ONS: Factories and builders blame Coronation for reduced output

A range of manufacturing industries and construction businesses cited the additional bank holiday for the Coronation of King Charles III, on Monday 8 May, as a reason for reduced output during the month.

But, the ONS reports that other sectors of the economy benefited from the festivities.

Today’s GDP report says:

On the positive side, we had comments suggesting industries in the arts, entertainment and recreation sector benefitted from the extra bank holiday.

There were also comments on both increased and reduced output received in the accommodation and food services sector.

Key events

ICAEW: Floundering economy putting PM’s growth pledge at risk

May’s GDP report shows that the UK economy was “floundering” even before the impact of recent interest rate rises are fully felt, says Suren Thiru, economics director at ICAEW (the Institute of Chartered Accountants in England and Wales).

The extra bank holiday for the Coronation curbing output in May, points out Thiru, who warns that Rishi Sunak’s growth pledge is at risk.

Thiru says:

“While the economy may rebound in June, the significant squeeze on activity from high inflation, stealth tax hikes and rising interest rates means the Prime Minister may struggle to meet his pledge to get the economy growing.

“These GDP figures are unlikely to prevent another rate rise in August. However, given the long time lag between rate rises and its effect on the real economy, tightening further risks damaging our growth prospects by overcorrecting for past errors.”

The largest contribution to the fall in consumer-facing services in May came from food and beverage service activities.

GDP in the sector fell by 1.1% in May, after growth of 2.4% in April.

The next largest contribution came from buying and selling, renting and operating of own or leased real estate, which fell 0.7% after a similar fall in April.

There was also anecdotal evidence that industrial action in May 2023 hit the economy, today’s GDP report shows.

That includes strikes in the public sector, and on the rail network.

The ONS says:

The health sector (nurses), rail network, education sector and the civil service all saw industrial action take place in May 2023 and this should be considered when interpreting monthly movements in these industries.

We also had some anecdotal evidence to suggest that the rail network industrial action had an adverse impact in terms of footfall for food and beverage service activities.

Digging into the report, it shows that human health activities actually grew by 1.8% in May, having shrunk in March and April.

The ONS says:

There was no industrial action by junior doctors in May 2023, compared with four days of industrial action in April 2023. There were two days of industrial action by nurses in England in May, compared with none in April.

ONS: Factories and builders blame Coronation for reduced output

A range of manufacturing industries and construction businesses cited the additional bank holiday for the Coronation of King Charles III, on Monday 8 May, as a reason for reduced output during the month.

But, the ONS reports that other sectors of the economy benefited from the festivities.

Today’s GDP report says:

On the positive side, we had comments suggesting industries in the arts, entertainment and recreation sector benefitted from the extra bank holiday.

There were also comments on both increased and reduced output received in the accommodation and food services sector.

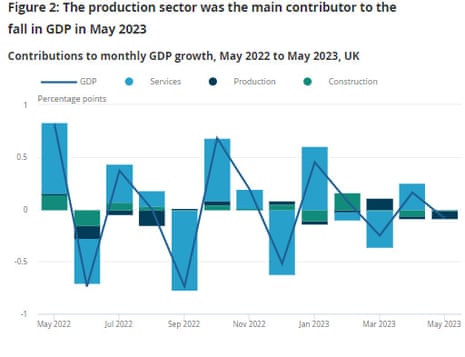

UK GDP: The key charts

May’s contraction means that monthly UK GDP is now estimated to be just 0.2% above its pre-coronavirus levels set in February 2020.

UK GDP shrank by 0.1% in May

Newsflash: Britain’s economy shrank slightly in May, with GDP falling by 0.1% as the dominant services sector stagnated and factories contracted.

The Office for National Statistics said that gross domestic product fell on the month, after growth of 0.2% in April.

That’s slightly better than expected, as City economists had forecast a fall of 0.3% in May. They feared that the extra bank holiday for King Charles’s coronation hit activity, while the economy continued to be held back by the cost of living squeeze, and public sector strikes.

But looking at the broader picture, GDP has shown no growth in the three months to May 2023.

The ONS reports that production output fell by 0.6% in May, while the construction sector fell by 0.2%.

The services sector showed no growth in May, while consumer-facing services fell by 0.2% in the month.

More to follow…

Britain’s housing market showed signs of a slowdown in June, an industry survey this morning shows.

New house buyer inquiries fell to an eight-month low in June, according to the Royal Institution of Chartered Surveyors (Rics), as buyers were deterred by rising mortgage rates and anxiety about an economic downturn.

Property surveyors expect activity to remain subdued as higher borrowing costs hit new buyer enquiries. More here.

Public sector strikes also weighed on the economy in May, as workers pushed for pay rises to protect them from inflation.

Michael Hewson of CMC Markets explains:

The monthly GDP numbers for May are forecast to show a -0.3% contraction due to the multiple bank holidays during the month, as well as widespread public sector strike action, with index of services seeing a sharp slowdown from 0.3% in April to -0.2%.

The weak performance in May is likely to act as a sizeable drag on Q2 GDP, although we should see some of that recovered in June.

Introduction: UK May GDP report in focus

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

This morning we learn how the UK economy fared in May, and whether the extra bank holiday for King Charles’s coronation hit growth.

The Office for National Statistics will release May’s GDP report at 7am. Economists predict the economy contracted during the month, with activity held back by three bank holidays.

That would continue the UK’s volatile 2023 – the economy grew by 0.2% in April, after a fall of 0.3% in March.

Sanjay Raja, Deutsche Bank’s chief UK economist, predicts that GDP shrank by 0.3% in May.

He explains:

Why the fall? In short, the extra Bank Holiday as a result of the King’s Coronation.

Deutsche Bank still expect the UK economy will contract by 0.1% in the April-June quarter, putting it halfway into recession.

And with interest rates set to keep rising, the risk that UK GDP contracts next year will “rise materially”.

Raja adds:

A hard landing may be unavoidable.

Also coming up today

The UK’s independent fiscal watchdog, the Office for Budget Responsibility, is due to publish a new report on Fiscal risks and sustainability.

The OBR is expected to warn that rising interest rates are hurting the public finances, scuppering any lingering prospect of pre-election tax cuts.

The report will also examine the impact of higher gas prices, and the role of sickness in explaining the rise in people dropping out of the workforce.

And to further dampen the mood, the OBR will also run through some of the “wider range of risks to the UK economy and public finances”.

The agenda

-

7am BST: UK GDP report for May

-

9am BST: IEA’s monthly oil market report

-

10am BST: OBR publishes fiscal risks and sustainability report

-

1.30pm BST: US PPI index of producer price inflation for June

-

1.30pm BST: US weekly jobless claims report