Despite the steps taken by Ukraine to reduce dependence on the market of the Russian Federation and its satellites in recent years, the consequences of breaking economic relations with Russia and Belarus after the start of a full-scale war turned out to be difficult due to the preservation of significant shares of these countries in the turnover of goods. Meanwhile, dependence on imports was greater than on exports. In pre-war 2021, the shares of the Russian Federation and the Republic of Belarus in the volume of external trade of Ukraine were 7.1% (third place among the countries of the world) and 4.5% (sixth place), respectively, in terms of import volume – 9.1% (second place) and 6.6% (fifth place), respectively. At the same time, in 2021, imports from the Russian Federation and the Republic of Belarus to Ukraine increased by one and a half times, and their volumes significantly exceeded Ukraine’s exports to them – by 1.9 and 3.2 times, respectively (data of the State Customs Service).

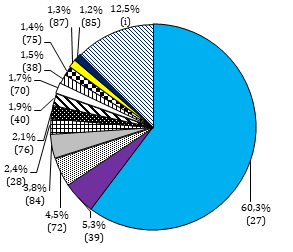

The nomenclature of imports from the Russian Federation and the Republic of Belarus coincided in many positions, due to which the aggregate share of the two countries in some import positions was critically high. The share of energy materials (60%) dominated in the structure of imports from both countries. Imports of chemical and petrochemical products, metallurgical, machine-building and woodworking industries, and construction materials were significant ( Fig. 1, 2 ).

27 Mineral fuels; oil and products of its distillation; bituminous substances; mineral waxes

31 Fertilizers

38 Various chemical products

39 Plastics, polymers and products thereof

40 Rubber, rubber and products thereof

44 Wood and products thereof, charcoal

70 Glass and products thereof

72 Ferrous metals

73 Products from ferrous metals

75 Nickel and products from it

76 Aluminum and products from it

84 Nuclear reactors, boilers, machines, equipment

85 Electric machines and equipment

87 Means of land transport except railway, parts

and – other

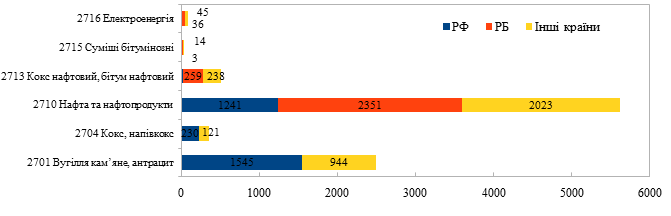

Import of energy materials and oil refining products

For many years, Ukraine has been critically dependent on Russian and Belarusian suppliers of energy materials and oil refining products ( Fig. 3 ).

The share of the Russian Federation in the Ukrainian import of hard coal and anthracite in 2021 was 62.1%, and part of the de facto import was coal from the Ukrainian territories occupied by the Russian Federation. The rest was supplied mainly from the USA and Kazakhstan. After the loss of almost all anthracite coal mines due to the Russian occupation of the eastern regions, Ukraine was forced to import coal from the Russian Federation to support the operation of thermal power plants, almost half of which operated on anthracite. The gradual transition of TPPs and CHPs to a more economical and environmentally friendly one in terms of emissions of gas coal of Ukrainian production began in 2017 with the active participation of Kharkiv machine builders, who offered innovative and economically more profitable compared to foreign technologies and equipment for converting coal-fired power units to burning non-design coal of the gas group[ 1]. But this only partially solved the problem – thermal power plants provided about a third of Ukrainian electricity generation. In addition, the conversion of one TPP unit to “G” coal requires tens of millions of dollars of investment, a long time and an increase in production, and gas coal is more flammable and explosive.

The supply of coking coal from the Russian Federation before the start of the war covered about half of Ukraine’s needs, since after the loss of control over part of the deposits in the Donetsk region, there was a sharp drop in domestic production. Currently, Ukraine is able to provide only a quarter of its own needs with domestic production.

Dependence on the import of coke was much less, in the volume of which the share of the Russian Federation was 65.5%, because before the beginning of the war, Ukrainian producers provided more than 90% of the domestic demand for coke. However, only in the first half of 2022, coke production in Ukraine decreased by 47.8%. This did not lead to an internal shortage of this type of fuel due to a significant decrease in demand from Ukrainian metallurgists, who reduced the production of basic products[2]. By the end of 2022, five coke-chemical plants[3] were operating, while the largest coke-chemical plant – PrJSC “Avdiivsky coke-chemical plant” – was idle.

The combined share of the Russian Federation and the Republic of Belarus in Ukrainian imports of oil and petroleum products (mainly motor fuels) was equal to 64% (22.1% and 41.9%, respectively), but most motor fuels from other countries are of Russian origin or produced from Russian raw materials. Prospects for increasing one’s own oil production are complicated by the significant dispersion of deposits (most of which are small or very small), the occurrence of primary resources at great depths (more than 3–5 km)[4], as well as the location of significant parts of the Eastern and Southern oil and gas-bearing regions in the occupied territories and in the war zone[5]. As a result of the Russian attacks, Ukraine also lost its own production of gasoline and diesel, which was actively growing before the war.

Before the start of the war, Belarus was one of the largest suppliers of bitumen and bituminous mixtures to Ukraine, which were used for the construction of asphalt concrete roads (and the volume of supplies was actively increased within the framework of the implementation of the “Great Construction” projects) – the share of the Republic of Belarus in the import of bitumen to Ukraine in 2021 affected 50.1%, bituminous mixtures – 78.6%. Almost half of the shares of the leading Belarusian supplier of bitumen to Ukraine – the Mozyr Refinery – belonged to the Russian OJSC “Slavneft”.

Import substitution potential

Substitution of the import of energy materials should take place on the basis of diversification and autonomy of energy supply sources and a significant increase in the share of RES in the structure of heat and electricity consumption –this will make it possible to reduce the shares of “dirty” extractive industries in the structure of industry. Ukraine has a significant potential for the development of bioenergy, which is due to the peculiarities of the climate, the potential of the industry and the agricultural sector, as well as the availability of the necessary workers. In particular, only thanks to the use of plant waste for energy production in the near future, 13–15% of the country’s primary energy needs can be met, and the total economically viable energy potential of biomass in Ukraine is about 20–25 million tons of conventional fuel per year. A significant potential for substitution of diesel imports is contained in the establishment of biomethane and biodiesel production. Thus, the estimated biomethane production potential of about 10 billion m3/year is sufficient, to fully cover the pre-war needs for imported natural gas and partly for motor fuels. Exported Ukrainian technical oil crops (rapeseed, soybean) and technical oil are equivalent to 1.6–1.9 tons of biodiesel, which can replace up to 30% of imported diesel. Despite the fact that 14 large biodiesel plants with a total capacity of 300,000 tons/year have been built in Ukraine and about 50 smaller enterprises capable of producing up to 25,000 tons of biodiesel annually operate, in 2019 Ukraine produced only 70,000 tons of liquid biofuel , that is, most of the capacities were idle. The share of liquid biofuels (bioethanol and/or biodiesel) used by Ukrainian transport is 1%. Biogas / biomethane is still not used in transport in Ukraine[6]. 9 tons of biodiesel, which can replace up to 30% of imported diesel. Despite the fact that 14 large biodiesel plants with a total capacity of 300,000 tons/year have been built in Ukraine and about 50 smaller enterprises capable of producing up to 25,000 tons of biodiesel annually operate, in 2019 Ukraine produced only 70,000 tons of liquid biofuel , that is, most of the capacities were idle. The share of liquid biofuels (bioethanol and/or biodiesel) used by Ukrainian transport is 1%. Biogas / biomethane is still not used in transport in Ukraine[6]. 9 tons of biodiesel, which can replace up to 30% of imported diesel. Despite the fact that 14 large biodiesel plants with a total capacity of 300,000 tons/year have been built in Ukraine and about 50 smaller enterprises capable of producing up to 25,000 tons of biodiesel annually operate, in 2019 Ukraine produced only 70,000 tons of liquid biofuel , that is, most of the capacities were idle. The share of liquid biofuels (bioethanol and/or biodiesel) used by Ukrainian transport is 1%. Biogas / biomethane is still not used in transport in Ukraine[6]. that is, most of the capacities were idle. The share of liquid biofuels (bioethanol and/or biodiesel) used by Ukrainian transport is 1%. Biogas / biomethane is still not used in transport in Ukraine[6]. that is, most of the capacities were idle. The share of liquid biofuels (bioethanol and/or biodiesel) used by Ukrainian transport is 1%. Biogas / biomethane is still not used in transport in Ukraine[6].

Coking coal is recognized as a strategic raw material in many regions of the world, in particular in Ukraine and the EU. The post-war recovery of metallurgical production will require a significant increase in supplies and may lead to significant shortages. Currently, the largest producers of coking coal are “Metinvest Pokrovsk coal” in Donetsk region and “Pavlograd coal” DTEK in Dnipropetrovsk region. The prospects for increasing the domestic production of coking coal and coke will depend to a significant extent on the course of hostilities in Donbas, where significant deposits are concentrated. There is a technical project for the construction of a new mine in the Lviv region with reserves of more than 300 million tons of coal grades “K” and “Zh” and an annual design capacity of 8 million tons, which requires about 1 billion dollars. US investment.

An innovative for Ukraine and an economically beneficial alternative to asphalt concrete roads using imported bitumen is the use of a cement concrete coating made of raw materials exclusively of Ukrainian production.Thus, the life cycle of a cement-concrete road is 20-25 years, while an asphalt-concrete road is up to 10 years. The total cost of cement-concrete roads over 20 years, taking into account the costs of new construction, current and capital repairs, is 2-2.5 times lower compared to asphalt-concrete highways[7]. In 2022, cement production in Ukraine was halved, and domestic consumption – by 70%. Despite the damage to one cement plant of PJSC Baltsem as a result of the war, the remaining capacities of the cement industry keep the total annual production potential at the level of 13 million tons [8] – they can be used for the purposes of post-war reconstruction of Ukraine.

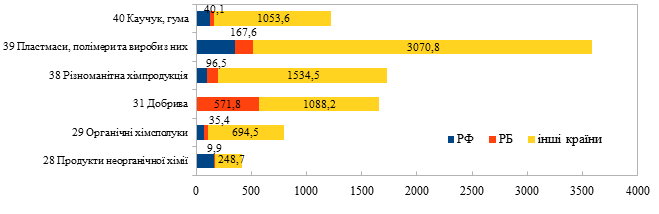

Import of chemical and petrochemical products

The total share of imports in domestic consumption of products of chemical and petrochemical complexes in Ukraine continues to grow (according to industry experts, it will reach about 78% in 2022). Such imports occupy the niches of domestic manufacturers that stopped or significantly reduced production after the start of the war. It is worth noting that in 2021–2022, thanks to the restrictive measures and sanctions introduced by Ukraine, the shares of the Russian Federation and Belarus in Ukrainian imports of this type of product decreased significantly, and their niches were quickly occupied by Polish and Chinese suppliers.

In general, the dependence on Russian and Belarusian imports was the greatest in the segments of fertilizers and inorganic chemistry ( Fig. 4 ) – the share of the Republic of Belarus in the import of fertilizers in 2021 was 34.5%, and the combined share of the Russian Federation and the Republic of Belarus in the import of inorganic chemical products, where ammonia prevailed , – 40.8% (38.4% and 2.4%, respectively). The Russian Federation and the Republic of Belarus collectively supplied 98% of sulfuric acid (49% each), 99.8% of ammonia (98.1% and 1.7%, respectively), and the Republic of Belarus became their leading supplier to Ukraine after Ukraine banned the import of Russian fertilizers, providing in 2021, 42.3% of the import of nitrogen fertilizers, 73.1% of potassium fertilizers, 27.5% of NPK fertilizers.

A strategically important asset of foreign economic relations with the Russian Federation in the chemical industry is the “Tolyatti-Odesa” ammonia plant[9], whose activities the UN proposed to restore within the framework of the “grain agreement”. The argument was the unprecedented aggravation of the risks of developing a world food crisis, one of the reasons of which is the insufficient provision of nitrogen fertilizers for the cultivation of agricultural products in both the poorest countries of the world and European countries. Ukraine also had the opportunity to supply ammonia to the domestic market through ammonia cogon dispensing stations, but due to tariff disputes with the Russian Federation, it did not use these opportunities to the full extent – yes, in 2019, 80.4 thousand tons of liquid ammonia was supplied to the domestic market with a potential of more than 200 thousand tons

For reference.Russian ammonia, the share of which in the world ammonia market was 20%, until February 24, 2022, was supplied by the Russian enterprises PJSC “Tolyattiazot” and JSC “Minudobreniya” to the JSC “Odesa Priportovy Zavod” (JSC “OPZ”) , which transshipped it for export from Ukraine to Turkey, India, African countries and the EU. The interest of the Russian Federation in restoring the work of ammonia cogon is caused by the lack of profitable alternative ways of exporting Russian ammonia by PJSC “Tolyattiazot”, which is one of the world leaders in its production. The capacities of JSC “OPZ” provided about half of all Russian ammonia exports. Currently, all deliveries are made by rail. After the start of the war, the company revived the project of building an ammonia transshipment complex in the port of Taman (Kuban) with an annual capacity of 5 million tons, which is planned to be completed in 2025 [10],

In 2021, the transit of Russian ammonia by ammonia cogon amounted to 2.3 million tons – Ukraine received 108 million dollars. The USA, and the Russian Federation received 1.6 billion dollars from the sale. USA. It is worth noting that, unlike other parties and potential beneficiaries of the agreement, Ukraine will bear all the risks in the event of the resumption of ammoniacogon supplies “Togliatti – Odesa”. In particular, the high probability of ammonia damage during hostilities can lead to ammonia exposure of the population and territories. Most of the Ukrainian section of the ammonia zone, which runs through eight oblasts of Ukraine, is located in or in the immediate vicinity of an active war zone. Thus, in May 2022, as a result of hostilities, the tightness of the ammonia branch in the Bakhmut district of the Donetsk region was damaged, however, due to the non-operational state of the branch since 2014, the volume of the leak was insignificant and did not cause much damage[11]. In addition,

Import substitution potential

A significant part of the technological chains in the chemical and petrochemical industries has not been brought to the level of the third redistribution and release of final commodity products, about 90% of highly technologically processed products and 65% of final chemical products are imported into Ukraine[12]. Therefore, the cessation of the import of chemical and petrochemical products from the Russian Federation and the Republic of Belarus was quickly compensated by a corresponding increase in imports from Poland, China, Turkey and some other countries. However, in conditions of increased risks for the development of strategic branches of the Ukrainian economy in war conditions (primarily agricultural production, the chemical and pharmaceutical industry, the military-industrial complex, mechanical engineering), there is a need to restore and diversify the production of certain strategically important types of products – fertilizers, plant protection products, polymers and plastics, etc. Unfortunately, taking into account the significant energy intensity, the outdated technological base and the decommissioning of a large part of the enterprises after the start of the aggression, it is unlikely to significantly increase the production of import substitute products in the conditions of a protracted war and a lack of investment. However, there are certain possibilities.

The prospects for increasing the production of nitrogen fertilizers will be significantly determined by the price of gas and the volume of its own production, which Ukraine is increasing despite all adverse conditions. Already today, due to the decrease in demand from agricultural companies and the restoration of stable work of domestic enterprises, Ukraine is able to fully provide itself with nitrogen fertilizers of its own production, there is a surplus of nitrogen fertilizers in the domestic market, and producers expect to increase export supplies to the EU market to 2 million tons per year and occupy 15% of the EU mineral fertilizers market[13].

In general, in the segment of nitrogen fertilizers, the share of imported products under the conditions of a periodic ban on exports (according to preliminary results of 2022) was 30%. In the segment of complex fertilizers, imported products on the domestic market exceeded 81%[14]. Provided that the domestic raw material base is developed (apatites, phosphorites, potassium chloride / potassium sulfate) and there is sufficient production of nitrogen components, the domestic production of complex fertilizers can significantly increase production and increase its market share in the medium term to 35–40%, and in the long term – up to 60-70%. However, this requires significant investment funds.

Much less expensive from the point of view of investment are small-tonnage chemical productions, which in the conditions of war have demonstrated greater stability due to faster adaptation and flexibility. In the future, it is possible to replace part of the import of complex fertilizers thanks to the establishment of the production of innovative and special types of fertilizers based on domestic and imported raw materials, which will be in demand both in Ukraine and in the EU countries (organo-mineral fertilizers for obtaining ecologically clean agricultural products, micro-fertilizers, chelated fertilizers, nano-fertilizers for organic agriculture, adaptive and compact fertilizers for precision agriculture). The same applies to plant protection products, meliorants, feed mineral additives, competitive fertilizer products based on microelements, biodestructors[15].

Restoration of production of petrochemical productsand its import substitution is complicated by the shutdown of many enterprises, including due to the lack of raw materials (which were almost entirely imported), as well as the blocking of work due to the seizure of property. Thus, since the beginning of the war, the largest petrochemical enterprise of Ukraine – LLC “Karpatnaftohim” (Kalush) stopped production due to the destruction of raw material supply chains. The resumption of the enterprise’s work in the second half of 2022 was blocked due to the fact that in October 2022 the Bratsky District Court of the Mykolaiv Region seized and handed over to the National Agency for the Detection, Investigation and Management of Corruption Assets the seized property of the enterprise, which is accused of reducing income tax for agreements with Cypriot companies for UAH 2.2 billion[16]. The plant specializes in the production of chlorine, caustic soda, vinyl chloride, ethylene, polyethylene and propylene.

Import of metallurgical products

The cumulative share of ferrous and non-ferrous metallurgy products in imports from the Russian Federation in 2021 reached 9.1% (ferrous metals – 4.5%, aluminum and its products – 2.1%, nickel and its products – 1.4%, ferrous metal products – 1.1%). In imports from the Republic of Belarus, the share of products made of ferrous metals was 1.1%, the shares of aluminum and ferrous metals were insignificant – 0.4% each. In general, in terms of import items, the greatest dependence on Russian and, to a lesser extent, Belarusian products was nickel and its products (79.1% of the group’s total imports), aluminum (31.1%). To a lesser extent – by ferrous metals (20.7%), ferrous metal products (11.3%) ( Fig. 5 ).

The main products of import of ferrous metals from the Russian Federation were semi-finished products, flat rolled products, rods and bars made of carbon and alloy steel; import of ferrous metal products – products for railway and tram tracks, pipes, tubes and fittings, metal constructions; from RB – metal structures and wires. Import of raw aluminum from the Russian Federation in 2021 amounted to 6.8 thousand tons, domestic production – 15.9 thousand tons. Import of aluminum wire from the Russian Federation during the same period amounted to 18.9 thousand tons, domestic production – 5.6 thousand t. Nickel products weighing 0.1 thousand tons made up about half of the value of imports from the Russian Federation of goods of group 75, another quarter – unprocessed nickel (1.5 thousand tons) and nickel rods, bars and profiles (0.3 thousand tons). t).

Import substitution potential

The import of ferrous metals and products from them to Ukraine is sufficiently diversified, and the shares of Russian suppliers for most goods were not critical. After the cessation of Russian imports, there was a rapid reorientation to other producers, primarily thanks to the increase in imports from Turkey. Significant prospects for import substitution in ferrous metallurgycontained in the development of a network of electrometallurgical mini-plants capable of working with the use of scrap. Their development will make it possible to: (i) reduce the dependence of the market on large vertically integrated companies that build their business on the extraction and use of non-renewable resources – ores and coking coal; (ii) locate production facilities in close proximity to sources of scrap accumulation or to consumers, reducing logistics costs; (iii) adapt the volumes and characteristics of products to the specific needs of consumers; (iv) to process scrap from alloy steels, from which a significant part of military equipment is manufactured. This determines the high efficiency of mini-factories to achieve the goals of post-war recovery, primarily in the most affected regions. The development of mini-factories will accelerate the processes of structural restructuring in the metallurgical industry,

The demand for aluminum in the world is growing rapidly, and in the EU it is classified as a critical raw material. Today, the largest capacities of the aluminum industry in Ukraine have passed into state ownership.In July 2022, the Shevchenkiv District Court of Kyiv transferred the corporate rights in the form of the charter capital of one of the largest non-ferrous metallurgical enterprises in Europe – LLC “Mykolaivsky Glinozemny Zavod” – to the management of the National Agency for the Identification, Search and Management of Assets Obtained from Corruption and Other crimes, due to his belonging to the Russian oligarch O. Deripaska[17]. Since March 2022, due to the impossibility of shipping products, the company has stopped working. Earlier, after the actual destruction by the Russian owners of the only primary aluminum producer in Ukraine, PJSC “Zaporizhsky Production Aluminum Combine”, the enterprise was returned to state ownership (68% of shares, but it practically ceased its activities). Instead, since 2011, the enterprise in the Kyiv region resumed its work, which has a full production cycle of aluminum products. The enterprise continued to work during the war, but due to a noticeable drop in domestic demand, 90% of the enterprise’s products were exported (before the war – 60-70%). Therefore, subject to an effective privatization campaign and state assistance (in particular, restrictions on the export of scrap non-ferrous metals that can be used for domestic production; support for energy modernization – the production of industries all over the world has a high energy intensity, the share of electricity in the cost price is at least 30%) the aluminum industry in Ukraine has prospects for recovery.

Nickel , which is the main element for the manufacture of batteries, is one of the most scarce metals in the world. Nickel production in Ukraine was carried out using imported raw materials, the supply of which became impossible after the blocking of sea transportation. The available deposits of nickel-containing ores in Ukraine are difficult to access due to their deep location. The only producer of ferronickel and nickel in Ukraine has suspended production since November 1, 2022 due to interruptions in energy supply as a result of massive shelling by the Russian Federation. In the nine months of 2022, the output of ferronickel decreased by 77.5% (to 42.3 thousand tons), and nickel – by 63.5% (to 7.4 thousand tons). Therefore, it is currently advisable to reduce import dependence on Russian suppliers primarily through geographical diversification of imports.

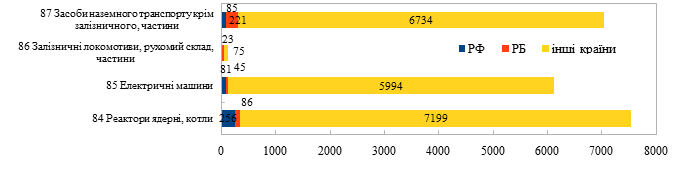

Import of engineering products

Despite the fact that Ukrainian imports of machine-building products are sufficiently geographically diversified ( Fig. 6 ), the shares of the Russian Federation and the Republic of Belarus remained sensitive for some import positions.

Fig. 6. Import of certain machine-building products to Ukraine in 2021, million dollars. USA

First of all, this concerns the strategically important sphere of nuclear energy, where the Russian Federation supplied about half of the nuclear fuel (subgroup 8401). After the full-scale invasion of Russia, Ukraine abandoned its nuclear fuel production and is now using accumulated reserves, which, according to experts, will last for the next 2 years. Currently, according to the State Atomic Energy Regulatory Commission, all power units at the Rivne and Khmelnytskyi NPPs, two at the Zaporizhia NPP, and one at the South Ukrainian plant run on Russian fuel. The other six are fueled by Westinghouse. According to the agreement signed with Westinghouse, within two years, the company will expand production to cover the needs of Ukraine, and Energoatom will ensure the modernization of power units for the use of American fuel[18].

The share of Belarusian-made tractors in 2021 in the total volume of imports of the subgroup was 13.7%, the shares of the USA and Germany were much larger. RB also supplied parts for tractors, bodies and trailers . The Russian Federation supplied 99.6% of vehicles for the maintenance of railway or tram lines ; the shares of the Republic of Belarus and the Russian Federation in the import of non-self-propelled wagons in 2021 reached 43.1% and 11.5%; shares in the import of parts for railway transport – 11.5% and 26.1%, respectively.

Import substitution potential

Thanks to the uranium deposits available in Ukraine and the production of parts of fuel assemblies already established by Energoatom, Ukraine is able to significantly increase its own production of nuclear fuel over the next three years[19]. The key tasks for successful import substitution in the future are to ensure the development of the production capacities of uranium deposits (Kirovohrad region), the restoration of zirconium production in the Dnipropetrovsk region, and the unification of uranium exploration, mining and processing assets.

Import substitution on the market of railway products has already begun . Thus, the Ukrainian multidisciplinary industrial and investment group “Aurum” developed a project and in 2023 plans to mass produce products for the railway industry, which were previously produced only in the Russian Federation[20]. In 2022, the enterprise, which is part of the “Aurum Group”, built 49 semi-wagons and repaired 700 wagons. The fact that JSC “Ukrzaliznytsia” took operational management of 25% of the shares of PJSC “Kryukiv Carriage Works” – arrested in the summer of 2022 and transferred to the Agency for Search and Asset Management, they previously belonged to the strengthening of the stability of Ukrainian production and import substitution on the market of railway products to the Russian shareholder S. Gamzalov[21].

Ukrainian tractor manufacturing , despite the existing production base, is in a deep crisis due to low competitiveness (even against used models of foreign production, which are preferred by Ukrainian farmers). After the start of the war, the crisis only intensified, and in July 2022, Russian troops completely destroyed PJSC Kharkiv Tractor Factory[22], which produced tracked and wheeled tractors and was included in the list of enterprises of strategic importance for the economy of Ukraine.

Belarusian tractors are also significantly inferior to foreign counterparts, and their only advantage for many years is a much lower price. Ukraine’s establishment of import-substituting industries requires the involvement of modern foreign technologies and the selection of specialization in accordance with the needs of Ukrainian consumers. In particular, industry experts include the production of low-power tractors for small farms and personal peasant farms as promising niches – this will create favorable conditions for logistical support of small farms and reduction of imports[23].

Import of construction and woodworking products

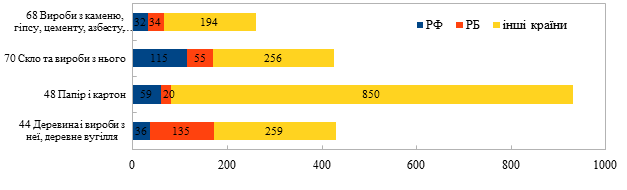

Significant dependence on Russian and Belarusian imports remained for some items of construction products and wood ( Fig. 7 ). In particular, the combined share of the Russian Federation and the Republic of Belarus in the import of stone, gypsum, cement, asbestos, and mica products in 2021 was 25.4% (12.3% and 13.1%, respectively); in the import of glass and glass products – 40.0% (27.0% and 13.0%, respectively); the import of wood and wood products from the Russian Federation and the Republic of Belarus in the total volume of imports of the group collectively reached 39.8% (8.4% and 31.4%, respectively).

In addition to bitumen, Belarusian and Russian manufacturers supplied asphalt products to Ukraine – their shares in imports were the same, and together – 80%. The Republic of Belarus also provided about a third of the import of cement and asbestos-cement products , and the Russian Federation – 70% of asbestos mixtures .

For many years, Ukraine exported raw materials for the production of glass to the Russian Federation and Belarus, instead importing finished products from these countries. Currently, Ukraine is still significantly dependent on the import of construction glass, producing mainly glass containers. To ensure national producers, on November 2, 2022, the Interdepartmental Commission on International Trade, based on the interim results of the anti-dumping investigation, decided to apply a preliminary anti-dumping duty of 31.37% to certain glass products from the Republic of Belarus[24], while trade with the Russian Federation was suspended back in April 2022. After the cessation of imports from the Russian Federation and the Republic of Belarus, the Ukrainian market reoriented itself towards Polish glass, however, in the future, given the need for large-scale restoration work, the demand for glass will grow, and a significant shortage of it is already felt for some items.

In terms of products of the woodworking industry, the greatest dependence was on pulp, the import of which was provided by the Russian Federation by 63.7% and by the Republic of Belarus by another 14.4%, newsprint (92.7% and 7.1%, respectively). RB supplied 91.2% of fuelwood imports, 100% of sleepers for railway and tram tracks, 42% of fiberboard imports and 65.5% of plywood imports.

Import substitution potential

The level of development and currently stable functioning of the cement and woodworking industries in Ukraine make it possible to diversify production and ensure effective import substitution in the relevant markets. On the other hand, the lack of modern production of building glass significantly limits the internal potential of Ukraine’s post-war recovery.

The potential for increasing the domestic production of construction glass is limited by the high cost and dependence on natural gas, the share of which in the cost of glass products is 60–70%. Until 2013, building glass was produced in Lysychansk, but due to high prices for natural gas, the plant stopped production. Currently, domestic manufacturers of double-glazed windows and windows work exclusively with imported glass.

There are 42 deposits of sand suitable for glass production in Ukraine , 40% of which are located in Kharkiv region. Less explored are the deposits of feldspars needed for the production of alloys. The construction of a plant for the production of thermopolished glass requires 80–100 million dollars. investments. Considering that some of the world’s leading glass-producing companies stopped their investments (Japanese glass manufacturer “Asahi Glass Co”) or left the Russian market (American glass manufacturer “Guardian Industries”), there are prospects that such foreign investors will come to Ukraine[25 ]. Already now in Ukraine, the domestic company “City One Development” is building two factories for the production of glass – in the Kyiv region and in the Center of Ukraine. The launch of the first production is planned for 2024, the amount of investments reaches 100 million euros.