreciates the work of these experts. Usually they are acting unpaid, he says.

Key events

Penny Mordaunt says Boris Johnson’s wrongdoing not serious enough to merit his exclusion from privy council

Aletha Adu

Penny Mordaunt, the leader of the Commons, has declined to back calls for Boris Johnson to be removed from the privy council.

But, speaking during questions on next week’s business in the Commons, she said she understood why some people felt he should have that honour removed.

Mordaunt was speaking in response to a question from the Lib Dem MP Wera Hobhouse, who said Johnson should lose his status as a privy counsellor following the Commons vote approving a report saying he lied to MPs. Hobhouse said:

We must send a clear signal that there is no place in British politics or in public life for someone who has no regard for standards. If we do not do so, we risk opening the door to people seeking to emulate Boris Johnson in the years to come.

Mordaunt, who was one of the few government ministers who voted to approve the privileges committee report, said she understood why Hobhouse felt strongly about that. But she went on:

Where people have been booted off the privy council, the threshold for that is much higher than the situation we were discussing on Monday, for example someone committing financial fraud.

So I would say to her, I understand where she’s coming from and her motivation, the integrity in all of these systems is very important, as I spoke about on Monday, but I don’t think this is an appropriate course of action in this instance.

Mordaunt also said that, if someone were to be removed from the privy council, that would have to be on the basis of advice submitted by the PM to the king. And she said that she thought it was best to keep the king out of controversies like that.

In recent years, when people have left the privy council, normally it has been at their own request, having been found guilty of a serious criminal offence.

Otherwise being a privy counsellor is an honour that lasts for life. Most of those appointed to the privy council are senior politicians. Although in theory they are all advisers to the king, in practice only serving ministers attend privy council meetings, where minor bits of legislation (orders in council) are agreed.

Sunak says meeting his inflation target now ‘more challenging’ but he is ‘throwing everything we have at it’

Rishi Sunak has told the Times CEO summit that meeting his pledge to halve inflation has become “more challenging” but he is “throwing everything we have” at it, Steven Swinford reports.

Rishi Sunak says inflation is not an abstract – it makes everyone poorer and takes the point in your pocket away

He tells Times CEO Summit: ‘I always said this would be hard. Clearly it’s got harder in the last few months. Anyone who tells you this is easy isn’t being straight’

— Steven Swinford (@Steven_Swinford) June 22, 2023

Rishi Sunak says govt is taking ‘robust’ action on inflation

He highlights restraint on public sector pay; says it might not be easy but it’s the ‘right thing to do’

But he says there are reasons for optimism, highlighting fact that producer inflation has ‘fallen off a cliff’

— Steven Swinford (@Steven_Swinford) June 22, 2023

Rishi Sunak says public sector pay settlements need to be fair but they need to be affordable too

‘I’m not going to deviate from the course we have. Public sector pay settlements have to be affordable, they have to be responsible’

He warns against fuelling wage price spirals

— Steven Swinford (@Steven_Swinford) June 22, 2023

Rishi Sunak concede that hitting his target to halve inflation has become harder

He says it’s an ambitious target. ‘It’s clearly become more challenging, it’s clearly become harder, but we’re throwing everything we have at it’

— Steven Swinford (@Steven_Swinford) June 22, 2023

Anyone listening to the James Cleverly interview this morning (see 9.26am) will have concluded that the government’s “everything we have locker” is quite empty. No 10 sought to counter that impression with a Twitter thread posted under Sunak’s name earlier. It starts here.

Join me later today for a live update on my plans to halve inflation and continue to support you with the cost of living.

Here’s what you need to know before then🧵 pic.twitter.com/dwAZo1xif7

— Rishi Sunak (@RishiSunak) June 22, 2023

Sunak’s personal ratings fall following his much-criticised response to privileges committee report into Boris Johnson

Rishi Sunak’s personal ratings have taken a significant hit in the aftermath of the Commons vote on the privileges committee report into Boris Johnson.

Sunak was widely criticised for his response to the report, which was published a week today. He refused to say whether or not he agreed with its findings, arguing that it would be improper to say anything that might influence MPs ahead of the free vote on Monday. Since Monday’s vote, Sunak has still refused to give any clear steer as to his thinking on this issue.

On the basis of polling conducted on Tuesday and Wednesday, YouGov says Sunak’s favourability ratings have fallen by six points as a result, while Keir Starmer’s are up by nine points. In his write-up for YouGov, Matthew Smith says:

YouGov’s latest favourability survey finds Rishi Sunak has taken a 6pt hit to his net favourability ratings, falling to -34 since last week.

Currently only 27% of Britons have a favourable view of the prime minister, compared to 61% who have an unfavourable view.

While recent economic news has been bad for Sunak, with mortgage travails covering the front pages in recent days, it is likely that the reputational damage has been caused primarily by his response to the privileges committee report which found that Boris Johnson had knowingly misled parliament about Covid rule breaches in Downing Street.

Our poll earlier this week found that 57% of Britons believe Sunak handled this badly, and Sunak’s 6pt net favourability drop is matched by an 8pt net decrease for Boris Johnson over the same time period (to -52).

Following the Privileges Committee report vote, Rishi Sunak and Boris Johnson have seen their net favourability scores take a hit

Rishi Sunak: net -34 (down 6 from 15-16 June)

Boris Johnson: -52 (down 8)

Keir Starmer: -14 (up 9)https://t.co/x9B7577Kgk pic.twitter.com/aVr9FR8KBT— YouGov (@YouGov) June 22, 2023

Whitty said there was ‘good reason’ for pandemic planning being heavily focused on flu risk

Back at the Covid inquiry, Prof Sir Chris Whitty was asked if it was true that there was a “longstanding bias” in pandemic planning in favour of a flu pandemic.

Whitty said that that was the case, but he said there was a “good reason” for this.

That statement is true, for good reason. I don’t think that means that other things were not considered. And the reason for this is simply that we’ve had many more influenza pandemics. Anyone who’s born after 1950 would have lived through three of them.

Only 18% of leave voters think Brexit has been a success, poll finds

Only 18% of 2016 leave voters believe Brexit has been a success, according to polling for the thinktank UK in a Changing Europe – but 61% think it will turn out well in the end, Heather Stewart reports.

Starmer says next month will feel ‘a lot worse’ for people because of rising costs

Keir Starmer has said that next month will feel “a lot worse” for people because of rising costs.

Speaking at the Times’ CEO summit, before the Bank of England announced its interest rate hike, he said that his own household had already been affected by rising mortgage costs over the past 12 months and that he expected today’s announcement to affect him too.

There would be “a real problem” for those struggling to make ends meet, he said.

Next month is going to feel a lot worse than it feels now, and as many people have said to me, if you’ve got only the mortgage going up, that might be bearable, but it’s alongside the energy bills going up, the food bill going up.

Echoing what Rachel Reeves said this morning, Starmer also said there were “problems” with the government subsidising mortgage, as proposed by the Liberal Democrats with their mortgage protection fund. Starmer said:

There’s no answer to this that doesn’t go with economic stability.

Bank of England raises interest rates by a half point to 5%

The Bank of England has raised interest rates by a half point to 5% as it intensifies its efforts to tackle stubbornly high inflation, adding to the strain on households struggling with soaring mortgage costs, Richard Partington reports.

Whitty says ‘extremely concerning’ threats to expert advisers during Covid could undermine future disaster planning

Back at the Covid inquiry, Prof Sir Chris Whitty, the chief medical officer for England, says Britain has a strong network in place providing scientific advice to government for emergencies.

But he says there are two potential threats to this.

First, he says, universities are becoming more “hawkish”, which means they may be less willing to spare academics for this sort of work.

Second, he says, the amount of abuse, and in some cases threats, levelled at experts during Covid was “extremely concerning”, he says. He says society should be firm in saying how much it appreciates the work of these experts. Usually they are acting unpaid, he says.

Sunak urges Britons to ‘hold nerve’ on economy, saying he is confident his plan can deliver

Rishi Sunak has posted a thread on Twitter setting out what the government is doing to help people with the cost of living. It starts here.

Join me later today for a live update on my plans to halve inflation and continue to support you with the cost of living.

Here’s what you need to know before then🧵 pic.twitter.com/dwAZo1xif7

— Rishi Sunak (@RishiSunak) June 22, 2023

He ends by saying “if we can hold our nerve” he is confident the plan will deliver.

I know things are difficult, but if we can hold our nerve I’m confident this plan will deliver.

Tune in later today here on Twitter to hear why.

— Rishi Sunak (@RishiSunak) June 22, 2023

Hugo Keith KC, lead counsel for the inquiry, is questioning Whitty.

He starts by stressing that he will not be asking today about the government’s response to the pandemic. Those are matters for the future.

Instead he will ask about the structures in place, he says.

Prof Sir Chris Whitty says he is assisted by an office of the chief medical officer. He has about 12 people working for him in that office, he says.

It expanded up to about 19 people during the pandemic.

That was the right size for the job he was being asked to do, which was advisory, he says.

Chris Whitty gives evidence to Covid inquiry

Prof Sir Chris Whitty, the chief medical officer for England, has just started giving evidence to the Covid inquiry.

At this stage the inquiry is just taking evidence on “resilience and preparedness”, and so his evidence today will cover how ready the UK was for a pandemic. It will not focus on what happened after Covid hit.

There is a live feed here.

James Cleverly is not the only politician who has recorded an interview out today they would rather forget. My colleague John Harris has been to Somerton and Frome in Somerset, where there will be a byelection on 20 July following the resignation of the Tory, David Warburton. (The Uxbridge and South Ruislip, and Selby and Ainsty byelections are on the same day.) The Lib Dems held Somerton and Frome until 2015, and so their candidate, Sarah Dyke, is favourite to win.

But when John interviewed her for a Politics Weekly podcast about the byelection, he found she had difficulty answering policy questions on topics like mortgages and housing. Eventually she terminated the interview, saying she wasn’t prepared for it.

You can listen to the interview, and the whole podcast, here.

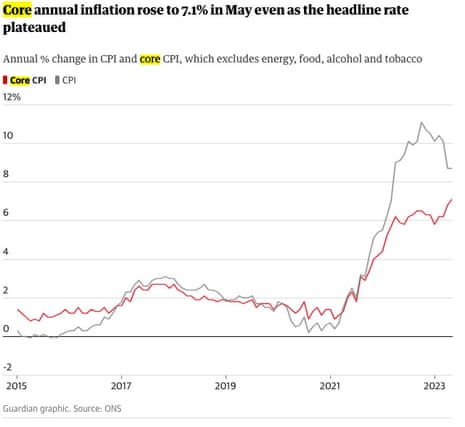

A reader has asked for an explanation of what “core inflation” is. It is a concept that came up a lot Amol Rajan’s interview with James Cleverly this morning. (See 9.26am.)

Here is a definition from the Office for National Statistics.

Certain classes of goods and services within an aggregate price index are considered very prone to short-term supply-side shocks or strong seasonal movements, such as energy and food. Many National Statistics Institutes around the world publish estimates of inflation excluding these specific classes, which they typically label as ‘core inflation’. The Office for National Statistics (ONS) publishes 13 exclusion-based estimates of inflation, although the specific measure excluding energy, food, alcohol, and tobacco is the one we typically refer to as ‘core’.

The ONS figures out yesterday put the headline rate of inflation (CPI – the consumer price index) at 8.7% in May. And core inflation was at 7.1% in May, the highest rate since 1992, up from 6.8% in April.

This Guardian graphic shows why the rise in core inflation is causing concern.

The Centre for Policy Studies, a conservative thinktank, has criticised Labour’s plan to require lenders to offer mortgage holders the chance to move to interest-only mortgages, or to extend the term of the loan. In a statement Tom Clougherty, the CPS’s research director, said:

Labour’s plan mostly “requires” lenders to do a variety of things they will already be doing voluntarily, because they understand the pressures their customers are facing and don’t want people to lose their homes unavoidably.

But direct intervention of this sort can still have big unintended consequences. To the extent that it forces banks to offer greater cross-subsidies to particular customers, it is bound to raise costs for other borrowers – or prevent necessary adjustments in the mortgage market from taking place.

It is much better to leave banks to work things out with borrowers. A legislated, one-size-fits-all approach is bound to cause as many problems as it solves.

When Rachel Reeves, the shadow chancellor, was asked what Labour would do to combat inflation, she told the Today programme this morning that her priority was to help those struggling the most. She said:

My priority with the inflation we’ve got at the moment is to give immediate support to those who are struggling the most.

That’s why we would extend the windfall tax, that’s why we’ve set out this mortgage plan, the best thing that government can do, and what I would be doing as chancellor, is providing the economic stability and not undermining the independent economic institutions.

One of the reasons we are in this mess is because of the conservative mini-budget but also because, at that time, undermining the independent Office for Budget Responsibility, the independent Bank of England, and the sacking of the permanent secretary of the Treasury.

I will respect those economic institutions who provide the economic stability which in the end is essential for low and stable inflation and a growing economy all of which we’ve missed out on in the last 13 years under the Conservatives.

Matt Hancock, the former health secretary, and Nicola Sturgeon, the former Scottish first minister, are among the witnesses who will be giving evidence to the Covid inquiry next week, it has announced this morning. Hancock will appear on Tuesday morning and Sturgeon on Thursday morning.

Rachel Reeves says Labour will not pay subsidies to people struggling with high mortgage costs

Rachel Reeves, the shadow chancellor, has ruled out Labour backing plans for subsidies or financial support for mortgage holders, as struggling homeowners brace for another interest rate rise, PA Media reports. PA says:

The Bank of England is widely expected to raise interest rates for the 13th time in a row but the shadow chancellor rejected calls from some quarters for direct financial help for homeowners hit by rising rates.

Banks would instead be forced to help mortgage holders struggling with payments under Labour plans, with the opposition urging the government to compel lenders to allow borrowers to temporarily switch to interest-only payments or lengthen their mortgage period.

Banks would also have to wait at least six months before starting repossession proceedings as part of the party’s five-point plan amid growing pressure on the government to respond to the crisis.

The Liberal Democrats have called for an emergency mortgage protection fund paid for by a reversal of tax cuts for big banks but Reeves warned that such measures could worsen the fiscal situation.

“I recognise the challenge of inflation, and a big fiscal injection of cash into the economy, especially an untargeted injection, would not be the right approach,” Reeves told BBC Radio 4’s Today programme.

Kiran Stacey has more on Labour’s plans to help people deal with higher mortgage payments here.

Foreign secretary James Cleverly struggles to explain what government is doing to reduce inflation

Good morning. At noon the Bank of England is expected to raise interest rates for the 13th time in a row. Economists are forecasting a rise of at least a quarter of one percentage point, from 4.5% to 4.75%, but some of them believe there is a chance of a half-point increase, taking the rate to 5%, its highest level since April 2008.

Graeme Wearden is covering the buildup to this decision in detail on his business live blog.

Rishi Sunak and Keir Starmer are both speaking in public today, and they will be under pressure to explain what they would do to tackle inflation. It remains stubbornly high, and that explains why the Bank keeps pressing the interest rate pedal. They will be hoping they do a better job than James Cleverly, the foreign secretary, who struggled in an interview this morning to explain what the PM was doing to halve inflation (one of his five pledges).

Asked by Amol Rajan on the Today programme what the plan was, Cleverly started by talking about Ukraine, which is part of his brief, and said that resolving the conflict would bring down energy prices. He also mentioned making the economy more productive, and creating more apprenticeships. Unimpressed by the waffle, Rajan took him back to the question. This was how the exchange went. It was excruciating listening.,

AR: The things you mentioned are not part of core inflation. If you look at core inflation, it’s very clear … that the UK has got a bigger problem with inflation than other countries. And if you strip out those things that you mentioned, which are volatile, like food and energy prices, core inflation in this country is different to other countries. It’s going up. I just want to know what the prime minister’s plan is to do about it. Because influencing apprenticeships isn’t really going to affect inflation in the short term.

JC: Look, we recognise that you have to deal with things in the short, medium and long term.

AR: So what is the plan in the short term to reduce inflation from the prime minister?

JC: As I say, the point is, with things like driving down the implications of food and fuel …

AR: I’m asking you about core inflation … The prime minister has said cutting inflation is a top priority. What is the prime minister’s short term plan for reducing inflation?

JC: One of the main vehicles for short term addressing inflation is interest rates …

AR: The prime minister does not control that. So what’s he going to do?

JC: The point is, not all the levers of control are in the government’s hands … We set inflation targets for the Bank of England, the Bank of England sets interest rates in response to those inflation targets. We do what we can do to try and address the issues over which we have direct control …

AR: Millions of our listeners are really concerned about inflation. We’ve established that inflation in this country is going up, core inflation, and the prime minister has made it a priority to reduce inflation … So in terms of what this country’s prime minister is doing immediately to reduce inflation, what is it?

JC: What we are doing is making sure that in the areas where we do have control – for example, one of the reasons why we have been thoughtful but cautious on public sector pay awards is we know that is one of those things that adds inflationary pressures. We’re very conscious that increased government borrowing is one of those things that loops around and increases inflationary pressures. That’s why we were standing firm on these things and that is in stark comparison with the Labour party, for example, who are talking about a massive borrowing spree and talking about well above inflation pay rises, all of which would have increased inflationary pressures.

Here is the agenda for the day.

10am: Sir Chris Whitty, the chief medical officer for England, gives evidence to the Covid inquiry. In the afternoon Sir Patrick Vallance, the former chief scientific adviser, gives evidence.

11.25am: Keir Starmer speaks at the Times’ CEO summit. At 12pm he will be interviewed on Times Radio.

11.30am: Downing Street holds a lobby briefing.

Noon: The Bank of England announces its latest interest rate decision.

Noon: Humza Yousaf, Scotland’s first minister, takes questions at Holyrood.

12.35am: Rishi Sunak speaks at the Times’ CEO summit.

2.15pm: Sunak holds a PM Connect Q&A in Kent.

If you want to contact me, do try the “send us a message” feature. You’ll see it just below the byline – on the left of the screen, if you are reading on a PC or a laptop. This is for people who want to message me directly. I find it very useful when people message to point out errors (even typos – no mistake is too small to correct). Often I find your questions very interesting too. I can’t promise to reply to them all, but I will try to reply to as many as I can, either in the comments below the line, privately (if you leave an email address and that seems more appropriate), or in the main blog, if I think it is a topic of wide interest.