Interest rate rises drive biggest postwar fall in UK household wealth

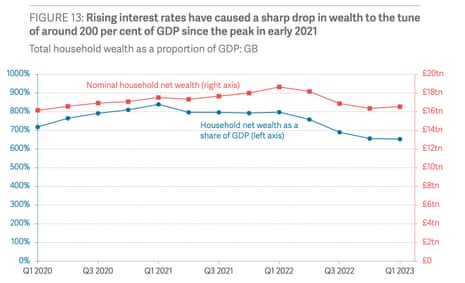

Rising interest rates have caused household wealth across Britain to fall by £2.1 trillion, the biggest drop since the second world war, a new report from Resolution Foundation has found.

However, there are also winners from the rise in borrowing costs – mainly among young people, who may find it easier to save for a retirement or buy a house.

New analysis published by Resolution shows how rising interest rates have caused household wealth across Britain to fall by £2.1 trillion over the past year.

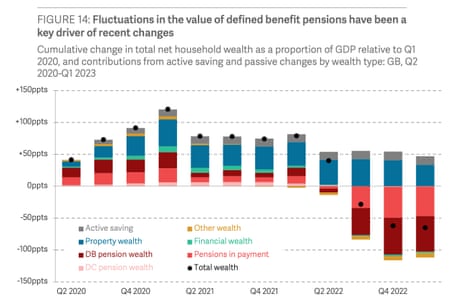

Much of the loss of wealth was due to falling bond prices, which have cut the value of pension assets.

Resolution estimates that total household wealth has fallen to 650% of national income in early 2023 – in the biggest fall as a share of GDP since World War II.

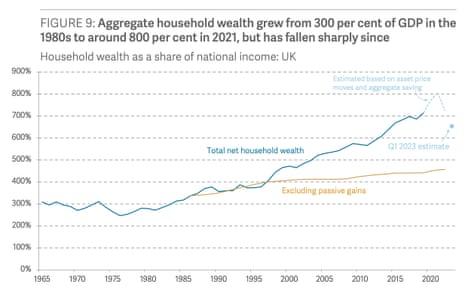

The report outlines that “a defining change to Britain and its economy took place over the past four decades”: household wealth grew from around three-times GDP in the mid 1980s, to seven-times GDP on the eve of the pandemic.

Much of this was due to ‘passive gains’ – the increase in asset prices that has fuelled intergenerational inequaliy.

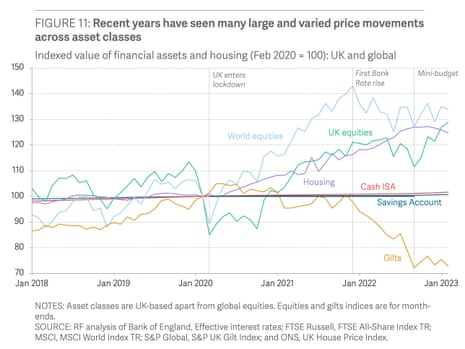

But that trend is now in reverse, with the Bank of England having hiked interest rates over a dozen times since the end of 2021 to fight inflation. This has hit the value of bonds, lowering guaranteed income streams such as defined benefit pensions, and weakening house prices.

Resolution says:

Our analysis suggests that, from early 2021, these passive changes reduced the household-wealth-to-GDP ratio by 185 percentage points, to around 650 per cent, by early 2023, based on a snapshot of asset prices and interest rates in March. This is by far the biggest fall on record as a proportion of GDP, wiping out £2.1 trillion of household net worth in cash terms.

We can expect further falls in wealth as asset prices continue to adjust to higher interest rates, although the scale of those falls is highly uncertain.

Indeed, if interest rates remain high, wealth could fall to around 550% of GDP.

And higher borrowing costs would have two key long-term effects – lowering house prices and making it easier to achieve a decent standard of living in retirement by raising rates of return on pension savings.

Resolution estimates that higher interest rates could reduce the house-price-to-earnings ratio from its 2022 peak of 8.9 to 5.6, a level not seen since the turn of the century. Were this adjustment to happen over five years, it would mean house price falls of around 25% in cash terms.

Ian Mulheirn, research associate at the Resolution Foundation, says governments should try to shield household from wild swings in interest rates.

Mulheirn says:

“Over the past four decades wealth has soared across Britain, even when wages and incomes have stagnated. But rapid interest-rate rises have ended this boom and brought about the biggest fall in wealth since the war, of £2.1 trillion.

“Those with significant mortgages will be hit by these major changes. But there are winners too from a shift to a world of higher rates and lower wealth. Higher returns will make it far easier for younger people to save for a pension that delivers a decent standard of living in retirement, while lower house prices will make it easier for younger generations to get on the property ladder and others looking to trade up.

“The future path of interest rates is very uncertain. The current surge could be a blip, or herald a new era for the UK. Either way, policy makers should focus more on whether and how to insulate households from wild swings in their fortunes from these forces well beyond their control.”

Key events

Although mortgage rates stabilised today, savings rates have continued to rise.

That could please critics of the banking sector, such as MPs on parliament’s Treasury Committee, who have accused the banks of “blatant profiteering” by offer paltry rates to savers.

Moneyfacts reports that:

-

The average 1-year fixed savings rate today is 5.10%. This is up from an average rate of 5.05% on the previous working day.

-

The average easy access savings rate today is 2.61%. This is up from an average rate of 2.60% on the previous working day.

-

The average 1-year fixed Cash ISA rate today is 4.78%. This is up from an average rate of 4.70% on the previous working day.

-

The average easy access ISA rate today is 2.72%. This is up from an average rate of 2.71% on the previous working day.

The number of residential mortgage products on the market has dipped this morning, Moneyfacts reports, to 4,246 today from 4,312 on Friday.

UK mortgage rates stabilise after weeks of gains

Newsflash: UK fixed-rate mortgage costs have stabilised today, having risen steadily in recent weeks.

Financial data provider Moneyfacts reports that the average 2-year fixed residential mortgage rate today is 6.78%, matching the rate recorded on Friday.

The average 5-year fixed residential mortgage rate has also remained flat at 6.30%.

The rates on both two and five-year fixed-rate mortgages have been rising pretty steadily since the end of May, when concerns over future interest rate rises began to grow.

In recent days, though, market expectations for rate rises have eased. The money markets currently predict Bank of England base rate could peak around 6.25% early next year, down from an earlier forecast of 6.5%.

UK sofa retailer DFS has told shareholders this morning that the furniture market has been “significantly worse than expected” this year, but it has grown its market share to a record level.

DFS reports that consumer demand was hit by “the macroeconomic environment”, with volumes across the market falling by between 15% and 20% in the last year (to 25 June).

But DFS expects to slightly grow its profits this year, reporting that its trading has been in line with expectations – leading to a record market share of 38%.

It told shareholders:

We currently expect market volumes to decline by mid-single digits for the full year, however, the economic outlook remains uncertain.

DFS – “FY23 profit within previously guided range…Group achieves record market share”. Does make you wonder when you see the latter observation but adjusted profit is “in line with previous guidance”. And did you see the outlook for 2024? pic.twitter.com/TqspRmIhBx

— Chris Bailey (@Financial_Orbit) July 17, 2023

Corporate optimism dips as CFO fret about rising interest rates

Inflationary pressure and rising rate expectations are weighing on optimism in Britain’s boardrooms.

Deloitte’s latest survey of chief financial officers (CFO) has found that tight monetary policy is seen as the top threat to business, outweighing the concerns around geopolitics and energy prices

CFOs are focusing on cost reduction and controlling their cash reserves, as the cost of credit hits a 14-year high.

And with recruitment challenges easing, many bosses are expecting a slowdown in wage growth.

Ian Stewart, chief economist at Deloitte, said:

“The burst of business optimism seen in the spring has faded under the weight of inflation and rising interest rates. Corporates have responded with an increasing focus on cost reduction and cash control.

Businesses have negotiated a series of major challenges in the last four years, including the UK’s departure from the EU, the pandemic and supply shortages. The legacy of those earlier shocks, in the form of inflation and high interest rates, is now the central challenge.”

Deloitte also found that the majority of CFOs expect employees to spend more time in the office in future.

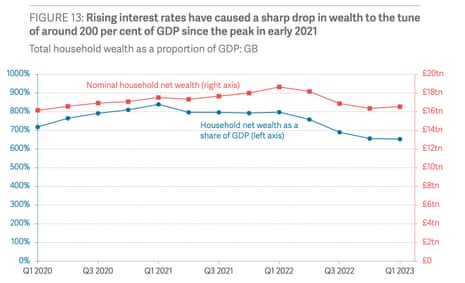

UK wealth: the key charts

Here are two interesting charts from Resolution’s new report into the impact of higher interest rates on UK household wealth

And here are the key points from the report:

-

Household saving has whipsawed over the past three years. The adjusted saving ratio peaked during the pandemic at 24.4 per cent – the highest on record. Saving has declined since but remains above its pre-pandemic level

. -

Saving behaviour has direct implications for household wealth holdings, but the fluctuations in interest rates have had a more profound impact: the pandemic saw interest rates hit record lows and asset prices boom which pushed the value of wealth to a peak of 840 per cent of GDP in early 2021.

-

The cost of living crisis, coupled with the monetary policy response, has put an end to the trend of rising wealth. Our estimates suggest that the wealth-to-GDP ratio fell to around 650 per cent by early 2023. This is by far the biggest fall on record as a proportion of GDP, wiping out £2.1 trillion of household net worth in cash terms.

-

A higher-rates world and an ultra-low rates world represent starkly different societies to live in. If the rise in long-term interest rates persists, would could see household wealth settling at around 550 per cent of GDP, a level last seen in 2007. But, if downward pressure on long-term interest rates resumes, this could see wealth settling at around ten-times GDP.

-

The future path of long-term interest rates matters hugely in the context of intergenerational inequality. Higher rates of return make it significantly easier to save for retirement. Pre-pandemic, a 40-year-old with median earnings needed to save approximately 16 per cent of their gross income (just over £5,000 a year) to reach a retirement target replacement rate of two-thirds of gross earnings. However, with current rates of return, the required contribution rate for the same goal is much lower at 9 per cent (£3,000 per year).

-

A higher-rates world would also improve housing affordability, helping young, would-be homeowners. Based on current interest rates, the house-price-to-earnings ratio could fall to around 5.6 – the lowest level seen since 2000. But if ultra-low rates return, there would be further upward pressure on house prices, with our modelling suggesting that they could reach 11 times earnings.

European stock market open lower after China’s GDP

Europe’s stock markets have begin the new week in the red, after China’s economy slowed in the last quarter.

In London, the FTSE 100 index of blue-chip shares is down 31 points or 0.4% at 7403 points.

Mining giant Anglo American (-2.5%) is leading the fallers, with copper producer Antofagasta (-2.2%) and Glencore (-2%) also weakening.

Germany’s DAX has lost 0.6%, as traders digest the news that China’s quarterly growth rate has slowed to 0.8% from 2.2%.

Naeem Aslam, chief investment officer at Zaye Capital Markets, explains:

Market sentiment is pretty much negative among traders and investors due to the Chinese economic data, which missed the forecast and raised concerns that the second-biggest economy in the world is suffering from a crisis.

Basically, going into Monday, traders and investors were highly focused on China’s GDP data, and they were hoping that the country’s economic data would print a decent reading if not a strong one.

Asking prices for UK homes slip as Bank of England’s rates rises bite

Rising interest rates are continuing to hit the housing market.

Asking prices for residential homes in Britain fell by 0.2% in July, new data from Rightmove shows, knoking £950 off the average price tag.

Rightmove reports that buyer demand remains resilient, around 3% higher than 2019. But sales of larger homes are lagging the wider market, as potential buyers wait to see what direction mortgage rates head in the coming months.

The pennies begin to drop as sellers reassess pricing, reducing avg ASKING prices by -0.2% (£950) to £371,907.

Compared to 2019, agreed sales & the number of properties on the mkt lag by 12% yet buyer demand is up 3%. Priced right, those that still can will move @rightmove pic.twitter.com/EftPQFyWtb— Emma Fildes (@emmafildes) July 17, 2023

But there is no room for delusion, especially for 2nd stepper properties & those at the top of the ladder. The mortgage booster removed, many buyers can’t now stretch so they are biding their time on their rung, observing rates & price movement.

— Emma Fildes (@emmafildes) July 17, 2023

Meanwhile those facing the first rung of the ladder, who retreated after the mini budget rate fall out, hopped on when interest rates averaged 4-5% in Q1. But the recent rate revival will cause many to pull back again, dependant on their deposit size

— Emma Fildes (@emmafildes) July 17, 2023

Victoria Scholar, head of investment at interactive investor, tells us:

The UK’s sluggish economic growth backdrop, rampant inflation and the Bank of England’s monetary tightening path are weighing on the housing market as mortgages become increasingly costly and consumer budgets get squeezed.

Smaller homes are more shielded from the headwinds as first-time buyers try to make the most of the weaker property market where they can despite the rising cost of debt. However, many homeowners are holding off from listing their properties amid the uncertainty, limiting the supply of flats and houses up for sale. But stemming an even steeper slide in the property market is a chronic undersupply of housing in the UK, exacerbated by the rise in build cost inflation, which disincentivises the housebuilders.

The combination of limited supplies and rising mortgage rates have prompted more potential would-be buyers to head to the lettings market instead, sending the cost of renting sharply higher.”

Resolution Foundation’s report also shows how higher rates of return make it significantly easier to save for retirement.

They explain:

In the pre-pandemic world of low interest rates, a 40-year-old on median earnings had to save around 16% of their gross income, or just over £5,000 a year, in order to achieve a target replacement rate of two-thirds of gross earnings in retirement.

But at today’s rates of return, the required contribution rate to achieve that goal is much lower, at 9%, or £3,000 per year, freeing up around £2,000 per year during working age.

Although many people are still not saving enough for retirement, the scale of the required increase would be much smaller if rates remain high, they add.

Interest rate rises drive biggest postwar fall in UK household wealth

Rising interest rates have caused household wealth across Britain to fall by £2.1 trillion, the biggest drop since the second world war, a new report from Resolution Foundation has found.

However, there are also winners from the rise in borrowing costs – mainly among young people, who may find it easier to save for a retirement or buy a house.

New analysis published by Resolution shows how rising interest rates have caused household wealth across Britain to fall by £2.1 trillion over the past year.

Much of the loss of wealth was due to falling bond prices, which have cut the value of pension assets.

Resolution estimates that total household wealth has fallen to 650% of national income in early 2023 – in the biggest fall as a share of GDP since World War II.

The report outlines that “a defining change to Britain and its economy took place over the past four decades”: household wealth grew from around three-times GDP in the mid 1980s, to seven-times GDP on the eve of the pandemic.

Much of this was due to ‘passive gains’ – the increase in asset prices that has fuelled intergenerational inequaliy.

But that trend is now in reverse, with the Bank of England having hiked interest rates over a dozen times since the end of 2021 to fight inflation. This has hit the value of bonds, lowering guaranteed income streams such as defined benefit pensions, and weakening house prices.

Resolution says:

Our analysis suggests that, from early 2021, these passive changes reduced the household-wealth-to-GDP ratio by 185 percentage points, to around 650 per cent, by early 2023, based on a snapshot of asset prices and interest rates in March. This is by far the biggest fall on record as a proportion of GDP, wiping out £2.1 trillion of household net worth in cash terms.

We can expect further falls in wealth as asset prices continue to adjust to higher interest rates, although the scale of those falls is highly uncertain.

Indeed, if interest rates remain high, wealth could fall to around 550% of GDP.

And higher borrowing costs would have two key long-term effects – lowering house prices and making it easier to achieve a decent standard of living in retirement by raising rates of return on pension savings.

Resolution estimates that higher interest rates could reduce the house-price-to-earnings ratio from its 2022 peak of 8.9 to 5.6, a level not seen since the turn of the century. Were this adjustment to happen over five years, it would mean house price falls of around 25% in cash terms.

Ian Mulheirn, research associate at the Resolution Foundation, says governments should try to shield household from wild swings in interest rates.

Mulheirn says:

“Over the past four decades wealth has soared across Britain, even when wages and incomes have stagnated. But rapid interest-rate rises have ended this boom and brought about the biggest fall in wealth since the war, of £2.1 trillion.

“Those with significant mortgages will be hit by these major changes. But there are winners too from a shift to a world of higher rates and lower wealth. Higher returns will make it far easier for younger people to save for a pension that delivers a decent standard of living in retirement, while lower house prices will make it easier for younger generations to get on the property ladder and others looking to trade up.

“The future path of interest rates is very uncertain. The current surge could be a blip, or herald a new era for the UK. Either way, policy makers should focus more on whether and how to insulate households from wild swings in their fortunes from these forces well beyond their control.”

China growth disappoints

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

China’s economy has grown more slowly than expected in the second quarter, driven by a slowdown in consumer spending and the ongoing problems in its property sector.

New GDP data released this morning shows that China’s GDP grew by 6.3% year-on-year in the second quarter of 2023, missing forecast of 7.3% growth.

On a quarterly basis, GDP grew by just 0.8% in April-June, a slowdown on the 2.2% expansion recorded in the first quarter.

Retail sales growth has stumbled too, growing by just 3.1% per year, down from 12.7% in Q1 2023, while fixed asset investment growth slowed to 3.8% from 4%.

China’s property sector remains firmly in a downtrend too; property investment slumped 20.6% in June year-on-year after a 21.5% drop in May, according to Reuters calculations.

The slowdown will add to calls for Beijing to do more to support the recovery, as Ipek Ozkardeskaya, senior analyst at Swissquote Bank explains:

In one hand, weak growth means that the government and the People’s Bank of China (PBoC) will step up efforts to further ease the financial conditions and pave the way for a quicker recovery.

On the other hand, supportive policies put in place so far have had little impact. The Chinese property downturn, risk of disinflation, and falling exports have been difficult to reverse.

The weak private sector investment continues, in China. Stockmarket down, suggesting a disappointment, although one scarcely imagines what expectations one could have, but a property bubble comingling with negative expected return assumptions. pic.twitter.com/mXoynZrXTj

— David Berthon-Jones (@berthon_jones) July 17, 2023

Mixed data out of #China. #GDP rose 6.3% which although up from last quarter’s 4.5% was below the 7.1% consensus. The SA QoQ was 0.8% as expected (down from prior’s 2.2%). #Retail sales was also softer than expected coming in at 3.1% YoY (vs 3.3% est) and down from May’s… pic.twitter.com/nr0OghKpsT

— Macro84 (@macro84) July 17, 2023

Also coming up today

China’s slowdown could be under discussion at Gujarat, India, where G20 finance ministers and central bankers are gathering for a summit.

UK supermarket bosses are set for showdown talks with the government next week over the cost of fuel at the pumps.

Energy Secretary Grant Shapps is expected to meet bosses from Asda, Tesco, Morrisons, Sainsbury’s and other major fuel retailers on Monday, and tell them to end any attempts to overcharge at the pumps.

The meeting comes after an investigation found that drivers paid an extra 6p per litre for fuel last year after supermarkets increased their profit margins.