Introduction: UK set to incur “highest debt interest costs in developed world”

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Rising inflation is driving up the debt burden on countries around the world, with the UK facing a bigger bill than other major economies.

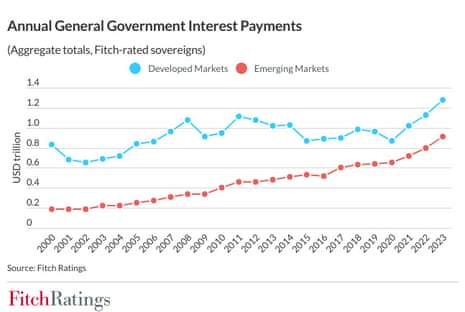

A new report from credit rating agency Fitch shows that governments face a steep rise in interest spending on their debts compared to pre-pandemic levels.

Developed countries face paying 47% more than in 2020, while the bill for emerging market countries has jumped 40%.

“The trend reflects an end to the era of low inflation and, at least for DMs, a period of exceptionally low interest rates,” Fitch warns.

In total, countries will pay around $2.3trn in interest costs in 2023, it has calculated, with developed economies facing a sharper rise – partly because they benefitted more from low borrowing costs previously.

The rise in interest costs among developed economices has been “particularly notable in the UK”, where interest payments on a 12-month basis reached £117bn in May 2023, double the level in the period to September 2021.

Fitch estimates that the UK Treasury will spend £110bn on debt interest in 2023. That would be around 10.4% of total government revenue, the highest level of any high-income country, the Financial Times reports.

UK TO RUN UP HIGHEST DEBT INTEREST BILL IN DEVELOPED WORLD – FT

— First Squawk (@FirstSquawk) July 25, 2023

The UK’s particular problem is that more of its debt is linked to inflation than other countries.

Inflation index-linked debt makes up almost 25% of UK government debt stock in 2023, so the cost of repaying those bonds has jumped as inflation hit 40-year highs last autumn.

As Ed Parker, global head of research for sovereigns and supranationals at Fitch, puts it:

We’ve had a very large inflation shock which is adversely affecting the public finances and that is obviously a key driver of the sovereign credit rating.”

Parker also warned that a UK downgrade is “more likely than not if current trends continue”. Fitch currently rates the UK as ‘AA-’ with a Negative Outlook.

The next largest issuer of inflation-linked debt among the G7, Italy, had just 12%; France was the only other member with a level of over 10%.

The US has also seen its debt repayments jump – to $616bn in the year to June 2023, breaking over the $600bn mark for the first time.

Also coming up today

The IMF will release updated forecasts for the world economy today, covering growth and inflation. The previous forecasts came in April, when the crisis in the US banking sector was looming over the global economy.

But while that danger has receded, inflation has proved persistent in some countries while dropping quickly in the US. And with the Ukraine war, which drove up energy and food prices, continuing, risks remain elevated….

Consumer goods giant Unilever is reporting results this morning, while Microsoft and Alphabet report financial results tonight.

The agenda

-

9am BST: IFO survey of German business climate

-

2pm BST: IMF releases an update to its World Economic Outlook (WEO)

-

2pm BST: US house price index for May

-

3pm BST: US consumer confidence report for July

Key events

Unilever shares surge to top of FTSE 100

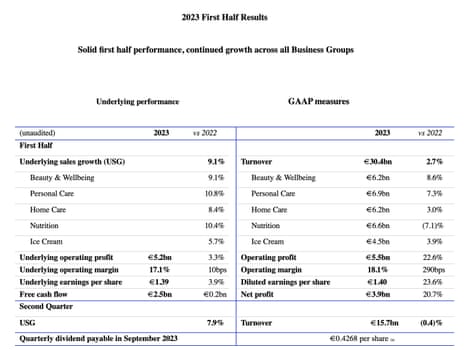

Shares in Unilever have jumped 5% at the start of trading in London.

Traders are clearly impressed that it has beaten sales forecast this morning (thanks to hiiking prices)

That puts Unilever’s shares on track for their best day since May 2022

Cost of living crisis is profitable for Unilever, says Fidelity

Emma-Lou Montgomery, associate director from Fidelity Personal Investing’s share dealing service says:

“From Tresemmé to Dermalogica and back to Dove, a determined focus by shoppers all over the globe on personal care has seen sales rise at Unilever.

“From the basics such as deodorant (delivering double-digit growth), to high-end beauty launches by the likes of Dermalogica and Paula’s Choice, first-half operating profits rose by 3.3% to €5.2 billion, as consumers simply paid more for the products they wanted.

“There’s no doubt that higher prices are boosting Unilever’s coffers, with the company acknowledging that volumes were virtually flat, aside from the Beauty & Wellbeing and Personal Care businesses.

“All in all, the cost of living is proving profitable for this global giant, with full-year underlying sales growth expected to beat forecasts. While the outlook for cash-strapped consumers is that price growth will ‘moderate’ as the year goes on.”

On a GAAP basis, Unilever’s profits have swelled by over 22% this year to €5.5bn (£4.74bn), as price rises have boosted its income.

On this measure, operating profits are up almost three percentage points to 18.1%.

On an underlying basis, though, profits and margins were lower:

Unilever grows sales as prices keep rising

Consumer goods giant Unilever has beaten sales forecasts, as it continues to hike prices.

The Dove and Marmite maker has reported sales growth of 9.1% in the first half of this year, entirely down to consumers paying more for its goods. Unilever’s prices rose by 9.4%, while sales volumes dipped by 0.2%.

In the second quarter of the year, underlying sales rose by 7.9%, beating analyst forecasts of 6.4% growth, driven by price rises of 8.2%.

Unilever predicts that price growth will continue to “moderate” through the year, which will disappoint those hoping to see price cuts.

The company has also been hit by rising prices. It expects to spend an extra €2bn on raw materials this year, having previously forecast net material inflation (NMI) of €1.5bn for the first half of 2023.

Unilever, which sells a range of food, beauty and wellbeing, and homecare brands, says:

We continue to expect a modest improvement in underlying operating margin for the full year, reflecting higher gross margin and increased investment behind our brands.

Introduction: UK set to incur “highest debt interest costs in developed world”

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Rising inflation is driving up the debt burden on countries around the world, with the UK facing a bigger bill than other major economies.

A new report from credit rating agency Fitch shows that governments face a steep rise in interest spending on their debts compared to pre-pandemic levels.

Developed countries face paying 47% more than in 2020, while the bill for emerging market countries has jumped 40%.

“The trend reflects an end to the era of low inflation and, at least for DMs, a period of exceptionally low interest rates,” Fitch warns.

In total, countries will pay around $2.3trn in interest costs in 2023, it has calculated, with developed economies facing a sharper rise – partly because they benefitted more from low borrowing costs previously.

The rise in interest costs among developed economices has been “particularly notable in the UK”, where interest payments on a 12-month basis reached £117bn in May 2023, double the level in the period to September 2021.

Fitch estimates that the UK Treasury will spend £110bn on debt interest in 2023. That would be around 10.4% of total government revenue, the highest level of any high-income country, the Financial Times reports.

UK TO RUN UP HIGHEST DEBT INTEREST BILL IN DEVELOPED WORLD – FT

— First Squawk (@FirstSquawk) July 25, 2023

The UK’s particular problem is that more of its debt is linked to inflation than other countries.

Inflation index-linked debt makes up almost 25% of UK government debt stock in 2023, so the cost of repaying those bonds has jumped as inflation hit 40-year highs last autumn.

As Ed Parker, global head of research for sovereigns and supranationals at Fitch, puts it:

We’ve had a very large inflation shock which is adversely affecting the public finances and that is obviously a key driver of the sovereign credit rating.”

Parker also warned that a UK downgrade is “more likely than not if current trends continue”. Fitch currently rates the UK as ‘AA-’ with a Negative Outlook.

The next largest issuer of inflation-linked debt among the G7, Italy, had just 12%; France was the only other member with a level of over 10%.

The US has also seen its debt repayments jump – to $616bn in the year to June 2023, breaking over the $600bn mark for the first time.

Also coming up today

The IMF will release updated forecasts for the world economy today, covering growth and inflation. The previous forecasts came in April, when the crisis in the US banking sector was looming over the global economy.

But while that danger has receded, inflation has proved persistent in some countries while dropping quickly in the US. And with the Ukraine war, which drove up energy and food prices, continuing, risks remain elevated….

Consumer goods giant Unilever is reporting results this morning, while Microsoft and Alphabet report financial results tonight.

The agenda

-

9am BST: IFO survey of German business climate

-

2pm BST: IMF releases an update to its World Economic Outlook (WEO)

-

2pm BST: US house price index for May

-

3pm BST: US consumer confidence report for July