Key events

Higher interest rates are also increasing pressure on UK landlords with buy-to-let mortgages. The report said:

Higher interest rates, together with other factors, are also putting pressure on buy-to-let landlords’ profitability, which has caused some to sell up or pass on higher costs to renters.

The private rented sector is an important part of the UK housing market, covering almost a fifth (19%) of households. Many private landlords take out mortgages to fund their investment: around 7% of the total UK housing stock has a buy-to-let mortgage on it and this type of lending comprises around 18% of the overall mortgage market by value, the Bank said.

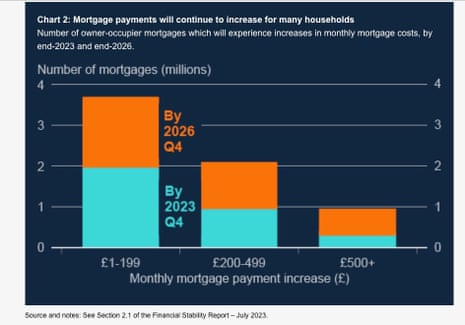

In the UK, more households are being affected by higher interest rates as fixed-rate mortgage deals expire, the Bank of England’s report said.

The mortgage debt-servicing ratio (DSR), which measures the proportion of post-tax income spent on mortgage payments across all households, is forecast to increase from 6.2% to around 8% by mid-2026. If that were the case, this share would remain below the peaks seen in both the 2007–08 global financial crisis and the early 1990s recession, despite interest rates now being at a similar level to those prior to the financial crisis.

The proportion of households with high debt service ratios, after accounting for the higher cost of living, has increased and is expected to continue to do so through 2023. But it is projected to remain some way below the historic peak reached in 2007.

There are several factors that should limit the impact of higher interest rates on mortgage defaults. Given robust capital and profitability, UK banks have options to offer forbearance and limit the increase in repayments faced by borrowers, including by allowing borrowers to vary the terms of their loans. There are now stricter regulatory conduct standards for lenders with respect to supporting households in payment difficulties.

And on 23 June, the UK’s biggest mortgage lenders, the chancellor and the Financial Conduct Authority (FCA) agreed new support measures for mortgage holders. Struggling mortgage holders will be given a 12-month grace period before repossession proceedings begin.

Introduction: Bank of England warns rising interest rates causing stress among indebted firms and consumers

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The Bank of England has warned about signs of rising stress among the most indebted consumers and smaller businesses as interest rates have risen sharply around the world, although overall the UK economy has so far proved resilient.

The failure of three mid-sized US banks, and a “global systemically important bank” – Credit Suisse – caused volatility in financial markets, the central bank’s financial policy committee said in its latest financial stability report. You can read it here.

The impact on the UK banking system through lower bank equity prices and increases in funding costs was limited, and market risk sentiment has stabilised since then. Nonetheless, elements of the global banking system and financial markets remain vulnerable to stress from increased interest rates, and remain subject to significant uncertainty, reflecting risks to the outlook for growth and inflation, and from geopolitical tensions.

The UK economy has so far been resilient to higher interest rates, though it will take time for the full impact of higher interest rates to come through, the Bank said.

Turning to businesses, the report said:

Overall, UK businesses are expected to remain broadly resilient as the impact of higher interest rates comes through, but there will be increased pressure on some smaller and highly indebted businesses.

It flagged risks to riskier corporate borrowing from higher interest rates, and the commercial property sector:

Riskier corporate borrowing in financial markets – such as private credit and leveraged lending – appears particularly vulnerable, and global commercial real estate markets face a number of short and longer-term headwinds that are pushing down on prices and making refinancing challenging.

The FPC has also looked at consumers, mortgages and borrowing on credit cards and concluded:

Distress among the most indebted may have increased. Contacts in the debt advice charity sector indicate that the scale of difficulties faced by those seeking debt advice has increased…

Although the proportion of income that UK households overall spend on mortgage payments is expected to rise, it should remain below the peaks experienced in the Global Financial Crisis and in the early 1990s.

For the typical mortgagor rolling off a fixed-rate deal over the second half of 2023, monthly interest payments would increase by around £220 if their mortgage rate rises by the 325 basis points implied by current quoted mortgage rates.

UK banks are in a strong position to support customers who are facing payment difficulties. This should mean lower defaults than in previous periods in which borrowers have been under pressure.

Major UK banks have been stress tested using a severe stress scenario that is much worse than the economic outlook the Bank expects. The stress scenario included the unemployment rate increasing to 8.5%, inflation rising to 17%, and house prices falling by 31%.

The results of this stress test showed that the UK banking system would continue to be resilient, and be able to support households and businesses, even if economic conditions turned out to be much worse than we expect.

Separately, the Treasury’s tax and spending watchdog is preparing to sound the alarm over the impact of rising interest rates on the public finances, delivering a serious blow to the government’s scope for pre-election tax cuts.

Also coming up later today: the latest US inflation numbers. We are expecting a further slowdown.

The Agenda

-

9am BST: Bank of England governor Andrew Bailey press conference

-

1.30pm BST: US Inflation for June (forecast: 3.1%, previous: 4%)

-

3pm BST: Bank of Canada interest rate decision (forecast: rise to 5% from 4.75%)