Key events

Chancellor Jeremy Hunt: We’re ‘willing to do what it takes’ on energy bill support

The chancellor has said he “is willing to do what it takes” and increase support for households if energy bills rise again this autumn.

In an interview with Sky News, Jeremy Hunt was asked if he could guarantee he would step in if energy bills start rising again.

Hunt says:

We’ve shown in the past that where they are acute pressures that people face unexpectedly, we want to do everything we can to help families.

Hunt says he doesn’t want to predict how energy prices will develop. The government doesn’t expect a repeat of last year’s price surge, but it doesn’t know that for sure.

The chancellor said:

“All I can say is that I think I’ve demonstrated in the autumn statement, and the spring budget where I extended the energy price guarantee for another three months, funded in part by a windfall tax on the oil companies, that we are willing to do what it takes.”

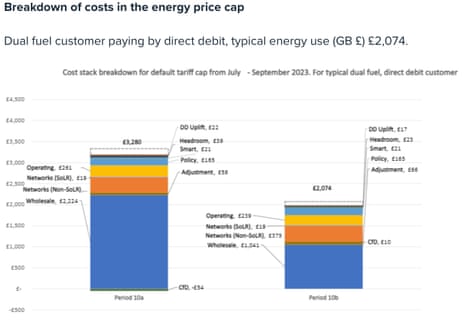

Hunt was speaking after Ofgem lowered its energy price cap, to a level where average bills will be £2,074 a year from July, down from the £2,500 level in Hunt’s energy price guaranteee.

But as we covered earlier, Ofgem’s CEO told MPs this morning that it would only take one major hit to supplies, or a jump in demand, to push gas prices up.

And charities have warned that over 6 million households will still be in fuel poverty, even once the cost of gas and electricity falls in July.

Chancellor Jeremy Hunt tells Sky News he is willing to do what it takes to help people with energy prices

For more on this and other news visit https://t.co/NEDMP2uP6W

— Sky News Breaking (@SkyNewsBreak) May 25, 2023

Just in. The number of Americans filing new claims for jobless support has risen, but remains low by historic measures.

There were 229,000 new ‘initial claims’ for unemployment insurance last week, a jump of 4,000.

The previous week’s level has been revised down by 17,000, from 242,000 to 225,000, due to some fraudulent claims being removed.

Massachusetts revises its weekly jobless claims numbers down by ~14,300/week for the past 12 weeks, blaming fraud. Claims revised down to 225k from 242k the prior week, this week 229k.

— Michael McKee (@mckonomy) May 25, 2023

Initial jobless claims at 229k vs. 245k est. & 225k prior (rev down from 242k); continuing claims at 1.794M vs. 1.8M est. & 1.799M prior … greatest increases in TX (+2.7k), CT (+2.5k), & CA (+844); greatest decreases in MA (-2.2k), MI (-1.1k), & IL (-923) pic.twitter.com/ywtqKHTSRL

— Liz Ann Sonders (@LizAnnSonders) May 25, 2023

Hundreds of workers at the largest soft drinks plant in Europe, in Wakefield, West Yorkshire, have voted to strike in a pay dispute.

The Unite union says staff rejected a pay deal worth 6%, which is a real terms pay cut given inflation was 8.7% in the year to April.

Workers are planning 14 days of strikes between Thursday 8 June and Thursday 22 June.

Unite regional officer Chris Rawlinson said:

“Coca Cola’s pay offer has fallen flat. The vast majority of the workforce have joined Unite to fight for fair pay. Now a series of strikes will inevitably shut down the production of Britain’s favourite soft drinks, including Coca-Cola.

But industrial action can still be avoided at Europe’s biggest soft drinks plant if bosses realise that they must pay workers a fair wage from the company’s enormous profits.”

CCEP Wakefield can produce 360,000 cans per hour, and 132,000 bottles per hour, and makes drinks including Coca Cola, Diet Coke, Coke Zero, Dr Pepper, Fanta, Fanta Lemon, Fanta Fruit Twist, Sprite, and the Monster and Relentless energy drinks.

It also makes Schweppes: Tonic, Diet Tonic, Bitter Lemon, Ginger Ale and Lemonade.

DBRS Morningstar places US credit ratings under review over debt ceiling worries

Credit rating agency DBRS Morningstar has put its rating for the United States on review for a downgrade on Thursday over Washington’s haggling over its borrowing limits.

The move comes less than 24 hours after Fitch, one of the big three rating agencies, issued a similar warning over the US debt ceiling deadlock.

DBRS said in a statement that:

“The Under Review with Negative Implications reflects the risk of Congress failing to increase or suspend the debt ceiling in a timely manner.

“If Congress does not act, the U.S. federal government will not be able to pay all of its obligations.”

DBRS says the precise timing of when the federal government will exhaust available cash and extraordinary measures, the so-called X-date, is “somewhat unclear”, but could be just days away….

Treasury Secretary Janet Yellen reiterated her warning on May 22 that the X-date could come as early as June 1. Judging from the latest data on daily net inflows into the Treasury General Account, we believe it is reasonable to assume the X-date could arrive within weeks if not days.

While we still expect Congress to raise the debt ceiling before Treasury runs out of available resources, there is a risk of Congressional inaction as the X-date approaches. DBRS Morningstar would consider any missed payment of interest or principal as a default.

Shares in energy company Centrica have jumped by over 4% this morning, after Ofgem proposed allowing suppliers to swell their profits.

The regulator is proposing increasing the amount of profit suppliers can make from 1.9% to 2.4% to prevent them going bust, because the cost of bailing out a failed supplier would be higher.

Under the plan, annual supplier profits would climb from £37 a household to £47 – meaning an extra £10 per year on energy bills.

Centrica, which owns British Gas, has jumped 4.2% to 118p per share.

Smaller mortgage lenders pull deal as UK borrowing costs rise

The jump in UK borrowing costs this week has forced some smaller British mortgage lenders to temporarily withdraw and repriced products for new customers, Reuters reports.

The move, following the spike in UK government bond yields yesterday and today (see earlier post), has some echoes of the turmoil in the mortgage market last autumn after the disastrous mini-budget.

Reuters reports that at least seven small lenders, mostly focused on the buy-to-let market, have pulled products or announced a repricing this week, according to mortgage brokers contacted by Reuters.

But none of the major high street banks have withdrawn or repriced products this week as a result of the market conditions, they add.

Fixed-rate mortgages are priced according to the UK government bond market, so a jump in the yield on two-year bonds, or gilts, has a knock-on impact on the mortgage market.

Two-year swap rate – which feeds through into mortgage pricing – on track for biggest weekly increase since September 1989, if you take last year’s minibudget out of the picture.

Up 51 basis points. pic.twitter.com/bJOzwC54lt

— Andy Bruce (@BruceReuters) May 25, 2023

The two-year British swap rate, for example, has gained half a percentage point from 3.98% last Friday to 4.45% today, as traders anticipate further Bank of England interest rate rises to fight inflation.

Here’s our explainer on how the UK’s energy price cap works, and how the change announced this morning will affect households:

Ministers have been urged to reveal if they are considering “controls” to stop supermarkets unfairly profiting from food inflation.

Yesterday’s inflation report shows that food and non-alcoholic beverage prices are rising by over 19% per year, remaining stubbornly high even as the headline inflation rate fell.

In the Commons, Conservative MP Michael Fabricant urged ministers to ensure “supermarkets don’t take unfair advantage and excess profits from wholesale prices”.

He told MPs:

“My constituents in Lichfield and Burntwood and indeed the rest of the country are enduring high food inflation, as indeed they are in the rest of Europe.

“But what controls have we got, if that is the word, to ensure that supermarkets don’t take unfair advantage and excess profits from wholesale prices?”

Environment minister Mark Spencer replied:

“Retailers work to ensure strong competitive pressure remains in the marketplace, however the Competition and Markets Authority (CMA) announced last week that they are looking into the grocery sector to see whether any failure in competition is contributing to prices being higher than would be normally.

“The CMA will focus on areas where people are experiencing greater cost-of-living pressures, but he will also be aware that the Grocery Code Adjudicator will remain separate from the CMA and can take up investigations should they choose to do so.”

Labour MP Dan Jarvis meanwhile called on the Government to reveal whether it had a plan to “rapidly reduce food price inflation”.

Jarvis, MP for Barnsley Central, said:

“Food price inflation remains at the eye-wateringly high level of 19%, causing misery to millions.

Minister Spencer replied that the government was working closely with retailers, with producers, and with processors to strip out the impact of pressures on global markets from the Ukraine war, which drove up food and energy costs.

Kalyeena Makortoff

The world’s biggest insurance market Lloyd’s of London is steeling itself for climate protests ahead of its AGM this afternoon.

The meeting starts at 2pm, but is closed to the public and media, meaning activists who have so far disrupted the AGMs of Barclays, HSBC and Shell, will likely stay outside of the One Lime Street headquarters in London.

Climate activists say they are concerned about Lloyd’s members providing insurance for fossil fuel projects, which they say would not be able to go ahead without their underwriting services. (See also the students launching a career boycott of firms involved in carbon-heavy projects).

Lloyd’s told staff and members earlier this month that it would be putting up barriers and restricting entry through its main reception to “ensure the safety of everyone in he building” until the AGM was over.

The marketplace has also issued a defence this morning ahead of the protests:

“We support safe and constructive engagement with NGOs and those highlighting important issues like climate change.

Lloyd’s is committed to insuring the transition by providing the vital risk management solutions that will support societal resilience, transition and growth. We have aligned our climate approach and activities to government policy in achieving net zero by 2050.

As all insurance in the Lloyd’s market is underwritten by the managing agents, not Lloyd’s itself, it is for the individual businesses that operate in the Lloyd’s market to make their own business and strategy decisions.”

Rishi Sunak has said the reduction in the energy price cap was a “major milestone” in his goal of halving inflation.

The Prime Minister said:

“Welcome news that the energy price cap is coming down, reducing energy bills from July by nearly £430 on average per year.

“It marks a major milestone in our work to halve inflation.”

April’s smaller-than-expected drop in UK inflation, to 8.7%, has raised questions over whether inflation will actually halve by December to 5%, from 10.1% in January.

Ofgem’s price cap in unit terms

We talk about the price cap in terms of its impact on typical household energy bills, but it actually regulates how much a supplier can charge per unit of energy.

For electricity, the unit rate will drop to 30p per kWh. That’s down from a unit rate of 51p per kWh set in April. There’s also a standing charge of 53p per day.

For gas, the unit rate has dropped to 8p per kWh, down from 13p per kWh, plus a standing charge of 29p per day.

So while the average bill will drop to £2,074, there’s no limit on the amount a customer can be charged.

[plus, the government’s energy price guarantee meant that the previous typical bill was £2,500 per year, not the current £3,280 price cap]

Ofgem: think before you fix your energy bill

The energy regulator is urging consumers to “think” before they fix their energy bills.

Ofgem warns:

With the lower price cap figure, fixed-rate energy tariffs might appear back on the market, but check if they are right for you.

Prices are still unpredictable & signing up for a fixed rate now might mean you miss out if prices fall.

From 1 July #PriceCap average direct debit unit rates for energy;

ELECTRICITY Unit rate: 30p per kWh Standing charge: 53p per day

GAS Unit rate: 8p per kWh Standing charge: 29p per day

These are caps on unit rates (not a cap on total bills) and vary by region pic.twitter.com/EkUQRzrV0C

— Ofgem (@ofgem) May 25, 2023

⚠️THINK BEFORE YOU FIX

With the lower #PriceCap figure, fixed-rate energy tariffs might appear back on the market, but check if they are right for you

Prices are still unpredictable & signing up for a fixed rate now might mean you miss out if prices fall pic.twitter.com/hhjuPLM7HY

— Ofgem (@ofgem) May 25, 2023

Ofgem CEO Jonathan Brearley has told MPs that a range of options to support customers with energy bills are being considered by the energy sector.

He’s appearing before the Public Accounts Committee this morning to discuss the rescue of Bulb (the largest energy supplier to collapse when wholesale price surged in 2021).

Brearley says options under consideration include companies providing more access to support for vulnerable customers, or putting more customers who fall behind with their bills on affordable repayment plans.

Beyond that, there is a “decision for ministers about what else might be done”, Brearley says (perhaps a social tariff??).

Brearley also points out that this morning’s cut in the price cap, from over £3,280 to £2,074 in July, is a reduction of over £1,200 – which is roughly what people were actually paying on energy bills per year before the surge in prices.

Brearley says that the good news is that wholesale gas prices has been coming down for some time, he hopes that will continue, but cautions that the situation is very hard to predict.

It would only take one significant supply event, or a big change in international demand such as demand from China, for that situation to reverse, Brearley adds.

Calls for ‘social tariff’ for energy bills

Pressure is mounting for a “social tariff” for gas and electricity to be introduced to protect the most financially vulnerable.

Such a social tariff would help lower-income households with their energy bills, which will still be around double their pre-Ukraine war levels even once the Ofgem price cap drops in July to £2,074 per year for a typical household.

The Money Advice Trust, the charity that runs National Debtline and Business Debtline, backs a social tariff.

Joanna Elson CBE, chief executive at the Money Advice Trust, warns that the damage from unaffordable energy bills is already done, adding:

Energy is still significantly more expensive than when this crisis started, and more support is going to be needed.

“We need permanent solutions to this problem – including a social tariff for low income households, and a wider Essentials Guarantee to ensure Universal Credit always covers essential costs.

“It’s also vital that people can access the advice they need. I would urge anyone who is worried about their energy bills to seek free, independent debt advice from a service like National Debtline. Our expert advisers are there to help and talk you through your options.”

Emily Fry, economist at the Resolution Foundation, says there is a strong case for social tariff:

“Expected energy costs for a typical household this year are now on course to be around £2,100 – still up by almost 80 per cent on what families were used to pre-crisis.

“A return to the level of bills households paid pre-crisis isn’t arriving anytime soon. The case for developing more sustainable support with energy bills, such a social tariff for vulnerable households, therefore remains strong.”

Simon Virley CB, vice chair and head of energy and natural resources at KPMG in the UK, says energy suppliers still need greater clarity about the future direction of government policy for the energy market.

Virley adds:

Serious thought needs to be given to how best deliver sustainable competition in the long-term, whilst protecting those that need it from higher prices.

If that is a move to a social tariff for energy, on what basis would the eligible group be defined, and is there an ongoing role for the price cap in this scenario?”

⚡️@ofgem have announced the new energy price cap this morning, which will apply from 1 July.

While it is welcome to see the cap fall, it is still higher than last summer and nearly double historic levels.

We need an energy social tariff to make energy affordable for all. https://t.co/lnKDQOGe3v

— CIH Policy & Practice (@CIH_Policy) May 25, 2023

Sana Yusuf, warm homes campaigner at Friends of the Earth, has warned that struggling households will still struggle to stay warm this winter, even once the price cap falls in July.

Yusuf says:

“Make no mistake, this announcement will make little difference to the millions of people who struggled to stay warm in cold, damp homes this winter. Most government energy bills support has already ended, and people will still be paying double what they were before the energy crisis.

“With the rate of food price inflation now outstripping energy, things will only get tougher for the hardest hit communities that have already suffered so much in the last year. What’s more, analysts say that average energy prices will not fall below pre-pandemic levels until at least the end of the decade. Amid all this, energy firms are still posting record-breaking profits.

“The injustice is breath-taking. People shouldn’t have to wait ten years before they can afford to pay for life’s basics. The government must not waste another summer that could be spent rolling out a street-by-street insulation programme. Not only will this bring down bills quickly and help to protect people from the cold, it’s vital to cut the emissions our homes produce if we’re to meet our climate goals.”

Shapps: Ofgem price cap is positive news in fight against inflation

Back on the Ofgem price cap announement, energy security secretary Grant Shapps says today’s reduction in bills is a ‘major milestone’ in the drive to halve inflation.

Shapps says:

“It’s positive households across the country will see their energy bills fall by around £430 on average from July, marking a major milestone in our determined efforts to halve inflation.

“We’ve spent billions to protect families when prices rose over the winter covering nearly half a typical household’s energy bill – and we’re now seeing costs fall even further with wholesale energy prices down by over two thirds since their peak as we’ve neutralised Putin’s blackmail.

“I’m relentlessly focused on reducing our reliance on foreign fossil fuels and powering-up Britain from Britain to deliver cheaper, cleaner and more secure energy.”

UK borrowing costs soar on fears of higher interest rates

UK government borrowing costs have climbed to the highest level since the aftermath of the mini-budget last year, after inflation failed to fall as much as hoped in April.

The yield, or interest rate, on two-year UK government bonds has jumped to 4.44% this morning, up from 4.35% last night.

That’s the highest since last October, when the markets were spooked by the chaos caused by Liz Truss and Kwasi Kwarteng’s package of unfunded tax cuts.

Benchmark 10-year and 30-year UK government bond prices have also fallen further in value, pushing up their yields.

The selloff comes as the City is gripped by anxiety that Britain’s inflation problem will force interest rates even higher, after the Consumer Prices Index fell by less than expected in April.

CPI dropped to 8.7% last month, higher than the 8.2% that was expected, while core inflation hit a 30-year high.

This is expected to prompt the Bank of England to keep raising interest rates, from 4.5% at present, up towards 5.5% by the end of this year.

Bond yields are also being pushed up by concerns that the US could default in June, if a debt ceiling deal can’t be agreed in time.