The cryptocurrency market has been on a roller coaster ride in the past few weeks, with Bitcoin and Ethereum prices fluctuating wildly. As the market continues to be unpredictable, it is important to stay informed of the latest developments in order to make informed decisions.

Recently, whales have moved an estimated $743 million in crypto, which could indicate a potential price surge or crash. In this article, we will discuss what you need to know about this development and how it could affect Bitcoin and Ethereum prices in the future.

Whales Move $743 Million in Crypto – Here’s What You Need to Know

Bitcoin recently hit an all-time high of $23,000 and has been the talk of the crypto world. Attention is also being paid to three large BTC and ETH whales that are turning heads in the crypto trading community. In what can be considered an astonishing event, the whales moved a whopping $743 million in crypto through 3 transactions combined.

On Friday, a large investor in the cryptocurrency space, known as a Bitcoin whale, transferred 13369 BTC worth $311 million from an unknown wallet to another. A crypto transaction was traced to one of the top 65 Bitcoin wallets according to BitInfoCharts. The wallet was used for both sending and receiving funds.

On Saturday, a large sum of Ethereum worth $309 million was moved by a so-called whale from one unknown wallet to another. The amount transferred was 186,009 ETH.

At a later time, Whale Alert detected another large Bitcoin transaction worth $123 million which originated from Gate.io and was transferred to an unidentified wallet. The amount sent was 5,278 BTC tokens.

Someone recently shifted funds to a cold wallet in order to make a purchase, or they may have done it as an extra security measure. Moving money from an exchange to a cold wallet is often seen as more secure than keeping funds on the exchange.

Bitcoin has been consistent in the last 24 hours, with a slight decline of 0.5% to reach $23,305. On the other hand, Ethereum has seen a marginal increase of 0.1% to reach 1,664 in the same period of time.

Ray Dalio On Bitcoin: Why It Doesn’t Fit The Bill As Money, Store of Value, or Medium of Exchange

Ray Dalio, the founder of Bridgewater Associates, is a well-known investor and has recently expressed his opinion on Bitcoin. In his view, Bitcoin does not fit the bill as money, a store of value, or a medium of exchange.

He believes that it is too volatile and unpredictable to be used as a currency. He also believes that it can’t be used as a store of value due to its lack of intrinsic value and lack of regulatory oversight.

Lastly, he believes that it can’t be used as a medium of exchange because its transaction fees are too high for most people to use it in everyday transactions.

Despite this criticism, he does believe that Bitcoin could become an asset class in the future and could potentially have some uses in certain contexts.

I think it’s been quite amazing that for 12 years it’s accomplished … But I think it has no relation to anything … It’s a tiny thing that gets disproportionate attention.

Billionaire investor, Ray Dalio, recently compared the total market value of Bitcoin to that of Microsoft’s stock. On Friday, Microsoft was worth $1.92 trillion while Bitcoin only had a third of that amount.

According to Ray Dalio, biotech and other industries in comparison prove to be much more interesting than investing in cryptocurrency.

It’s not going to be an effective money. It’s not an effective storehold of wealth. It’s not an effective medium of exchange.

Hence, his remarks are putting downward pressure on the leading cryptocurrencies.

Bitcoin Price

The current Bitcoin price is $23,365 and the 24-hour trading volume is $15 billion. In the last 24 hours, it has gone up by 0.10%. It holds the 1st rank on CoinMarketCap with a live market cap of $450 billion.

The current amount of Bitcoin in circulation is 19,281,825 coins out of an eventual maximum supply of 21 million.

Recently, Bitcoin has been trending downwards, with $23300 being its immediate support area. If it breaches this level, it could lead to further losses in the price – eventually settling at $23000 which is marked by a rising trendline and could be seen as a potential point of support.

The RSI and MACD indicators have indicated that there may be an increase in selling pressure which could result in the BTC price going down to $22,750 as its next support level.

At present, the 50-day exponential moving average is pointing to a positive momentum above $23,300 for BTC/USD. This suggests that a rebound could be imminent. If the price breaks out of the $23,950 mark, it could potentially rise up to around $24,500.

Ethereum Price

Ethereum’s current price stands at $1,664 and it has a 24-hour trading volume of $5.9 billion. It has also seen a 0.50% increase in its value over the past 24 hours. Ethereum is ranked 2nd on CoinMarketCap with an overall market cap of approximately $203 billion.

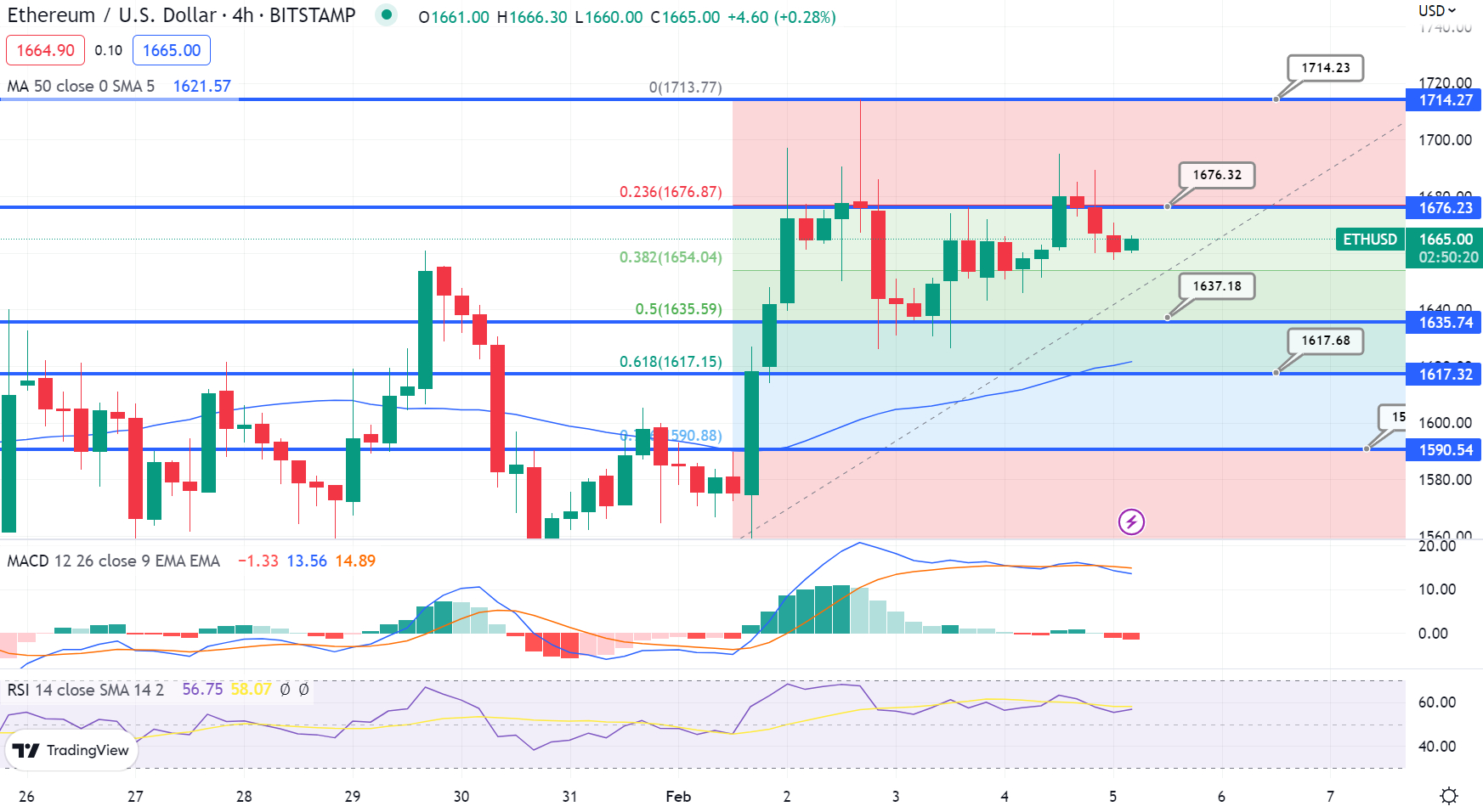

The ETH/USD pair has not made much progress in the past couple of days and is currently trading within a limited range of $1,650 to $1,685. If it breaks out of this range, there may be potential for the price to reach up to $1,720.

The Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) indicators have begun pointing in opposite directions, signaling a potential change in trend. One indicator is suggesting buying, while the other is indicating that investors should be looking to sell.

The 50-day Exponential Moving Average signals a possible bullish trend with values above $1,620, indicating a growth in coin prices.