Key events

This can cause a lot of stress and sleepless nights. My colleague Jedidajah Otte has talked to homeowners who fear a sharp rise in mortgage payments as they come off fixed-rate deals this year.

However, mortgage costs are still much higher than they have been in recent years after the Bank of England raised interest rates to 5.25% to fight stubbornly high inflation. (Financial markets expect it to cut rates to below 4% by the end of the year.)

As a result, homeowners are facing a £19bn increase in mortgage costs as millions more fixed-rate deals expire and borrowers are forced to renegotiate their home loans after the toughest round of interest rate increases in decades, writes our economics correspondent Richard Partington.

Despite an escalating price war between lenders cutting the cost of remortgaging in recent days, economists at the US investment bank Goldman Sachs said many UK households would still experience a dramatic leap in repayments compared with the deals they were leaving behind.

In what has been described as a Tory mortgage timebomb by Rishi Sunak’s critics, just over 1.5m households are expected to reach the end of cheaper deals in 2024 – with an increase in annual housing costs of about £1,800 for the typical family, according to the Resolution Foundation thinktank.

As fixed-rate deals expire and households absorb the biggest hit to their finances in the postwar age, with inflation and tax rises taking their toll on spending power, borrowers are turning to a range of measures to cope with the increased costs, from renting out rooms in their homes to drawing down pensions early and even postponing having children.

Anthony Codling, housing analyst at RBC Capital markets, said:

The demise of the UK housing market is somewhat over reported. The Halifax reported today that house prices rose by 1.7% in 2023, an increase of £4,800. Most, including us, thought house prices would fall during 2023, and most think they will fall in 2024, but not us.

With rising wages, falling inflation, falling mortgage rates, and increasing talk of election related housing stimulus packages we expect house prices to rise in 2024. Our pessimism was misplaced in 2023, and we don’t want to make the same mistake twice.

Introduction: UK house prices rise for third month amid property shortage

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

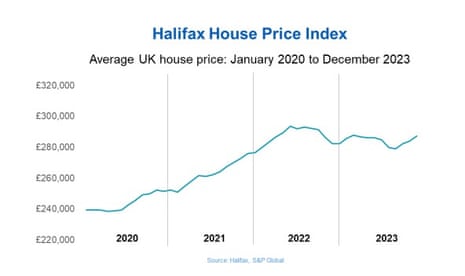

House prices in the UK rose for the third consecutive month in December, reflecting a shortage of properties on the market, according to mortgage lender Halifax. It added that with mortgage rates easing, confidence among buyers may improve in the coming months.

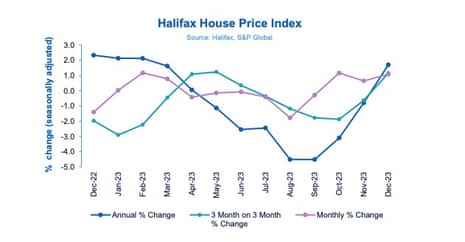

The cost of an average home rose by 1.1% to £287,105, just over £3,000 more than in November and the highest level since March, Halifax said. This comes after monthly gains of 0.6% and 1.2% in November and October.

Compared with December 2022, values were up 1.7%, the first annual growth in eight months, following a 0.8% drop in November.

Kim Kinnaird, director of Halifax Mortgages, said:

The housing market beat expectations in 2023 and grew by 1.7% on an annual basis. The average property price is now £4,800 higher than it was in December 2022. Whilst it’s encouraging that we saw growth in the last three months of the year, this was preceded with property price falls for six consecutive months between April and September.

The growth we have seen is likely being driven by a shortage of properties on the market, rather than the strength of buyer demand. That said, with mortgage rates continuing to ease, we may see an increase in confidence from buyers over the coming months.

Across all the UK regions, Northern Ireland recorded the strongest house price growth in 2023, as properties increased in value by 4.1% to £192,153. Scotland saw property prices increase by 2.6% to £205,170. At the other end of the scale, the south east fell most sharply, houses there now average £376,804, a drop of £17,755 or 4.5%.

Halifax expects prices to fall by between 2% and 4% this year as many still struggle to afford the sharply higher mortgage costs compared with recent years following a series of Bank of England rate hikes. The question is when will the central bank start cutting rates? Financial markets are betting that the first reduction will come by May.

Kinnaird explained:

As we move through 2024, the UK property market will continue to reflect the wider economic uncertainty and buyers and sellers are likely to be naturally cautious when considering making a move. While wage growth is now above inflation, helping to ease cost of living pressures for some and improving housing affordability, interest rates are likely to remain elevated for as long as inflation remains markedly above the Bank of England’s target.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said:

The housing market saw a remarkably strong finish to the year, as buyer and seller confidence was boosted by three consecutive interest rate holds and the growing belief that the next move in rates will be downwards.

Increased competitiveness among lenders leads to lower mortgage rates and we find ourselves in the midst of a price war. With HSBC launching the headline-grabbing 3.94% five-year fix and reductions from Halifax, NatWest, TSB and other lenders, the gloves really are off.

With 2023 being a disappointing year in terms of amount of business done, lenders are keen to get this year off to a cracking start. Increased competition, rates aside, may also lead to lenders broadening criteria to attract business with longer mortgage terms or greater flexibility to allow certain variable incomes. Although those remortgaging this year will still see an increase in their payments, the pain will not be as bad as it could have been.

Later today we will get the US non-farm payrolls report for December, which is expected to show that the economy added 150,00 jobs following November’s 199,000 increase.

The Agenda

-

9.25am GMT: UK New car sales for December

-

9.30am GMT: S&P Global/CIPS Construction PMI for December

-

10am GMT: Eurozone inflation for December (forecast: 2.9%)

-

1.30pm GMT: US Non-farm payrolls jobs report for December (forecast: 150,000)