One quarter of British shoppers struggling as grocery price inflation hits 17%

Supermarket inflation has hit a new record high this month, with prices climbing by more than 17% in the year to February.

Data provider Kantar reports that grocery price inflation rose to 17.1% in the four weeks to 19 February. This means that households face spending an extra £811 on their annual supermarket bills, unless they change their shopping habits.

This is the highest level of grocery inflation Kantar has ever recorded, and shows that the pressures on food shoppers are intensifying this year. One in four shoppers are now struggling financially, they warn.

Fraser McKevitt, the head of retail and consumer insight at Kantar, says:

Shoppers have been facing sustained price rises for some time now and this February marks a full year since monthly grocery inflation climbed above 4%. This is having a big impact on people’s lives.

Kantar’s latest research shows that grocery price inflation is the second most important financial issue for the public behind energy costs, with two-thirds of people concerned by food and drink prices, above public sector strikes and climate change.

The report shows that more households are being dragged into the cost of living crisis. squeeze.

McKevitt says:

One quarter say they’re struggling financially, versus one in five this time last year. The numbers speak for themselves. If people don’t change how they buy their groceries, households are facing an £811 increase to their average annual bill.

However, cost-of-living pressures failed to dent enthusiasm for Valentine’s Day celebrations this year.

Sales of steak up by a quarter in the seven days to February 14 compared to the previous week, sparkling wine sales doubling and shoppers spending an extra £5m on boxed chocolates.

Key events

Credit Suisse ‘seriously breached’ obligations in Greensill affair: Swiss watchdog

Switzerland’s financial watchdog has ruled that Credit Suisse “seriously breached its supervisory obligations” in connection with its business relationship with financier Lex Greensill and his companies.

FINMA announced this morning that it has ordered “remedial measures”, after concluding that Credit Suisse had “seriously breached its supervisory obligations in this context with regard to risk management and appropriate organisational structures”.

The regulator says:

In future, the bank will have to periodically review at executive board level the most important business relationships (around 500) in particular for counterparty risks. In addition, the bank is required to record the responsibilities of its approximately 600 highest-ranking employees in a responsibility document.

FINMA has also opened four enforcement proceedings against former Credit Suisse managers.

In 2021, Credit Suisse suspended $10bn of investor funds after the collapse of the supply-chain lender Greensill Capital, whose loans were packaged and sold to Credit Suisse clients.

FINMA says today that the business relationship with Greensill was repeatedly discussed at Credit Suisse management level, but usually only done selectively because of a specific event or request.

“There was a lack of an overall view as well as regular, consistent engagement with the risks associated with Greensill at the highest level,” the regulator says.

Ulrich Körner, Chief Executive Officer of Credit Suisse, says the bank welcomes the conclusion of FINMA’s work.

Körner says:

This marks an important step towards the final resolution of the SCFF issue. FINMA’s review has reinforced many of the findings of the Board-initiated independent review and underlines the importance of the actions we have taken in recent years to strengthen our Risk and Compliance culture. We also continue to focus on maximizing recovery for fund investors.”

Körner adds that since March 2021 (when Greensill Capital filed for insolvency), Credit Suisse has taken action to directly address many of the issues subsequently highlighted by FINMA.

Elsewhere in the retail sector, union members at an Amazon distribution centre in Coventry have begun a second day of industrial action.

More than 310 Amazon staff at its giant fulfilment centre in the West Midlands city are striking today, and will also strike on 2 March and from 13 to 17 March, in an ongoing pay dispute.

In January, workers at the Coventry warehouse became the first in the UK to take strike action against the online retail giant. As well as seeking higher pay, they have also complained of overbearing management practices and long hours.

The GMB union is calling for a pay rise from £10.50 to £15 an hour, although the union is not recognised by Amazon.

The leader of Amazon’s first union made his first trip outside the United States last week to support striking workers at the Coventry warehouse.

Chris Smalls, who helped coordinate a successful unionisation drive at an Amazon warehouse in Staten Island, New York, in April 2022, travelled to the UK last week to provide advice to British workers as they try to gain recognition from the company.

“It’s important that we amplify each other’s fight and struggles because we want to build that international solidarity,” Smalls told the Observer.

“Just like they’re refusing to talk to these workers and negotiate a fair contract, we’re in the same process back at home.”

UK building supplier Travis Perkins warns of challenging 2023

Travis Perkins, Britain’s biggest supplier of building materials, has warned that 2023 will be challenging as housebuilders slow down projects and home-owners delay improvements.

The country’s gloomy economic outlook is likely to weigh on the housing market this year, with Travis Perkins warning that there is “macroeconomic uncertainty”.

Reuters has the details:

Travis Perkins, which sells bricks, timber and new kitchens, as well as equipment for large construction projects, said adjusted operating profit fell 16% last year to £295m, behind a consensus forecast of £320m pounds.

The miss was blamed on restructuring costs from closing 20 smaller branches out of the group’s 1,500, which Chief Financial Officer Alan Williams said was part of Travis Perkin’s plan to prepare for a tougher year.

The surge in grocery inflation to record levels is adding to the pressure on Ocado, says Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown:

Lund-Yates points out that despite a 13% increase in active customers last year, volumes haven’t followed suit, meaning the cost to serve all those online orders has become a burden.

Ocado is in the eye of the cost-of-living storm because its offering isn’t synonymous with being the best value, it’s a higher-end option, without the same benefits of enticing people in with tangible, physical goods like M&S or Waitrose can.

One quarter of British shoppers are struggling as grocery price inflation goes above 17% for the first time, according to new data from Kantar. It was a year ago that food inflation climbed above 4%, meaning consumers now feel like there’s a hole in their wallet every time they reach the checkout.

If you were ill this month, you weren’t alone.

February also saw sales of cold treatments rising by 82%, cough liquids up 78% and cough lozenges 70% higher, Kantar reports.

Aldi and Lidl grow market share

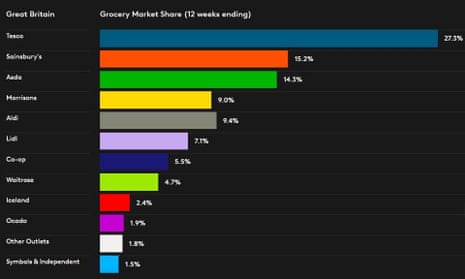

Sales at discount supermarket chains Aldi and Lidl both rose this month, as UK shoppers tried to cut their grocery bills.

Aldi’s market share rose to a new record, of 9.4% this month, and remains the fastest growing grocer, with sales up by 26.7%.

It was closely followed by Lidl which increased sales by 25.4%, growing its market share to 7.1%. Frozen food specialist Iceland also won share, taking 2.4% of market sales, up from 2.3% last year as spending through its tills increased by 10.8%.

Kantar also reports that Ocado “put in a strong performance, bucking the overall trend in online sales”.

Fraser McKevitt, the head of retail and consumer insight, says:

While online fell by 0.9% over the 12 weeks, the digital specialist [Ocado] grew sales by 11.3% to achieve its largest ever market share of 1.9%.

Tesco edged slightly ahead in the battle between Britain’s biggest retailers, with sales up by 6.6%. Sainsbury’s and Asda were just behind with sales rising by 6.2% and 5.9% respectively. Morrisons’ sales decline of 0.9% was its best performance since May 2021.

Waitrose returned to growth, nudging up sales by 0.7%. It has a market share of 4.7%. Convenience retailer Co-op increased sales by 3.4% while independents and symbols were up by 1.8%.

Demand for supermarket own label ranges has swelled over the last year, Kantar reports.

Sales of these lines are up by 13.2% this month, well ahead of branded products at 4.6%, and this trend “shows little sign of stopping”, Kantar’s Fraser McKevitt explains.

One quarter of British shoppers struggling as grocery price inflation hits 17%

Supermarket inflation has hit a new record high this month, with prices climbing by more than 17% in the year to February.

Data provider Kantar reports that grocery price inflation rose to 17.1% in the four weeks to 19 February. This means that households face spending an extra £811 on their annual supermarket bills, unless they change their shopping habits.

This is the highest level of grocery inflation Kantar has ever recorded, and shows that the pressures on food shoppers are intensifying this year. One in four shoppers are now struggling financially, they warn.

Fraser McKevitt, the head of retail and consumer insight at Kantar, says:

Shoppers have been facing sustained price rises for some time now and this February marks a full year since monthly grocery inflation climbed above 4%. This is having a big impact on people’s lives.

Kantar’s latest research shows that grocery price inflation is the second most important financial issue for the public behind energy costs, with two-thirds of people concerned by food and drink prices, above public sector strikes and climate change.

The report shows that more households are being dragged into the cost of living crisis. squeeze.

McKevitt says:

One quarter say they’re struggling financially, versus one in five this time last year. The numbers speak for themselves. If people don’t change how they buy their groceries, households are facing an £811 increase to their average annual bill.

However, cost-of-living pressures failed to dent enthusiasm for Valentine’s Day celebrations this year.

Sales of steak up by a quarter in the seven days to February 14 compared to the previous week, sparkling wine sales doubling and shoppers spending an extra £5m on boxed chocolates.

Reuters: UK home prices to fall, but unlikely to come crashing down

British home prices will fall less than previously expected in 2023, a new poll of analysts has found.

After years of bumper price rises, the average cost of a home will fall 2.4% this year, according to a poll of 19 housing market experts conducted by Reuters in February has found.

That’s shallower than the 4.7% fall predicted in a November poll. This month’s survey found that house prices are expected to rise by 1.0% next year on average and 3.5% in 2025.

Aneisha Beveridge at estate agency Hamptons predicts:

“It’s likely 2023 will be a year of transition as buyers and sellers adapt to a new era of higher interest rates before the market returns to growth again in 2024.”

Higher borrowing costs will weigh on the housing markets this year. The Bank of England is expected to raise interest rates in March, to 4.25%, with rates currently seen approaching 5% by the end of this year.

The cooling in the UK property market is likely to be ‘persistent’, predicts buying agent Emma Fildes, founder of Brick Weaver.

The wind has shifted causing both seller & buyer to chose a different tack to secure a sale. Pandemic gains, which averaged £42,000 are chipped by a 3rd with buyers discounting on AVG 4.5% (£14,000) to secure a property. I expect this new weather front to be…persistent @Zoopla pic.twitter.com/U4uRNWViJT

— Emma Fildes (@emmafildes) February 28, 2023

Ocado has “unsurprisingly reported disappointing financial results this morning” during volatile times for the supermarket industry, says Chris Daly, CEO of the Chartered Institute of Marketing.

Daly says Ocado is approaching a ‘tipping point’:

While the pandemic prompted a jump in demand for online groceries, a return to in-store shopping and the cost-of-living crisis is affecting consumer spending habits.

With competitors such as Tesco increasingly matching the discounts offered by budget supermarkets, Ocado is approaching a tipping point where it must decide how to position itself.

There are testing times ahead for the supermarket industry, with those companies at the top of the market especially vulnerable to price squeezes. Now, it’s essential Ocado defines its target market, creating coherent, clear messaging that stands out in the competitive market.”

Ocado shares drop 9%

Shares in Ocado have dropped by over 9% at the start of trading in London, the top faller on the FTSE 100 index.

They fell as low as 563p, down from over £13 a year ago.

Richard Hunter, head of markets at interactive investor, says Ocado is “caught between a rock and a hard place”.

That’s because the two elements of its business – its technology solutions arm, and the Retail division – continue to face different tests, Hunter explains:

The Solutions business, on which most of the group’s hopes for future growth and profitability is pinned, has yet to deliver on a sufficient scale to appease investors. The promises of large-scale adoption for its cutting-edge technology has yet to fully materialise, after some considerable time, which has led to investors shunning the stock in their droves. Over the last two years, the share price has fallen by 72%.

Yet progress is evident in this part of the business. UK solutions revenue grew by 13% to £802.7 million over the period, while the International unit saw revenues spike by 122% to £148 million. The latter continues to run at a loss, however, leading the group to attempt to accelerate the rollout of its Ocado Smart Platform to partners. Over the last year, 12 new sites were opened, with 23 now live split between 12 overseas and 11 in the UK. Further deals were signed, most notably with Lotte Shopping of South Korea, and Ocado maintains that the new partner pipeline is strong and that further OSP deals are being sought.

For the Retail business, from which the vast majority of revenues are currently derived, the environment is getting tougher. The so-called “Covid unwind” has had an impact as shopping habits normalise, while given some UK economic hardship, customers have begun to seek cheaper product offerings elsewhere. It is also evident that while customers are still coming to Ocado, it tends to be more selective. As such, even though active customers rose by 13% to 940000, average basket sizes falling from £129 to £118, leaving the Retail part of the business with a 3.8% decline in revenues to £2.2 billion, marginally shy of expectations.

Abrdn hit by one of toughest years in living memory

Stock market turbulence has hit earnings at Abrdn, the global investment company.

Abrdn has reported a pre-tax loss of £615m for 2022 this morning, down from a £1.115bn profit in 2021 when markets were

Business was hit by global markets turmoil and runaway inflation last year, as the Ukraine war hit the world economy, knocking global markets down by 20%.

Stephen Bird, chief executive officer of Abrdn plc, says that 2022 was “one of the toughest investing years in living memory”.

But, Bird says Abrdn- created through the merger of Aberdeen Asset Management and Standard Life – is “creating a stronger business model”, and scaling up its UK savings and wealth businesses.

Shares have jumped 4% in early trading.

Ocado’s push to sell its technology to grocery retailers around the world should help it turn its fortunes around, predicts Jocelyn Paulley, retail partner at law firm Gowling WLG:

“As Ocado has been experiencing difficulties since the end of the pandemic when demand for its delivery service dropped, this update will be welcome news to investors but they will be wary of a challenging period ahead as shoppers tighten their belts amidst economic uncertainty and increased energy costs eat into the company’s margins.

“However, the food retailer is actively seeking to be a technology partner for other supermarket chains internationally, and if it is able to secure a number of contracts in this area, then this is likely to contribute to a turnaround for the business.”

Ocado struck two new international partnerships last year, with Lotte Shopping in South Korea and Auchan Polska in Poland, to jointly build warehouses.

Full story: UK home sellers having to cut average of £14,000 from asking price

Rupert Jones

Although UK home sellers are shaving an average of £14,000 off the original asking price, separate research from Halifax today has highlighted the sizeable house price gains made by millions of homeowners during the past three years.

Halifax’s data showed that the average UK house price went up by 20.4% – or £48,620 – between January 2020 and December 2022, climbing from £237,895 to £286,515.

Owners of larger homes have been the big winners from the pandemic-fuelled “race for space”, while London flat owners have gained the least.

My colleague Rupert Jones explains:

According to the 2020-22 data, the average price for bigger homes grew at almost twice the rate than for smaller properties. When the UK housing market first reopened after months of Covid lockdown, there was an increase in demand for larger homes as buyers sought more space, a garden or better environments for working from home.

As a result, the average price of a detached home soared by 25.9% between the start of 2020 and the end of 2022.

Here’s the full story:

Introduction: Ocado’s annual loss swells to £500m

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Ocado, the online grocery and technology firm, has posted a £500m loss for last year as the cost of living crisis hits spending.

2022 was “a challenging year for Ocado Retail”, the company tells shareholders this morning, reporting that pre-tax losses widened to £500.8m for last year, up from £176.9m in 2021.

That compared to analysts’ average forecast of a loss of 399 million pounds, Reuters reports.

Revenues at Ocado Retail, its joint venture with Marks & Spencer, fell by 3.8% during the year, despite the company reporting record sales over Christmas.

Ocado Retail did swell its customer base, though – active customers increased by 13% to 940,000.

One challenge is that Ocado Retail customers are putting fewer items in their baskets in response to higher prices and the cost of living crisis.

Soaring costs, and the unwinding of the spending boost during pandemic lockdowns, are also biting.

Tim Steiner, Ocado’s CEO, says every company has had its business model tested by a combination of macro-economic and geopolitical headwinds. Ocado has “more confidence” in its model than ever before, he declares.

Steiner tells the City:

Ocado Retail, our UK JV with M&S, has shown its resilience against a backdrop of higher costs and smaller baskets, reflecting the Covid unwind and the UK cost of living crisis, by growing customer numbers and increasing online market share.

As the Covid unwind fades and customer growth continues the business will start to recover the fixed costs of recent capacity commitments.

Ocado’s business also builds robots and software for online grocery deliveries.

The company says that its partners have reported “leading customer satisfaction metrics” and growth ahead of the broader online channel in their respective markets.

Also coming up today

As the UK housing market cools, home sellers are accepting an average discount of 4.5% off their asking prices to find a buyer, property website Zoopla reports this morning.

The average property price in the UK is now £260,800, Zoopla said, which means sellers are taking a cut of £14,100.

It is the highest gap between the asking price and sale price for five years, according to Zoopla, and follows several months of falling house prices.

“The average discount to asking price was 4.5% this month, the biggest discount in more than five years and up from 0.4% in 2022, according to Zoopla”

(via bbg) pic.twitter.com/u7nJ5jf3Sn

— Michael Brown (@MrMBrown) February 28, 2023

But, the surge in house prices since the start of the pandemic means sellers have flexibility to accept lower offers, as Richard Donnell, executive director at Zoopla, explains:

“Greater realism on the part of sellers is supporting housing market activity in the face of higher borrowing costs.

Many homeowners are sitting on sizable house price gains made over recent years and have more room to be flexible accepting offers below the asking price. Discounts to asking price have widened and while 4-5% discounts are manageable, if these were to widen further then this would point to a greater likelihood of larger house price falls.

We believe the market remains on track for a soft landing in 2023 with modest price falls of up to 5% and one million housing sales.”

Investors will be watching Westminster, where MPs are scrutinising Rishi Sunak’s new Northern Ireland Brexit deal.

The pound has dipped a little this morning, to $1.294, having gained ground yesterday as the “Windsor framework” was revealed.

Businesses have been welcoming the deal, which should make it easier to import goods from Great Britain into Northern Ireland.

Andrew Lynas, the managing director of Lynas Foodservice, told us:

The uncertainty was the biggest challenge. So this is good progress.”

European stock markets are set to inch higher on the final day of February, its second ‘up month’ in a row.

The FTSE 100 index is expected to open flat, though, having gained 0.75% to 7935 points on Monday.

Michael Hewson of CMC Markets says:

As we come to the end of what looks set to be another positive month for European equities the question being posed is how much further can this year’s rally take us, with the DAX currently up over 10.5% year to date, and the FTSE100 up almost 6.5%?

The agenda

-

7.45am GMT: France’s inflation report for January

-

8am GMT: Switzerland’s Q4 2022 GDP report

-

9.45am GMT: BEIS committee hearing on UK plc 2050

-

10.15am GMT: Treasury Commiteee ask Bank of England: what is the purpose of a digital pound?

-

Noon GMT: India’s Q4 2022 GDP report

-

1.30pm GMT: Canada’s Q4 2022 GDP report

-

2pm GMT: US house price index for December

-

3pm GMT: CB survey of US Consumer Confidence report for February