Moody’s cuts China’s credit outlook to negative

Newsflash: Credit rating agency Moody’s has cut its outlook for China’s government bonds to negative, from stable, due to concerns over its rising debts and slowing economy.

Moody’s slashed its outlook due to concerns that Beijing’s government will need to provide fiancial support to “financially-stressed regional and local governments and State-Owned Enterprises”.

This would pose broad downside risks to China’s fiscal, economic and institutional strength, Moody’s says.

Moody’s also warns that China faces “structurally and persistently lower medium-term economic growth”, saying:

Moody’s expects that China’s annual GDP growth will be 4.0% in 2024 and 2025, and average 3.8% from 2026 to 2030, with structural factors including weaker demographics driving a decline in potential growth to around 3.5% by 2030

The agency also points to the “downsizing” taking place in China’s property sector, where many developers such as Evergrande are trying to restructure debts.

The changes in the property sector is “a major structural shift in China’s growth drivers”, and could be a more significant drag to China’s overall economic growth rate than expected, they say.

Moody’s move underscores deepening global concerns about the level of debt in the world’s second-largest economy.

It has maintained China’s credit rating at A1, which is its fifth-highest rating (the top ‘upper medium grade’).

Key events

Beijing: Moody’s concerns are ‘unnecessary’

China’s finance ministry says it is “disappointed” by Moody’s downgrade of the country’s ratings outlook today.

The ministry says:

“Moody’s concerns about China’s economic growth prospects, fiscal sustainability and other aspects are unnecessary.”

Moody’s cuts China’s credit outlook to negative

Newsflash: Credit rating agency Moody’s has cut its outlook for China’s government bonds to negative, from stable, due to concerns over its rising debts and slowing economy.

Moody’s slashed its outlook due to concerns that Beijing’s government will need to provide fiancial support to “financially-stressed regional and local governments and State-Owned Enterprises”.

This would pose broad downside risks to China’s fiscal, economic and institutional strength, Moody’s says.

Moody’s also warns that China faces “structurally and persistently lower medium-term economic growth”, saying:

Moody’s expects that China’s annual GDP growth will be 4.0% in 2024 and 2025, and average 3.8% from 2026 to 2030, with structural factors including weaker demographics driving a decline in potential growth to around 3.5% by 2030

The agency also points to the “downsizing” taking place in China’s property sector, where many developers such as Evergrande are trying to restructure debts.

The changes in the property sector is “a major structural shift in China’s growth drivers”, and could be a more significant drag to China’s overall economic growth rate than expected, they say.

Moody’s move underscores deepening global concerns about the level of debt in the world’s second-largest economy.

It has maintained China’s credit rating at A1, which is its fifth-highest rating (the top ‘upper medium grade’).

Grocery inflation slows again

Good news for consumers: British grocery inflation has slowed again.

Market researcher Kantar has reported that annual grocery inflation dropped to 9.1% in the four weeks to November 26, down from 9.7% a month earlier.

And the cost of a traditional Christmas dinner is rising by less than the headline rate of food inflation, Kantar adds.

The average cost of a frozen turkey Christmas dinner for four with all the trimmings, Christmas pudding and sparkling wine was up 1.3% at £31.71 – with the prices held down by cheaper Brussels sprouts and Christmas pudding than a year ago.

Kantar also predicts that take-home supermarket sales will surpass £13bn for the first time ever this December, with Friday December 22 set to be the busiest day for festive grocery shopping.

Fraser McKevitt, head of retail and consumer insight at Kantar, said:

“The scene is set for record-breaking spend through the supermarket tills this Christmas.

“The festive period is always a bumper one for the grocers, with consumers buying on average 10% more items than in a typical month. Some of the increase, of course, will also be driven by the ongoing price inflation we’ve seen this year.”

Clothing retailer Quiz reports disappointing sales

UK clothing retailer Quiz has issued a sales warning to the stock markets, after a disappointing Black Friday.

Quiz told shareholders that sales in October and November had been below management expectations, which it blamed on the cost of living and inflationary pressures for hitting customer demand during the financial year.

Quiz warns:

As a result, the near-term outlook is difficult to predict for many UK retailers including QUIZ.

Quiz now estimates that revenues for the current financial year (to the end of March) will be between 6 and 8% below market expections.

Quiz has also reported a £1.5m loss for the six months to 30 September, down from a £1.8m profit the year before.

Given its recent poor trading performance, Quiz’s board is now going to conduct “a thorough review of the strategic options” available to maximise shareholder value.

#QUIZ – Interims report Rev down 14.4% & LBT of £1.5m.

Warns ⚠️ that “the Board anticipates that full year revenues will be approximately 6-8% lower than current market expectations” in part due to recent poor sales.

Strategic review underway & reports in Q1. Liquidity of £4.9m pic.twitter.com/g2s2dhNkFf

— James (@1James1n1) December 5, 2023

Cautious consumers delay Christmas spending

UK retailers have warned that many households are holding back on Christmas spending, as the festive period threatens to be a damp squib for shops.

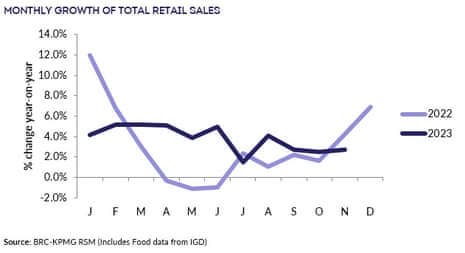

Like-for-like retail sales spending was just 2.6% higher in November than a year ago, the British Retail Consortium reported this morning, despite attempt to lure consumers to spend in the Black Friday sales.

With inflation running at 4.6% in October, that implies a chunky fall in the amount of goods being bought.

Total food sales spending slowed to a 7.6% increase in the September-November quarter, down from 8.2% in June-August.

Spending on non-food items fell by 1.6% as households cut back.

Helen Dickinson OBE, chief executive of the British Retail Consortium, said:

“Black Friday began earlier this year as many retailers tried to give sales a much-needed boost in November. While this had the desired effect initially, the momentum failed to hold throughout the month, as many households held back on Christmas spending. Health and beauty products showed stronger growth, but non-food sales were down overall year on year.

November had the highest proportion of non-food goods purchased online for 2023, though this remains below the previous years’ level.

Introduction: Shoppers face spending £105 more amid Christmas shrinkflation

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

With Christmas approaching, the scourge of shrinkflation and rising prices means UK shoppers will be spending over £100 more this year to keep their cupboards and larders filled with festive favourites.

Three in five customers have noticed “shrinkflation” on classic Christmas goods, according to a report by Barclays, with boxes of chocolates, tins of biscuits, cheese, mince pies and Christmas cake all singled out for getting smaller, but not cheaper.

Barclays reports that shoppers expect to spend an average of £105 more on Christmas this year than in 2022. But some of that spending will be driven by shrinkflation.

Festive food and drink is expected to be the largest contributor, up £25.87, followed by gifts (+£18.62) and activities (+£11.86).

Shrinkflation – where a product gets smaller but stays the same price – has been a growing threat to shoppers as food producers have tried to absorb rising costs. In September, for example, Mars trimmed 10g off its Galaxy chocolate bar.

But the problem predates the current cost of living crisis. According to the Office for National Statistics, 2,529 items shrank between January 2012 and June 2017.

Barclays reports consumer card spending rose slightly in November, growing by 2.9% following a 2.6% increase in October. However, that’s still below the headline inflation figure of 4.6% in November.

Spending at clothing retailers picked up, as shoppers took advantage of Black Friday discounts to update their winter wardrobes to ward off the wet and cold weather.

But while high street spending picked up, restaurants were hit by falling spending – as cold weather and dark evenings encouraged people to stay in.

Jack Meaning, chief UK economist at Barclays, said:

“This data suggests consumers are continuing to spend more but get less for their money, as spending growth remains below inflation. However, the gap is narrowing as the rate of price increases slows, and we expect it to narrow further in the coming months.

“It’s reassuring to see that some of the previous weakness in spending was due to unseasonal weather, as shoppers go out and finally buy that new winter coat and get in the Christmas spirit. But the key question for the UK is what happens after the holiday period – it will take more than a festive bounce to keep consumers spending in 2024.”

Also coming up today

UK car sales rose again in November, by around 9%, according to preliminary data from the Society of Motor Manufacturers and Traders. We get the full details at 9am.

There’s also a healthcheck on eurozone and UK services companies, which will show whether recessionary fears are building.

In Australia, the central bank has left interest rates on hold, sparing borrowers a pre-Christmas increase in borrowing costs as it assesses cooling inflation and a softening jobs market.

The agenda

-

7.45am BST: French industrial production report for October

-

9am BST: UK car registrations data for November

-

9am BST: Eurozone service sector PMI report for November

-

9.30am BST: UK service sector PMI report for November

-

Noon BST: Brazil’s Q3 GDP report

-

3pm BST: US service sector PMI report for November

-

3pm BST: TIPP survey of US economic confidence

-

3pm BST: JOLTS survey of US job openings