UK economy grew by 0.3% in November

Newsflash: The UK economy returned to growth in November, with GDP expanding by 0.3%.

That’s slightly stronger than the 0.2% growth which City economists expected.

It follows the 0.3% contraction in October.

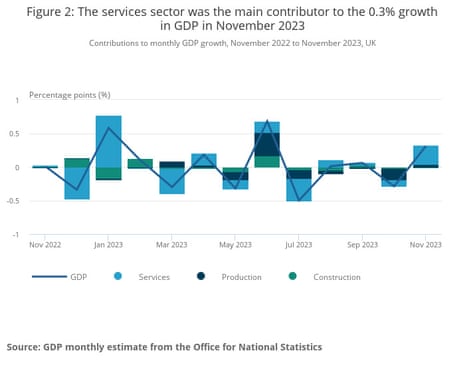

The Office for National Statistics reports that the UK’s services sector provided the bulk of the growth in November.

Here’s the details:

-

Services output grew by 0.4% in November 2023 and was the main contributor to the monthly growth in GDP; this follows a fall of 0.1% in October 2023 (revised up from a 0.2% fall).

-

Production output grew by 0.3% in November 2023, following a fall of 1.3% in October (revised down from a 0.8% fall).

-

The construction sector fell by 0.2% in November 2023 after a fall of 0.4% in October 2023 (revised up from a 0.5% fall).

Key events

Rachel Reeves MP, Labour’s Shadow Chancellor, has responded to the latest GDP figures, saying:

“The Conservatives have presided over 14 years of economic failure that has left working people worse off.

A decade of low economic growth has left Britain with the highest tax burden in 70 years, with families set to be £1,200 a year worse off under the Tories’ tax plans.

It’s time for change. Rishi Sunak should call an election and give the people the chance to vote for a Labour government that will get Britain’s future back.”

UK GDP: the key charts

These charts from the ONS show how the economy fared up to November:

Hunt welcome rise in November GDP

Chancellor of the Exchequer Jeremy Hunt has welcomed the news that the UK economy returned to growth in November.

Hunt points out that efforts to slow inflation (such as high interest rates) weighed on the economy, saying:

“While growth in November is welcome news, it will be slower as we bring inflation back to its 2% target.

But we have seen that advanced economies with lower taxes have grown more rapidly, so our tax cuts for businesses and workers put the UK in a strong position for growth into the future.”

ONS chief economist on recession risks

Q: What needs to happen for the UK to avoid shrinking in the fourth quarter of 2023, putting the economy into recession?

ONS chief economist Grant Fitzner says “everyone is obsessed” whether the Q4 GDP reading is slightly positive or slightly negative.

That data is due in a month’s time, when we also discover how the economy fared in December.

The UK would be in a ‘technical recession’ if Q4 GDP was negative, given Q3 GDP fell by 0.1%.

Fitzner, though, explains that an actual recession is more serious than just two small falls in quarterly GDP in a row [although this is a widely-held definition].

He told Radio 4’s Today Programme:

It’s important to remember that a recession is not simply a very small negative number followed by another very small negative number. It’s a significant and sustained fall in output.

We don’t expect to see that.

If December’s GDP is flat or positive, and there are no revisions to previous months, the UK might avoid a negative quarter in Q4, Fitzner adds.

The 0.2% drop in construction output in November was driven by falling housebuilding activity, Grant Fitzner explains.

The UK economy received a boost from Black Friday spending in November.

ONS chief economist Grant Fitzner is on Radio 4’s Today programme, explaining that “We have had quite a number of companies telling us they saw strong Black Friday sales”.

That had a positive impact not just on the retail sector, but also warehousing and couriers.

Fewer strikes in health and transport than earlier in 2023 also helped the economy, as did the end of the Hollywood strikes, Fitzner adds.

Here’s ONS chief economist Grant Fitzner on this morning’s GDP report:

“The economy contracted a little over the three months to November, with widespread falls across manufacturing industries, which were partially offset by increases in public services, which saw less impact from strike action.

GDP bounced back in the month of November, however, led by services with retail, car leasing and computer games companies all having a buoyant month.

The longer-term picture remains one of an economy that has shown little growth over the last year.”

But economy shrank in September-November

Despite the pick-up in growth in November, the UK economy shrank in the three months from September to November.

GDP in the three months to November fell by 0.2%, compared with the three months to August 2023.

Services showed no growth, production output fell by 1.5% and construction fell by 0.6% over the period, the Office for National Statistics reports.

UK economy grew by 0.3% in November

Newsflash: The UK economy returned to growth in November, with GDP expanding by 0.3%.

That’s slightly stronger than the 0.2% growth which City economists expected.

It follows the 0.3% contraction in October.

The Office for National Statistics reports that the UK’s services sector provided the bulk of the growth in November.

Here’s the details:

-

Services output grew by 0.4% in November 2023 and was the main contributor to the monthly growth in GDP; this follows a fall of 0.1% in October 2023 (revised up from a 0.2% fall).

-

Production output grew by 0.3% in November 2023, following a fall of 1.3% in October (revised down from a 0.8% fall).

-

The construction sector fell by 0.2% in November 2023 after a fall of 0.4% in October 2023 (revised up from a 0.5% fall).

Reuters: Tesla Berlin to stop most output for two weeks due to Red Sea disruption

Delays to deliveries to components due to the attacks on ships in the Red Sea will force Tesla to suspend most car production at its factory near Berlin for two weeks, Reuters reports.

The partial production stop will run from 29 January to 11 February, and highlights the risks that rising geopolitical tensions pose to the economy.

Reuters explains:

The partial production stop is evidence that the crisis in the Red Sea, unleashed by Iranian-backed Houthi militants attacking vessels in solidarity with Palestinian Islamist group Hamas fighting Israel in Gaza, has hit Europe’s largest economy.

The U.S. electric vehicle maker is the first company to disclose an interruption to output due to the disruption. Many companies including Geely, China’s second-largest automaker by sales, and Swedish home furnishing company Ikea have warned of delays to deliveries.

“The armed conflicts in the Red Sea and the associated shifts in transport routes between Europe and Asia via the Cape of Good Hope are also having an impact on production in Gruenheide,” Tesla said in a statement.

The UK’s services sector could help the country avoid falling into recession at the end of last year, suggets Michael Hewson of CMC Markets:

Today’s November numbers are unlikely to be anywhere near as poor [as October, when GDP fell 0.3%] and should see a modest rebound of 0.2%, with the index of services expected to drive the improvement with a strong rebound from their decline in October.

We already know from recent services PMI numbers that the UK economy appeared to rebound strongly in the final 2-months of 2023, which in turn could see the economy avoid a technical recession after the -0.1% contraction in Q3.

November is also expected to see an improvement in industrial and manufacturing production of 0.3% after the sharp declines in October.

The UK economy “likely rebounded in November”, predicts Sanjay Raja, Deutsche Bank’s chief UK economist.

He told clients this week:

Indeed, many of the factors driving the drop in output over October looked temporary. Survey data also pointed to a mild bounce back in activity. And our nowcast models point to a rebound in GDP.

What do we expect? We expect a 0.2% month-on-month expansion in GDP. Services activity, we think, will have jumped by 0.2% m-o-m, with industrial production up 0.4% m-o-m, and construction output rising by 0.1% m-o-m. Risks to our projection are skewed to the upside.

However, Deutsche has also lowered its forecast for 2023 GDP growth to 0.3%.

And it expects a “a bumpy start” to 2024, with strike activity dragging output in January.

Introduction: UK GDP report in focus

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

New GDP data will show how the UK economy performed in November, as it flirts with a technical recession.

Economists predict the economy returned to growth in November, with GDP expected to have risen by 0.2%.

That would be a welcome pick-up, after GDP fell by 0.3% in October, and also shrank in July-September, which put Britain on the brink of a recession.

Matthew Ryan, head of market strategy at global financial services firm Ebury, says:

We expect a modest rebound in activity that should allay fears of a Q4 recession.

But, the broader picture may be that the UK economy is stuck in neutral gear, wavering between stagnation and a minor contraction.

Bloomberg says:

It’s a bleak backdrop for Prime Minister Rishi Sunak to fight the next election, though there is some prospect of an improvement later this year.

We’ll get the figures at 7am.

Also coming up today

The financial markets are on edge after US and UK forces launched air and missile strikes in Houthi-controlled areas of Yemen overnight.

The oil price has jumped 2%, up $1.5 to around $79 per barrel.

Houthi attacks have already disrupted shipping in the region (as we covered yesterday), pushing up container costs and leading to longer delays as vessels avoid the Red Sea and reroute their journeys.

The agenda

-

7am GMT: UK November GDP report

-

7am GMT: UK November trade report

-

Noon GMT: India’s inflation rate in December

-

1.30pm GMT: US PPI index of producer price inflation in December

-

4pm GMT: Russia’s inflation rate in December

I do not even know how I ended up here, but I thought this post was great. I do not know who you are but certainly you’re going to a famous blogger if you are not already 😉 Cheers!

I agree with all of the thoughts you have presented in your article; they are incredibly persuasive and will indeed be effective. However, the postings are extremely brief for beginners; could you perhaps make them a little longer in future? Thank you for the post.

I have been browsing online more than three hours today yet I never found any interesting article like yours It is pretty worth enough for me In my view if all website owners and bloggers made good content as you did the internet will be a lot more useful than ever before