Introduction: UK house prices fell 3.4% in May in annual terms

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices have dropped again on an annual basis, and rising mortgage rates could put more pressure on the market in the months to come.

Nationwide reports this morning that the average price of houses sold in May were 3.4% lower than a year ago, down from the 2.7% fall recorded in April.

In May alone, prices slipped by 0.1% on a seasonally-adjusted basis, partly reversing April’s 0.4% rise.

The average price was £260,736 in May, reports Nationwide, who predict activity is likely to remain subdued in the near term.

Aprils house price reprieve is short lived as annual house prices in May 2023 “slipped” back -3.4% & -0.1% on last month to £260,736. With further interest rate turbulence predicted in the short term expect growth to slip further before stagnating for longer @AskNationwide pic.twitter.com/YTn5r5qrWG

— Emma Fildes (@emmafildes) June 1, 2023

The broader picture is that average house prices are around 4% below their peak last summer, just before the mini-budget rocked the markets and drove up mortgage rates.

Robert Gardner, Nationwide’s chief economist, explains:

“Following tentative signs of improvement in April, annual house price growth softened again in May, falling back to -3.4% (from -2.7% in April).

However, this largely reflects base effects with prices broadly flat over the month after taking account of seasonal effects. Average prices remain 4% below their August 2022 peak.

“Recent Bank of England data had shown some signs of recovery in housing market activity, although the number of mortgages approved for house purchase in March was still around 20% below pre-pandemic levels.

The Bank of England will release new mortgage approvals and consumer credit data this morning, giving an insight into the health of the property market.

More details and reaction to follow….

Also coming up today

We also get healthchecks on factories across the eurozone, in the UK and in the US. Last week’s ‘flash readings’ showed that manufacturing in France and Germany was weak, so today’s readings could reinforce recession worries.

At lunchtime, a new survey of job creation across America will be released, which could indicate how the main US jobs report, Friday’s Non-Farm Payroll, will unfold.

Investors are also keen to see May’s eurozone inflation report, which may give hints as to whether the European Central Bank could stop raising interest rates soon.

Eurozone inflation is expected to have fallen, from 7% to 6.3%, after drops in Germany, France, Italy and Spain earlier this week. But core inflation could be stickier, posing problems for central bankers.

The agenda

-

7am BST: Nationwide house price index for May

-

9am BST: Eurozone manufacturing PMI report for May

-

9.30am BST: UK manufacturing PMI report for May

-

9.30am BST: UK mortgage approvals and consumer credit data

-

10am BST: Eurozone flash inflation reading for May

-

12.30pm BST: European Central Bank releaases accounts of its latest meeting

-

1.15pm BST: ADP national employment report of US private sector jobs creation

-

1.30pm BST: US weekly jobless claims figures

-

3pm BST: US manufacturing PMI report for May

Key events

In the City, shares in footwear maker Dr Martens have dropped by around 10% after it reported a drop in profits and admitted it struggled in the US.

Dr Martens’ pre-tax profits slumped by 26% in the year to 31 March 2023, from £214.3m to £159.4m.

That’s despite a 10% rise in revenues, to just over £1bn for the first time.

The company says it had a strong performance in Europe, the Middle East and Africa, but a “softer performance in America”.

Kenny Wilson, Dr Martens’ CEO, explains:

“In America, against the backdrop of a challenging consumer environment, we made operational mistakes, such as the move to our LA Distribution Centre, and how we executed our marketing campaigns and ecommerce trading.

We have undertaken detailed reviews to understand why these issues occurred and have begun to embed the lessons learned into the business. We are fixing the issues in America, including a significant strengthening of the team there, and returning America to good growth is our number one operational priority.

Dr Martens says its planned price increases will cover supply chain cost inflation.

But profit margins are expected to be squeezed this year, with Dr Martens predicting that its EBITDA margin in the current financial year (FY 2024) will be 1-2%pts lower than FY23.

Jocelyn Paulley, retail partner at Gowling WLG, says bad weather, supply chain disruption and rising costs all hit the business:

“Dr Martens has experienced a mixed year, initially starting off on the right foot as it recovered from the pandemic with an uplift in revenue and the opening of 10 new stores. But, demand for its products has been impacted by cold weather deterring shoppers and with the summer period now beginning, consumers will be choosing alternative footwear. Other challenges for the brand have included supply chain disruption, especially in America which is its largest market, as well as rising costs.

“Shareholders will remain upbeat for the future as the company’s strong brand heritage and reputation means it can always attract a loyal custom base. Moreover, earlier this year, CEO Kenny Wilson announced a collaboration into the second-hand clothing market as demand surges for refurbished and sustainable fashion, which will help to keep the business a step ahead of competitors in an ever changing retail sector.”

The EY Item Club economic forecasters agree that the UK housing market will come under more pressure this year, due to higher interest rates.

Martin Beck, chief economic advisor to the EY ITEM Club, points out that many borrowers on fixed-term mortgages have not yet moved onto new, higher, mortgage rates yet.

Beck says:

-

Although Nationwide’s measure of house prices fell in May, a 0.1% month-on-month decline was small and points to values resisting a serious correction, despite rising mortgage rates. The dominance of fixed-rate mortgages and the sizeable savings built up by households during the pandemic is probably helping. However, with the Bank of England likely to continue raising interest rates, house prices are likely to continue drifting down.

-

The market is not out of supports. Strong growth in cash pay has pushed down the ratio of house prices to earnings, unemployment is still very low and consumer confidence has picked up. And rises in rent costs may support demand from first-time buyers.

-

However, the chief headwind facing the housing market is likely to intensify. Previous rises in interest rates have yet to feed through in full to existing borrowers. And stickiness in underlying inflation means the Bank of England is likely to raise rates beyond what many were expecting only recently. This would add to what has already been a significant rise in mortgage rates over the last 12 months and compound a still-challenging outlook for household finances.

There are signs that activity in the housing market picked up last month.

Matt Thompson, head of sales at London-based estate agent Chestertons, reports:

“We registered more sellers listing their home for sale in May, which provided buyers with a more varied selection of properties.”

The cost of living squeeze is pushing down on house prices, reports Jeremy Leaf, a north London estate agent:

‘Continuing worries about the cost of living highlighted in the recent core inflation numbers are compromising confidence and having a knock-on effect on mortgage cost and availability, inevitably leading to a softening of property prices.’

But despite the pressures on the housing market, Nationwide remains hopeful that the UK will avoid a housing crash.

Robert Gardner, Nationwide’s chief economist, says “a relatively soft landing remains the most likely outcome”.

Why? Because labour market conditions remain solid and household balance sheets appear in relatively good shape, they say.

Gardner adds:

“While activity is likely to remain subdued in the near term, healthy rates of nominal income growth, together with modestly lower house prices, should help to improve housing affordability over time, especially if mortgage rates moderate once Bank Rate peaks.”

Nationwide: Headwinds to the housing market set to strengthen

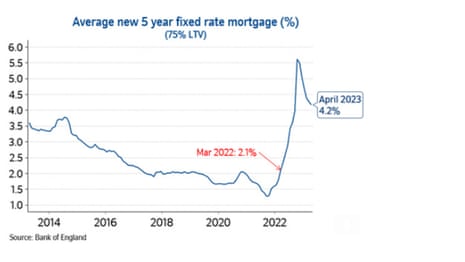

With the Bank of England expected to keep raising interest rates, the housing market will come under more pressure, Nationwide warns.

The financial markets currently predict Bank Rate could be near 5.5% by the end of this year, up from 4.5% today, due to the UK’s persistently high inflation.

This prompted some mortgage providers to reprice their mortgage offers – as Nationwide did last week.

Chief economist Robert Gardner says this will add to pressures, on top of May’s 3.4% annual drop in house prices.

“Headwinds to the housing market look set to strengthen in the near term.

While consumer price inflation did slow in April, it was a much smaller decline than most analysts had expected. As a result, investors’ expectations for the future path of Bank Rate increased noticeably in late May, suggesting it could peak at c5.5%, well above the c4.5% peak that was priced in around late March. Furthermore, rates are also projected to remain higher for longer.

Gardner warns that this could push up mortgage rates:

“If maintained, this is likely to exert renewed upward pressure on mortgage rates, which had been trending down after spiking in the wake of the mini-Budget in September last year.

Introduction: UK house prices fell 3.4% in May in annual terms

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices have dropped again on an annual basis, and rising mortgage rates could put more pressure on the market in the months to come.

Nationwide reports this morning that the average price of houses sold in May were 3.4% lower than a year ago, down from the 2.7% fall recorded in April.

In May alone, prices slipped by 0.1% on a seasonally-adjusted basis, partly reversing April’s 0.4% rise.

The average price was £260,736 in May, reports Nationwide, who predict activity is likely to remain subdued in the near term.

Aprils house price reprieve is short lived as annual house prices in May 2023 “slipped” back -3.4% & -0.1% on last month to £260,736. With further interest rate turbulence predicted in the short term expect growth to slip further before stagnating for longer @AskNationwide pic.twitter.com/YTn5r5qrWG

— Emma Fildes (@emmafildes) June 1, 2023

The broader picture is that average house prices are around 4% below their peak last summer, just before the mini-budget rocked the markets and drove up mortgage rates.

Robert Gardner, Nationwide’s chief economist, explains:

“Following tentative signs of improvement in April, annual house price growth softened again in May, falling back to -3.4% (from -2.7% in April).

However, this largely reflects base effects with prices broadly flat over the month after taking account of seasonal effects. Average prices remain 4% below their August 2022 peak.

“Recent Bank of England data had shown some signs of recovery in housing market activity, although the number of mortgages approved for house purchase in March was still around 20% below pre-pandemic levels.

The Bank of England will release new mortgage approvals and consumer credit data this morning, giving an insight into the health of the property market.

More details and reaction to follow….

Also coming up today

We also get healthchecks on factories across the eurozone, in the UK and in the US. Last week’s ‘flash readings’ showed that manufacturing in France and Germany was weak, so today’s readings could reinforce recession worries.

At lunchtime, a new survey of job creation across America will be released, which could indicate how the main US jobs report, Friday’s Non-Farm Payroll, will unfold.

Investors are also keen to see May’s eurozone inflation report, which may give hints as to whether the European Central Bank could stop raising interest rates soon.

Eurozone inflation is expected to have fallen, from 7% to 6.3%, after drops in Germany, France, Italy and Spain earlier this week. But core inflation could be stickier, posing problems for central bankers.

The agenda

-

7am BST: Nationwide house price index for May

-

9am BST: Eurozone manufacturing PMI report for May

-

9.30am BST: UK manufacturing PMI report for May

-

9.30am BST: UK mortgage approvals and consumer credit data

-

10am BST: Eurozone flash inflation reading for May

-

12.30pm BST: European Central Bank releaases accounts of its latest meeting

-

1.15pm BST: ADP national employment report of US private sector jobs creation

-

1.30pm BST: US weekly jobless claims figures

-

3pm BST: US manufacturing PMI report for May